E&P | NGI All News Access | NGI The Weekly Gas Market Report

Surge in U.S. Well Completions Predicted After ‘Abnormally High Backlogs’ in 1Q2014

Global exploration and production (E&P) spending in 2014 should increase for the fifth year in a row, with the largest gains again in North America (NAM), a Barclays Capital annual survey has determined.

Oilfield services analysts James West and his colleagues reviewed financial and strategic documents for more than 300 oil and natural gas companies in the past six weeks to assess the health of the industry and the outlook for future growth based on capital expenditures (capex) planned.

Stay long U.S. land, said West.

The majority of spending growth in 2014 is seen in North America, where capital budgets are expected to rise 8.4%, higher than Barclays expectations of 7.3% forecast in December. The independents, which dominate the NAM land markets, are primed to “take advantage of robust commodity prices and record resource inventories.”

The largest market worldwide for E&P spending continues to be North America (30%), according to Barclays.

“The United States is far and away the largest single country for E&P activity (23% of the global total) and, with capex expected to rise in the U.S. by nearly 10% year/year, we expect $14 billion of additional capital will make its way through domestic oil fields in 2014.”

The United States, which is the largest E&P market in the world, is anticipated to see 2014 year/year spending gains of 9.6% this year, up from a Barclays estimate in December of 8.5%. Upstream capex in Canada is seen rising 4.5% year/year, also up from a previous 3.2% forecast.

Analysts believe “there are multiple drivers that could cause actual spending to again further exceed our estimates.” Nearly all (90%) of the U.S. capex in 2014 is forecast to be directed to well completion activity and services, with the rest allocated to drilling costs.

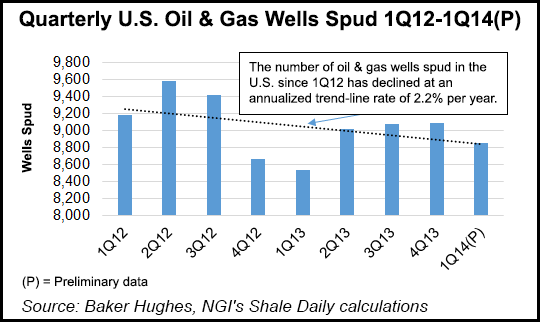

However, there’s “emerging evidence of abnormally high backlogs of uncompleted wells” at the end of 1Q2014, with the backlog in the Bakken Shale 60% higher than year/year levels in 2013.

That backlog would suggest that most of the U.S. E&P capex “was held on the sidelines during 1Q2014 awaiting more benign operating conditions,” said analysts. “Starting in early 2Q2014, the U.S. land rig count has shot higher and we think a surge in well completion activity is unfolding in its wake.”

Analysts took a closer look at the 1Q2014 spending activity and future plans of around 30 large and medium-sized U.S. independents to gauge how upstream capex in the coming quarters will compare to the first quarter levels. The companies represent about one-third of the total U.S. spend, which should provide an accurate picture of industrywide trends.

“Not surprisingly, the annualized 1Q2014 capex rate in 2014 was well below the full-year budgets for the majority of the companies we studied,” said analysts. “In aggregate, the independents under-spent their annualized 2014 budgets by 10% in 1Q2014. This compares to a 2% under-spend in 2013 and a 12% over spend in 2012.”

By extrapolating the 2014 and 2014 capex trajectories from the independents reviewed across the entire U.S. E&P universe, analysts believe that spending in 1Q2014 “was so depressed that it was relatively on par with upstream capex in the U.S. in 1Q2013.” Data from the American Petroleum Institute shows the completed well count and footage drilled in the United States at similar levels year/year in 1Q2014.

“The important takeaway here is that U.S. E&Ps have a lot of catching up to do in order to hit their new budget projections,” said West.

To reach the capex level that Barclays is expecting this year, U.S. operators should spend about $127 billion through the rest of this year, which would be 12.5% higher than the implied spending rate for the same period of 2013.

Upstream activity in the United States is “on a clear path higher relative to our previous expectations,” and analysts favor companies levered to the domestic markets.

“We are particularly bullish on those companies with product lines focused on new horizontal well completions, an area where we think E&Ps will direct the lion’s share of incremental capital.”

Worldwide, E&P spending is expected to eclipse $712 billion level in 2014, 6.2% higher than in 2013 and relatively on par with Barclays’ December forecast of 6.1%.

Surveyed companies are basing 2014 budgets on Henry Hub natural gas prices of $4.12/Mcf, West Texas Intermediate prices of $91.00/bbl and Brent oil prices of $101.00/bbl. Several “significant geographic shifts” are unfolding, especially in North America, according to Barclays.

The analysts said they think shareholder activism is having an impact on spending by mid-sized NAM E&Ps and the majors, leading some to “right-size international portfolios and slow spending growth.”

Those impacts present a “threat to the physical commodity market and will likely lead to a structural leg-up in oil prices over time. This capital discipline is being driven by a short-term focus on cash returns in our view, and we think investor focus and preference will ultimately shift back to production growth” from cash flow growth.

This period of underinvestment by the majors may lead to a “period of underproduction and could drive a structural leg-up in international oil prices.” Barclays is forecasting global spending by the majors to decline 0.4% this year, down from 2.9% in December.

The dynamic is similar to “insufficient investment by the majors in 2002 and 2003 (0.9% and 0.3%, respectively),” which “contributed to significant oil price appreciation in 2004 and 2005 (35% and 46%, respectively).”

Retrenchment by North American independents and majors creates an opportunity for resource-hungry national oil companies, which do not always adhere to the principles of western finance and are happy to pick up additional acreage to fulfill ambitious domestic strategic agendas.”

International spending should be at a more modest pace, up 5.3% from 2013, and slightly lower than Barclays initial outlook of 5.7%. The Middle East “will lead the way in terms of capex gains (16%),” with Africa and Asia anticipated to see gains of 8% each. Growth in Europe is lower than first forecast, minus 0.2% from 7.8%, and Latin America’s capex forecast also was cut (5.5% versus 12.8%).

“Although directionally accurate, our spending forecasts tend to capture budgeting activity as a snapshot in time and, in many cases, actual spending levels tend to exceed our expectations,” West said. “Since 2000, there have only been two years in which capital spending fell below our forecasts: in 2010, which we attribute to the Macondo incident and the ensuing moratorium in the Gulf of Mexico; and in 2012, when our initial forecast was slightly high.”

Last year’s survey anticipated that global 2013 spending would increase 6.6% from 2012. With the 2013 expenditures now confirmed, analysts found that original estimates were roughly 1% too low as global E&P spending actually increased by 7.4%.

Most of the companies surveyed expect spending levels in 2015 to increase, with about half anticipating double-digit increases above 2014.

“The industry,” said analysts, “remains in what we believe are the early days of a long and powerful global upcycle, valuations remain at attractive levels, and fundamentals continue to improve for most subsectors.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |