Utica Shale | E&P | NGI All News Access

Still Not Convinced, Street Wants More Answers From The Utica Shale

Despite the Utica Shale’s historic rise over the last five years in eastern Ohio, there remains significant uncertainty among investors who are not yet convinced by its limited data and gassy production profile, especially at a time when development elsewhere is on the upswing and the market still favors oil heavily.

This was the overview provided by Sterne Agee financial analyst Tim Rezvan at last week’s DUG East Conference in Pittsburgh, which attracted more than 3,200 attendees. Rezvan’s remarks helped to shine a light on a pattern that has defined the Utica in its early evolution, one that at times has wedged its place in the market to a gray area where no long-term return on investments can easily be seen and the shadow of its larger de-risked cousins in other basins across the country looms large.

“Let’s talk about what the industry knew about Ohio five years ago: very little,” Rezvan said. “The industry remains in the early stages of actively delineating what we really believe is a prolific hydrocarbon reservoir that extends from eastern Ohio all the way out to West Virginia and possibly western Pennsylvania.”

Those extensive boundaries, however, have yet to be tested, with operators only now beginning to drill West Virginia’s first horizontal Utica wells (see Shale Daily, May 16; March 26) and development in western Pennsylvania’s Utica stuck in an exploratory rhythm (see Shale Daily, June 5; Dec. 12, 2013).

“At this point, it’s important to think what is the next step. Do you think we’re going to see an escalation in prices given the rally we’ve seen in natural gas? It’s important to note that there are some very clear headwinds facing the industry [in Ohio].” said Rezvan, who covers 19 exploration and production companies, including some of the Utica’s key players such as Chesapeake Energy Corp. and Gulfport Energy Corp.

“The biggest one is natural gas processing and takeaway; they continue to be limiting factors for growth, especially for companies that are well capitalized. They could be running higher rig programs right now.”

Beyond the widely discussed limitations of too few pipelines and processing options, Rezvan said the volatility of natural gas prices still threatens the bottom lines of small-, mid- and large- cap independents that rely on the Utica more than some of their peers do. The”gassy skew of Utica wells may be too gutsy [or] contrarian in today’s commodity price environment,” he said.

“A lot of the investment clients we speak with have a lack of uniform view on how pricing will play out over the next 12 to 18 months. It’s also important to note about gas prices that the Utica is much gassier than investors have thought about over the last couple years. You need to see some price stability and some improvement in the near-term future strip for people to really get excited.”

Rezvan said with the 2015-2016 futures strip running at $4.25-4.30/Mcf that it does not provide favorable near-term drilling economics. In the play’s early days, when the Utica first landed on investors “radar screens” in 2010, he said many financial analysts were forced to swallow what the dominant companies scooping up land in Ohio had to say about the Utica’s prospects. Many believed the play would be analogous to the Eagle Ford in Texas, with distinct and prolific oil, condensate, wet and dry gas windows there for the taking.

Since then, the oil window has proved to be a challenge, with companies capital allocations indicating that they have reservations about pressure dynamics and reservoir quality that for now are holding it back from commercial success. Dry gas results have been astounding, though, with a number of wells drilled by Magnum Hunter Resources Corp., Antero Resources Corp., Gulfport Energy Corp. and Rice Energy Inc. all testing at, or well above, 30 MMcf/d, in southeast Ohio (see Shale Daily, June 2; Feb. 14; Nov. 8, 2013).

There does still exist a great deal of optimism for the Utica Shale, Rezvan said. Today, more than 800 wells have been drilled, about half of which are now producing, while another 400 have been permitted. Thirty-one operators are active in the play across 15 different counties.

And even as mergers and acquisitions in the Utica have slowed, with private equity backers bought out, land mostly spoken for and splashy deals a thing of the past, an acre is still fetching between $10,000-18,000 in some parts of the state, as evidenced by recent moves from players such as American Energy Partners LP and Antero Resources Corp. (see Shale Daily, June 9; April 22).

Those prices could go higher with more delineation, improving well results and progress on the infrastructure buildout, which could ultimately help to balloon valuations for the Utica’s leaders.

“There’s still a lot of stuff we don’t know. Are we going to be drilling on 1,000 foot [downspacing] on these wells? Can we drill at 500 feet,” Rezvan asked the audience.

“We don’t know that kind of stuff yet. We need to be patient and get towards 2016 and beyond” when more infrastructure is online and more questions have been answered, he said.

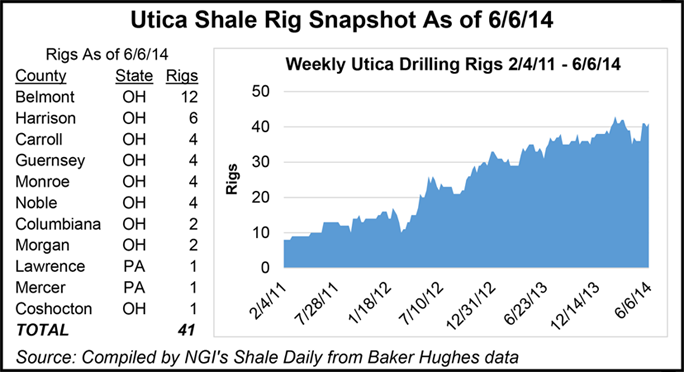

There were 41 rigs working the Utica Shale in Pennsylvania and Ohio as of June 6, with nearly a third of them working in Belmont County, OH, according to Baker Hughes data. Baker Hughes did not include rigs in West Virginia in compiling the data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |