Markets | NGI All News Access | NGI Data | NGI The Weekly Gas Market Report

Futures Mega-Move Not a Game-Changer, Yet; July Vaults 25 Cents, Cash Eases

Physical prices for Friday delivery slipped lower in Thursday’s trading as most cash transactions were concluded before the release of government storage data. How quickly things change. Futures market followers Wednesday saw the third decline for the week and were thinking that a lack of summer heat and bountiful production could pressure prices lower.

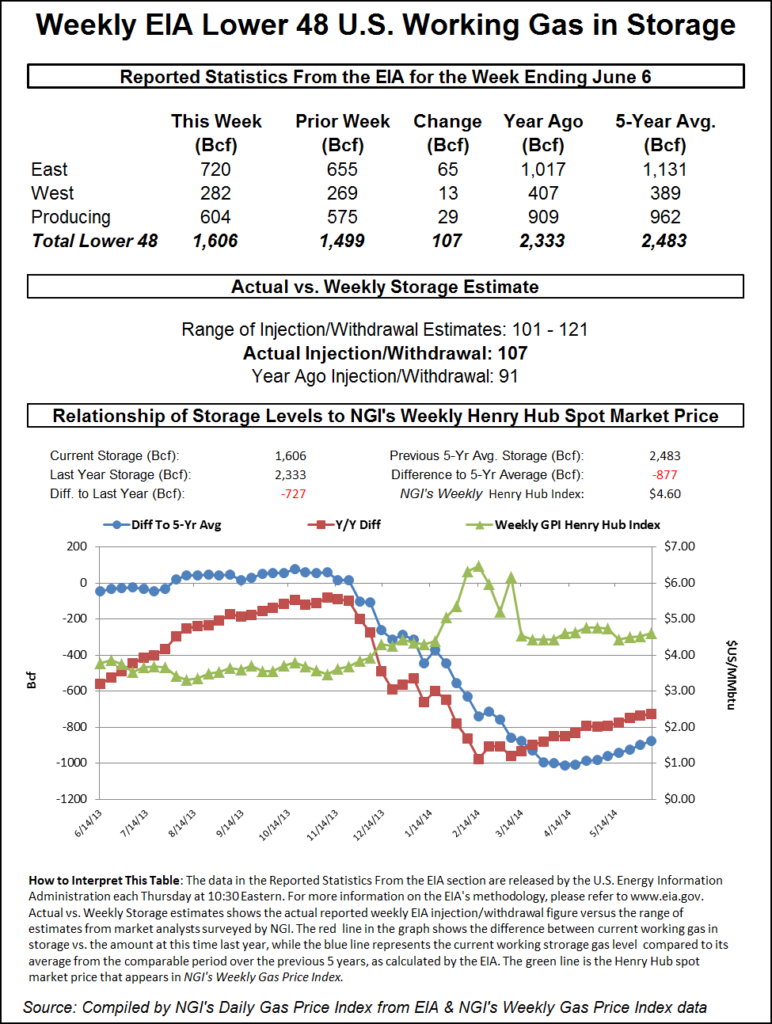

That may have all changed with Thursday’s inventory report, which saw a modestly bullish storage build catapult the market higher by a gut-wrenching 25 cents. Going into the 10:30 a.m. EDT release of the data analysts were looking for an increase of about 110 Bcf. A Reuters survey of 22 traders and analysts suggested an increase of 110 Bcf with a range of 101-117 Bcf. United ICAP forecast a build of 121 Bcf, and Bentek Energy’s flow model anticipated an injection of 113 Bcf.

The actual figure of 107 Bcf was just shy of the mark by 3 Bcf, but for the bulls and those holding short positions that was enough. July futures jumped to a high of $4.687 shortly after the number was released, and by 10:45 a.m. July was at $4.677, up 16.9 cents from Wednesday’s settlement. July went on to trade as high as $4.769 before settling at $4.762, up 25.4 cents on the day. August added 25.9 cents to $4.763, and July crude oil was also active, gaining $2.13 to $106.53/bbl.

With such a large gain the question arises: does this change anything? If nothing else it shows how tightly wired this market is and able to soar or sink on the slightest bit of bullish or bearish news.

“Sadly, no,” said David Thompson, vice president at Powerhouse LLC, a Washington, DC-based risk management and trading firm. “We are still within a trading range, and to be technically significant it would have to get through the high of May 30 of $4.852. The more recent lows are coming in at $4.29, so we have about a 55-cent range that we bounce back and forth in.

“The MACD [moving average convergence divergence] has crossed over into bullish territory. You can’t say the market is overbought since the RSI [relative strength indicator] is just over 50 at 58, and you can’t say it broke through resistance. All you can say is the market moved hyper-dramatically, but we are not even in a key reversal since we didn’t trade lower than Wednesday’s low at $4.504.

“Certainly dramatic but not [a game-changer] until you break $4.852,” Thompson said.

“In terms of this big concern, it’s interesting to compare natural gas with its cousin, natural gas liquids. Both commodities came out of the Polar Vortex extremely low. Propane since the beginning of April has refilled at an average that is 75% faster than last year, and it’s right back in the middle of its five-year average. It went from being way under to completely normal. Not so natural gas.

“Is anybody worried about propane prices taking off? No. The big question with natural gas is that there is still a lot of uncertainty in the market due to whether the rate of refill is sufficient enough.”

Analysts saw Tuesday’s 11-cent drop as a case of tired longs bailing, and Wednesday’s 2-cent slide due to a change in weather forecasts and upward revisions to storage report estimates. “Natural gas futures fell for a second day on Tuesday, with apparent long liquidation knocking 11.5 cents (2.48%) off the nearby July contract to $4.530/MMBtu settlement,” said Tim Evans of Citi Futures Perspective following the close Thursday.

“The market began this downswing as a correction to last week’s rally in the face of weeks of above-average storage injections, but it may have gotten an extra push to the downside after the Department of Energy’s Short Term Energy Outlook showed May dry gas production reaching a new record of 69.49 Bcf/d, an increase of 3.17 Bcf/d (4.8%) from a year ago (see Daily GPI, June 11).

“Growth in supply for last month was more than double the corresponding 1.46 Bcf/d (2.6%) year-on-year increase on the demand side of the market and suggests that the bearish storage trend of the past two months may well continue, at least in the absence of intense heat this summer.”

Evans forecast a build of 114 Bcf in Thursday’s storage report and looks for subsequent three-digit gains for the two weeks following. By June 27 he sees the five-year “surplus” down to an 805 Bcf deficit. The five-year deficit currently stands at 896 Bcf.

The physical market Thursday was much subdued due to traders making sure they got their deals done prior to the release of the storage data. Eastern points were the big losers dropping double digits at some locations, but producing zone points were flat to lower. Overall the market weakened about 6 cents.

At Mid-Atlantic points next day gas fell over a dime as weather forecasts were more focused on load-killing storms and thundershowers than any real accumulations of heat. AccuWeather.com forecast that the Thursday high in Boston of 66 degrees would reach all of 68 Friday before rising to 80 on Saturday. The normal high in Boston in mid June is 75. New York City’s Thursday maximum of 71 was expected to reach 78 Friday before making it to 80 on Saturday. The seasonal high in New York City is 78. Philadelphia’s Thursday high of 76 was predicted to rise to 83 on Friday an ease to 81 on Saturday. The normal high for Philadelphia this time of year is 82.

“Sunshine and less humid conditions are in the offing for Philadelphia and vicinity this weekend, but not before more downpours drench the region into Friday,” said AccuWeather.com meteorologist Alex Sosnowski. “Clouds, high humidity and rounds of heavy rain and thunderstorms will rule through Friday [and] the pattern will bring an ongoing risk of flash and urban flooding that can greatly slow travel and disrupt outdoor activities. Most of the downpours and strongest storms will occur during, but will not be limited to, the afternoon and evening hours.”

Gas deliveries into Transco Zone 6 New York for Friday fell 12 cents to $3.16, and gas delivered on Tetco M-3 dropped a baker’s dozen to $3.12.

At the Algonquin Citygates Friday packages skidded 71 cents to $4.09, and on Iroquois, Waddington Friday gas came in at $4.66, down 6 cents. On Tennessee Zone 6 200 L next-day gas was seen at $3.90, down 54 cents.

In the Midcontinent quotes for next-day gas were mixed. Gas deliveries to the NGPL Midcontinent Pool added a penny to $4.43, but parcels on ANR SW shed 6 cents to $4.36. Gas on Panhandle Eastern added 4 cents to $4.24, but gas on OGT was flat at $4.24.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |