Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Physical, Futures Race Each Other Lower; July Off 7 Cents

Physical gas for Friday delivery fell hard and fell often as traders worked hard to accommodate a more normal weather environment and get deals done before the release of government storage figures.

Only a handful of points crept into positive territory and most points were down a dime or more. The average overall tumble was just over a dime, and losses were seen not only in the Northeast and Mid-Atlantic, but also in the Great Lakes, Midcontinent, and Rockies.

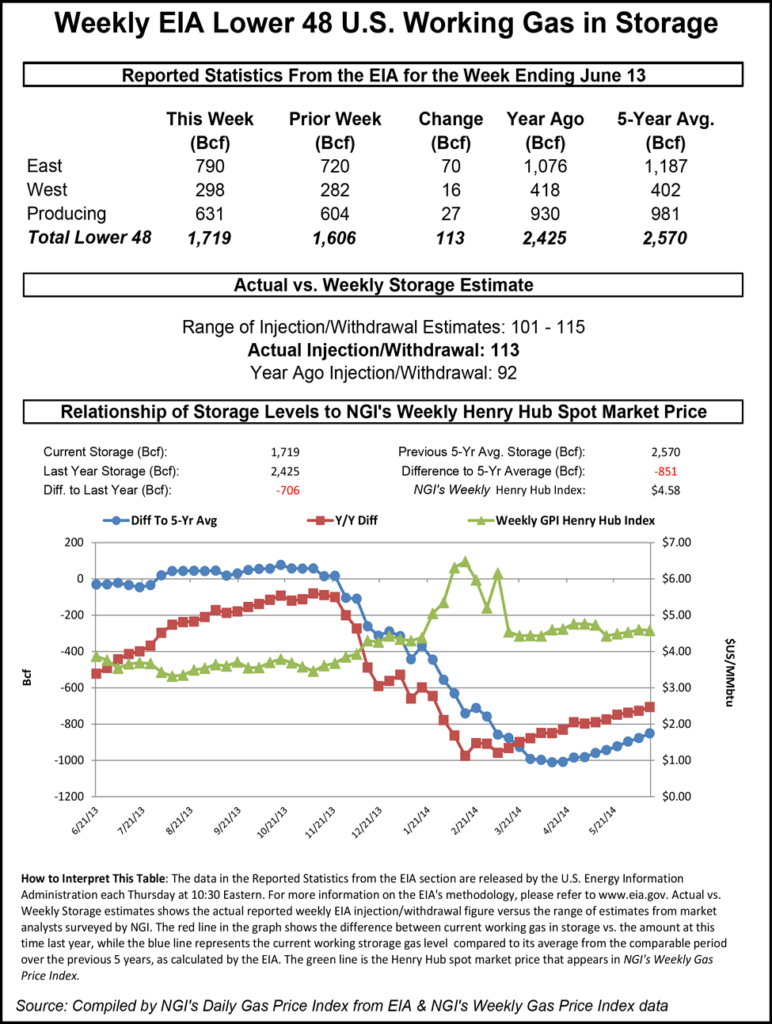

The Energy Information Administration reported a storage increase of 113 Bcf, about 3 Bcf above market expectations, and after some early market strength following the release of the data, the market ground lower finishing close to the lows of the session. At the closing bell July was down 7.5 cents to $4.584 and August had sunk 7.2 cents to $4.603. July crude oil rose 46 cents to $106.43/bbl.

The biggest declines were seen in the East and Mid-Atlantic as both soft power pricing and a return to normal temperatures weighed on the market. Forecaster Wunderground.com predicted that Boston’s Thursday high of 81 was expected to decline to 75 Friday and recover somewhat to 77 on Saturday. The seasonal high in Boston is 77. New York City’s Thursday high of 82 was expected to ease to 81 Friday before sliding to 76 on Saturday. The normal high in New York City this time of year is 80.

The National Weather Service in New York City characterized Friday as “a top-5 most pleasant weather day of this year.” It noted “high pressure building in from the north…[and] can expect a light west-northwest flow…generally 5-10 miles per hour. This will keep dew points in the 40s and most sea breezes at Bay. Highs will generally top off in the upper 70s to lower 80s…with the warmest temperatures just west of the Hudson River due to the downsloping flow.”

IntercontinentalExchange reported that next-day peak power at Nepool fell $9.14 to $40.67/MWh and Friday peak power at PJM fell $19.15 to $42.79/MWh.

Gas at the Algonquin Citygates plunged 83 cents to $4.81 and gas at Iroquois Waddington shed 27 cents to $4.80. On Tennessee Zone 6 200 L Friday parcels changed hands at $4.73, down 41 cents.

Parcels destined for New York City on Transco Zone 6 skidded 64 cents to $2.92 and gas on Tetco M-3 fell 66 cents to $2.83.

Gas in the Marcellus was one of the few market gains, but rose from an extremely low level as production in the region struggles to find its way to mainstream markets. Gas on Transco Leidy rose 15 cents to $2.37 and on Tennessee Zone 4 Marcellus next-day packages changed hands at $2.33, up 6 cents.

Genscape said Appalachia production has increased by an average of +4.2 Bcf/d year-on-year in 2014. Much of the increase has gone into storage, but Genscape noted that imports to the region have fallen hard. “Appalachia imports from the Midwest, from the southeast, and from Canada have all declined year-on-year. Southeast exports to Appalachia declined by -3.2 Bcf/d year-on-year in the past month.

“The year-on-year decline ranked by pipelines is as follows: TGP (-1.4 Bcf/d), Columbia Gas (-0.9 Bcf/d), TETCO (-0.6 Bcf/d), Transco (-0.4 Bcf/d), and ANR (-0.3 Bcf/d). TGP, Columbia Gas, and TETCO have all reversed from bringing gas from the Southeast into the Northeast during the last year to taking gas from the Northeast and bringing it down south,” Genscape said.

“This is the first summer in which Columbia does not rely on gas imports from the producing region to fill up gas storage. Columbia is receiving more gas in the northern part of the system due to Marcellus gas production growth. This growth in production receipts prompted Columbia to warn shippers in the past month of OFOs for overscheduling in New York, central Pennsylvania, southwestern Pennsylvania, northwestern Pennsylvania,and West Virginia.

“ANR’s Lebanon lateral expansion went into service in April and has picked up the pace to take Marcellus production out of Pennsylvania via DTI interconnect. TGP’s increase in flow south is mostly driven by compressor capacity expansions,” the company said in a report.

Traders took a close look at Thursday’s storage report for signs of just what impact recent elevated temperatures have had on the rate of storage builds. It appeared to be not that much. Last year, 92 Bcf was injected, and the five-year average is for 87 Bcf. Credit Suisse was expecting an increase of 109 Bcf, and Bentek Energy calculated a 110 Bcf injection. A Reuters poll of 22 traders and analysts revealed an estimated 110 Bcf average with a range of 101 Bcf to 115 Bcf.

Tim Evans of Citi Futures Perspective estimated a 112 Bcf increase and noted that the 113 Bcf build “largely sustains the existing background supply/demand balance, with more intense heat needed to offset the year-on-year growth in supply. Otherwise, above average injections will remain the norm, as has been the case for nine consecutive weeks.”

Despite a bearish storage number, the market was actually up slightly in mid-day trading after dropping initially after the storage report came out. “This suggests that the bulls retain significant influence in the market,” analysts with EMEX LLC said in a note Thursday afternoon. “We will still need record injection numbers (85 Bcf/week) to refill storage to the levels expected by the Energy Information Administration and to get to the high of 2012, we would need to average 109 BCF/week.”

Looking further down the road, EMEX said bulls might find room to roam. “With the need to continue to refill storage at a breakneck pace, EMEX maintains a bullish position on the natural gas market for the balance of the year, pending a clearer winter weather forecast.”

Bentek saw a large component of the robust build as being due to lower demand. “Demand decreased by 8 Bcf from the previous week, driven largely by a drop in power burn, which declined by an average of 1.2 Bcf/d for a total of 8.8 Bcf through the week,” the firm said in a report. “Total supply noted a decline of 3 Bcf, driven by a decline of 3 Bcf in Canadian imports and 1 Bcf from production. Of the decrease in the power sector, a majority of the dip occurred in the Producing Region, where sample injections at facilities such as Pine Prairie have remained strong.”

Eastern storage facilities continue to sock it away. “Further robust builds throughout the East Region have continued to prop up the daily storage range’s midpoint in the triple digits. A lack of demand in the Northeast has allowed regional fields to post strong injections over the past week. Week-over-week, [and]…builds in the East Region are 3.0 Bcf higher, led by facilities such as ANR, Dominion and NGPL,” Bentek said.

That decrease in demand will most likely not be in play for next week’s storage report. The National Weather Service (NWS) predicts elevated levels of cooling requirements in key population centers. For the week ended June 21, NWS forecasts that New England will see 49 cooling degree days (CDD), well ahead of normal by 33. The Mid-Atlantic is anticipated to endure 62 CDD, or 32 more than normal, and the Midwest from Ohio to Wisconsin is likely to experience 76 CDD, or 39 more than its normal seasonal tally.

WeatherBELL Analytics in its Thursday morning 20-day forecast sees a sequence of oscillations between warmth and cooling. Joe Bastardi in reviewing the JMA (Japan Meteorological Association) model said, “JMA through mid-July is not looking like its monthly, though a trough reforms near the East Coast for Weeks three and four. It’s a two-week segment, so it may be heading back toward its monthly ideal.

“Summer El Nino response [was] not there on the CFSv2 [National Weather Service Climate Forecast System] [and] ENSO 3.4 cooling may be leading to decreased model skill.” Transient weather patterns may be in the making. Bastardi said week one is represented by cooling, but he calls warming in week two “over the top”. Week three is expected to begin a new cooling phase. “Pattern still wet, with transience still across the U.S.,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |