NGI Archives | NGI All News Access

Weekly Cash Prices Emerge Slightly Bruised, But Refill Questions Remain

The physical market survived a wild and wooly week of trading with modest, single digit losses for the most part. Friday’s hefty advances induced by a Thursday screen surge were not enough to offset pervasive mid-week selling, and the NGI National Weekly Spot Gas Average was down 4 cents to $4.42. Regionally, all locations were lower by anywhere from just a few pennies to less than a dime. Of the individual market points, Algonquin Citygates jumped to the top of the leader board with a maintenance-induced gain of 45 cents to $4.51 and buyers at the Millenium East Pool got the week’s biggest break with a slide of 17 cents to $2.89.

Regionally, the Midcontinent saw the week’s biggest decline dropping 8 cents to $4.46 but the Rocky Mountains, Midwest and California came in at a 7-cent slip to $4.47, $4.75, and $4.90, respectively.

The Northeast maintained its position as the country’s lowest cost producer and for the week eased 4 cents to $3.62. South Texas, South Louisiana, and East Texas all shed just 3 cents to $4.49, $4.53, and $4.56, respectively.

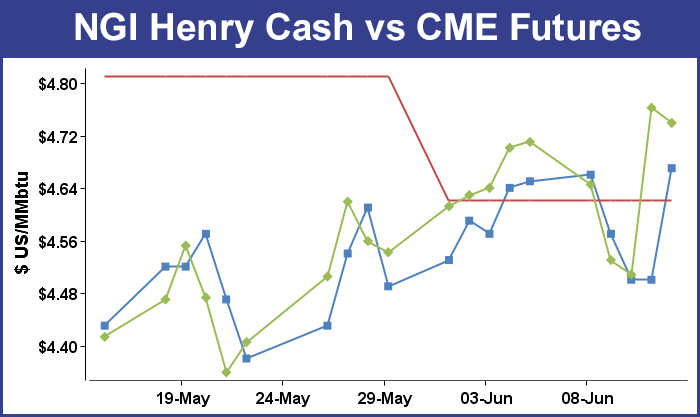

Despite a 25-cent rocket launch on Thursday, July futures managed just a 2.9-cent advance for the week to $4.739.

In Friday’s trading spot gas for weekend and Monday delivery staged a broad rally as the physical market played somewhat of a catch-up to the screen’s Herculean 25-cent leap on Thursday.

Most points came in with double-digit gains, and only a handful of locations slipped into the loss column. Northeast locations were particularly strong, but gas out of the Marcellus Shale came in noticeably lower. Appalachia quotes were firm, but Mid-Atlantic prices were mixed. At the close of futures trading, July settled for something of a disappointing loss of 2.3 cents to $4.739 and August had retreated 1.5 cents to $4.748.

Traders saw Thursday’s Titanic advance due to not only a bullish storage report, but also prompted by turbulence in the petroleum sector. “Prior to the issuance of the [storage] report, we would have viewed an injection of 107 Bcf as worth a price advance of about 8-10 cents,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday to clients.

“[Thursday’s] excess beyond this expectation appeared driven by aggressive short-covering after some minor chart points were violated. Additionally, some forecasts are beginning to shift in the direction of some warming temperature patterns, and some buying spillover from the oil was apparent. Regardless, we still feel that the supply deficit will need to be cut much more before supply worries ease enough to enable significant downside price follow-through.

“Obviously, some large funds are trading this market from both sides and contributing to elevated late-week price volatility. Just as this week’s selloff exceeded our expectations, [Thursday’s] advance also proved much more than we had anticipated. At the end of the day, we still view this market as one that needs to be worked strictly from the long side.”

Those not working the market from the long side Thursday were rudely awakened. Traders saw a modestly bullish storage build catapult the market higher by a gut-wrenching 25 cents. Going into the 10:30 a.m. release of the data analysts were looking for an increase of about 110 Bcf. A Reuters survey of 22 traders and analysts revealed an increase of 110 Bcf with a range of 101 Bcf to 117 Bcf. United ICAP forecast a build of 121 Bcf and industry consultant Bentek Energy utilizing its flow model anticipated an injection of 113 Bcf.

The actual figure of 107 Bcf was just shy of the mark by 3 Bcf, but for the bulls and those holding short positions that was enough. July futures jumped to a high of $4.687 shortly after the number was released and by 10:45 EDT July was at $4.677, up 16.9 cents from Wednesday’s settlement. July went on to trade as high as $4.769 before settling at $4.762, up 25.4 cents on the day, and August added 25.9 cents to $4.763.

With such a large gain the question arises does this change anything. If nothing else it shows how tightly wired this market is and able to soar or sink on the slightest bit of bullish or bearish news.

“Sadly, no,” said David Thompson, vice president at Powerhouse LLC, a Washington DC risk management and trading firm. “We are still within a trading range and to be technically significant it would have to get through the high of May 30 of $4.852. The more recent lows are coming in at $4.29 so we have about a 55 cent range that we bounce back and forth in.”

“The MACD [Moving Average Convergence Divergence] has crossed over into bullish territory You can’t say the market is overbought since the RSI [Relative Strength Indicator] is just over 50 at 58, and you can’t say it broke through resistance. All you can say is the market moved hyper-dramatically but we are not even in a key reversal since we didn’t trade lower than Wednesday’s low at $4.504.”

“Certainly dramatic but not [a game changer] until you break $4.852,” Thompson suggested.

“In terms of this big concern, it’s interesting to compare natural gas with its cousin, natural gas liquids. Both commodities came out of the Polar Vortex extremely low. Propane since the beginning of April has refilled at an average that is 75% faster than last year, and it’s right back in the middle of its five-year average. It went from being way under to completely normal. Not so natural gas.”

“Is anybody worried about propane prices taking off? No. The big question with natural gas is that there is still a lot of uncertainty in the market due to whether the rate of refill is sufficient enough.”

Pipeline maintenance at Northeast points Friday prompted the day’s greatest gains in the physical market boosting quotes well above the overall average. “Capacity reduction due to Algonquin’s maintenance on its 30-inch Mainline started on Tuesday and is expected to be completed by Monday. Algonquin Citygate prices have been trading higher due to the decreased flow into the New England area,” said industry consultant Genscape.

“Due to this maintenance, AGT [Algonquin Gas Transmission] has restricted interruptible, secondary out of path nominations that exceed entitlements, secondary out of path nominations within entitlements, secondary in path and approximately 38% of primary firm nominations sourced from points west of its Southeast Compressor Station (Southeast) for delivery to points east of Southeast. Flow through Stony Point dropped from 1131 MMcf/d before the maintenance to 528 MMcf/d [Friday]. Flow through Southeast compressor station dropped from 1,112 MMcf/d before the maintenance to 518 MMcf/d [Friday]. Flow through Cromwell dropped from 648 MMcf/d before the maintenance to 296 MMcf/d [Friday].”

Quotes for weekend and Monday gas at the Algonquin Citygates jumped 55 cents to $4.64, and gas at Iroquois Waddington was seen 14 cents higher at $4.80. Deliveries to Tennessee Zone 6 200 L gained a stout 37 cents to $4.27.

Quotes in Appalachia and the Mid-Atlantic were higher to mixed as active weather was seen for the area. The National Weather Service in Baltimore reported that “an upper trough will remain over the area for much of [Friday]…before a cold front sweeps the warm and humid air mass off the coast [Friday night]. High pressure will settle over the area Saturday…then shift off the East Coast next week leading to a return of warm and humid conditions.”

Temperatures were close to if not a little above normal. Wunderground.com reported that Boston’s Friday high of 64 would reach 75 Saturday before advancing to 79 Monday. The seasonal high in Boston is 75. Albany, NY’s 72 high on Friday was seen climbing to 75 Saturday and making it to 86 on Monday. The normal mid-June high in Albany is 77. Baltimore’s 82 high on Friday was expected to ease to 78 on Saturday and then rise to 83 on Monday. The normal high in Baltimore this time of year is 83.

Deliveries to New York City on Transco Zone 6 slipped 7 cents to $3.09, but weekend and Monday gas on Tetco M-3 added 2 cents to $3.14. Gas on Columbia TCO rose 16 cents to $4.60, and parcels on Dominion South were seen up a nickel to $3.15.

The Marcellus was one of the few locales posting a loss. Gas for delivery over the weekend and Monday on Transco Leidy slumped 30 cents to $2.00, and packages on Tennessee Zone 4 Marcellus shed 20 cents to $1.90.

Futures traders are still optimistic in spite of Friday’s lackluster settlement. “I think a settlement above $4.75 would have positioned the market for a move to $5 by next week, but it didn’t happen. Two days of gains would have indicated good movement to the upside,” said a New York floor trader.

He indicated that with the storage number for next week likely to induce another surge of volatility, $5 was easily within reach.

Analysts see continued tightening in the supply-demand balance. “Despite the mild weather, deep cash discounts in the Northeast are supporting electric power demand and limiting the region’s inventory restocking effort,” said Teri Viswanath, director of commodity strategy for natural gas at BNP Paribas. “According to our analysis of the interstate pipeline deliveries, the month-to-date electric power demand in the Middle-Atlantic states appears to be running roughly 0.3 Bcf/d higher than year ago levels or on pace to the 2012 record burns. Accordingly, this demand competition is limiting the inventory restocking effort in the East Consuming region, with weekly injections falling short of the five-year maximum reported levels.

“All told, we see supply-demand balances continuing to tighten, limiting the industry’s progress in paring the y-o-y storage deficit.”

Figures from Baker Hughes aren’t helpful to the cause of improving the storage deficit. The firm said Friday that the number of gas-directed rigs operating in the United States fell by 10 this week to 310. Horizontal rigs, those commonly associated with the active shale plays fell by two to 1,248, the firm said.

Weather forecasts called for a Midwest cooling in the six- to 10-day period. In its Friday morning outlook, MDA Weather Services said, “The first half of the period progressed well from [Thursday] with a round of heat and humidity still playing out of the East back into the eastern Midwest before an expected cool-down.

“This cool-down comes with greater intensity and focus in the East today where model trends suggest high pressure descends southeast from Canada, bringing a cold front through the Great Lakes and Midwest to East mid to late period. While the East trends a bit cooler the central U.S. shifts warmer late in the period as another round of active weather moves in and quickly overpowers the cool air.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |