LNG | NGI All News Access | NGI The Weekly Gas Market Report

Downeast LNG Gets Back Up With Bi-Directional Project

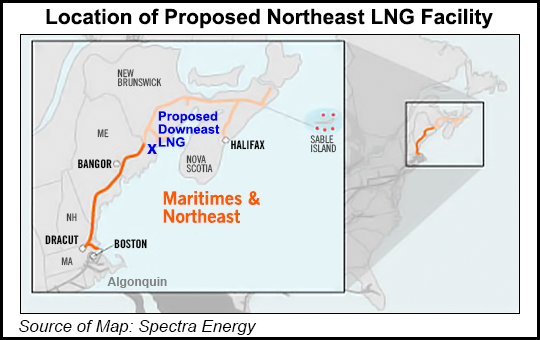

The Downeast LNG import terminal, which has been long-planned for Washington County, ME, has come back to life as a bidirectional liquefied natural gas (LNG) import/export project, its backer said Friday.

And with plans to contract for 300 MMcf/d of firm pipeline capacity into New England, Downeast could pull a new long-haul pipeline into the gas-hungry region.

“Having a bidirectional facility will give us the ability to respond to market conditions and customer needs while increasing the supply of natural gas in the state, whether we are importing or exporting,” said Dean Girdis, founder of Downeast.

“It’s probably counter-intuitive,” Girdis told NGI. “I know some people are saying, ‘Wait, why would you export LNG from Maine? It’s not a supply region.’”

During the winter, New England often finds itself short on gas and long on high prices for the commodity. Having the Marcellus/Utica shales almost in its backyard doesn’t help due to a lack of pipeline capacity.

Projects to address the problem are in the works. Portland Natural Gas Transmission System has its Continent-to-Coast Expansion, and Spectra Energy Corp. has the Atlantic Bridge project (see Daily GPI, June 20). Kinder Morgan’s Tennessee Gas Pipeline is targeting New England, too (see Daily GPI, April 22; Feb. 14).

For its part, TransCanada Corp. has confirmed that there is “the possibility of flow reversal at Iroquois,” a 20-year-old exit point in southeastern Ontario for Canadian gas exports via a pipeline named after the spot to destinations across New York State, New Jersey and New England. “TransCanada has been in discussions with Marcellus producers and gas consumers about the possibility of receiving gas at Iroquois,” the pipeline said in a recent regulatory filing. (see Daily GPI, May 9).

Gas from the Marcellus — which is projected by some to be a 25 Bcf/d monster in a few years — could be picked up by Downeast at Wright, NY. Or gas could be sourced from Dawn, ON, Girdis said. The Dawn supply would be a mix of western Canadian gas and U.S. gas. Wright would offer a Marcellus-Utica-Canadian gas mix. “We’ve been in discussions with a number of parties, producers and others, that have suggested they’re willing to commit gas at a fixed-price, long-term contract,” he said.

Downeast plans to contract for 300 MMcf/d of firm pipeline capacity, enough to support a new pipeline but not so much as to harm other New England gas consumers such as local distribution companies, industrials and power generators, Girdis said.

Because of ISO New England rules, power generators in the territory are not allowed to contract for long-term pipeline capacity, Girdis said, adding that the LNG plant’s demand would help the situation.

Further, the proposed facility would release up to 20 days of pipeline capacity annually to New England consumers on the coldest winter days to increase gas supply, thereby reducing high winter spot gas prices in the region. “It’s an elegant way to help solve a problem for the peaking days, the biggest problem in New England,” Girdis said.

The project would be in Robbinston, ME, and would have the ability to liquefy 2 million tons of LNG per year (270 MMcf/d of gas) or regasify the equivalent of 100 MMcf/d of LNG, as market conditions warrant. The original project was planned to have 500 MMcf/d of regasification capacity.

Although the proposed bidirectional facility will require modifications to the current site plan, much of the facility will remain the same, Downeast said. The reconfigured project would retain one LNG storage tank, pier, regasification equipment and natural gas pipeline as currently proposed, adding liquefaction capacity to the current design. The estimated cost of constructing the facility is $1.3-1.4 billion.

Downeast would offer up to 2 million tons of LNG per annum beginning in 2019 or 2020 to LNG buyers through a tolling model. As compared to other LNG projects proposed in the U.S., Downeast would offer LNG buyers an opportunity to access Canadian and U.S. gas reserves, with gas committed under a fixed-price contract.

The trip from the Downeast terminal to European markets would be four to six days shorter than from U.S. Gulf Coast terminals, Girdis said.

“We think, particularly given the circumstances in Europe right now that, North America — Canadian and U.S. — gas exported as LNG would provide a lot of gas supply security to some countries in that part of the world,” Girdis said. “I think it makes sense. We wouldn’t be the predominant supply source in some of the countries that we’re speaking with, but we would be a beneficial hedge against supply disruptions that could occur in the marketplace given the [political] climate.”

The colder climate in Maine relative to the Gulf Coast also would make liquefaction more efficient than in hot and humid Louisiana and Texas.

As for the downsized regasification capacity, why have it at all in a shale gas and export world? Girdis said it’s a hedge because the market is unpredictable, as anyone who remembers the pre-shale days will admit.

“We don’t know what the future is,” he said. “Right now, the future’s looking like it’s a solely export-oriented project.” But even a remote possibility of wanting regas capability, even if it’s 20 years out, means it’s better to get it in the project now than to have to go back to FERC for it later, he said. Someday it could come in handy for regional peak-shaving service, if the market would support it.

Downeast was originally proposed in 2005 by Downeast LNG Inc. and Downeast Pipeline LLC (collectively Downeast) [Docket Nos. CP07-52-000, CP07-53-000, CP07-53-001] as an import terminal.

Local voters approved the Downeast LNG import facility in early 2006 (see Daily GPI, Jan. 13, 2006), but Canadian officials and citizens groups subsequently urged the Federal Energy Regulatory Commission (FERC) not to approve the project (see Daily GPI, April 12, 2007; Feb. 28, 2007; Feb. 16, 2007; March 13, 2006). FERC later rejected calls by the Canadian province of New Brunswick to halt the project (see Daily GPI, June 5, 2007).

In 2009 the U.S. Coast Guard told FERC that several waterways — specifically Head Harbor Passage, Western Passage and Passamaquoddy Bay — were suitable for LNG marine traffic if recommended risk mitigation measures were implemented (see Daily GPI, Jan. 12, 2009). In 2010 the Coast Guard said the St. Croix River and the approaches to the Bay of Fundy from the Atlantic Ocean and Grand Manan Channel from the Gulf of Maine were also suitable (see Daily GPI, Sept. 24, 2010).

FERC issued a draft environmental review in favor of the Downeast LNG project in May 2009 (see Daily GPI, May 19, 2009). Just last month, the import project received its final environmental impact statement from FERC (see Daily GPI, May 15).

Downeast plans to submit its free trade agreement (FTA) and non-FTA export requests to the U.S. Department of Energy and enter the pre-filing process with FERC within a month. The company said it hopes to begin construction in 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |