Markets | NGI All News Access | NGI Data

Futures Glide Lower Following Super-Sized Storage Build

Natural gas futures fell following the release of government storage figures that were bit on the high side of what the market was expecting.

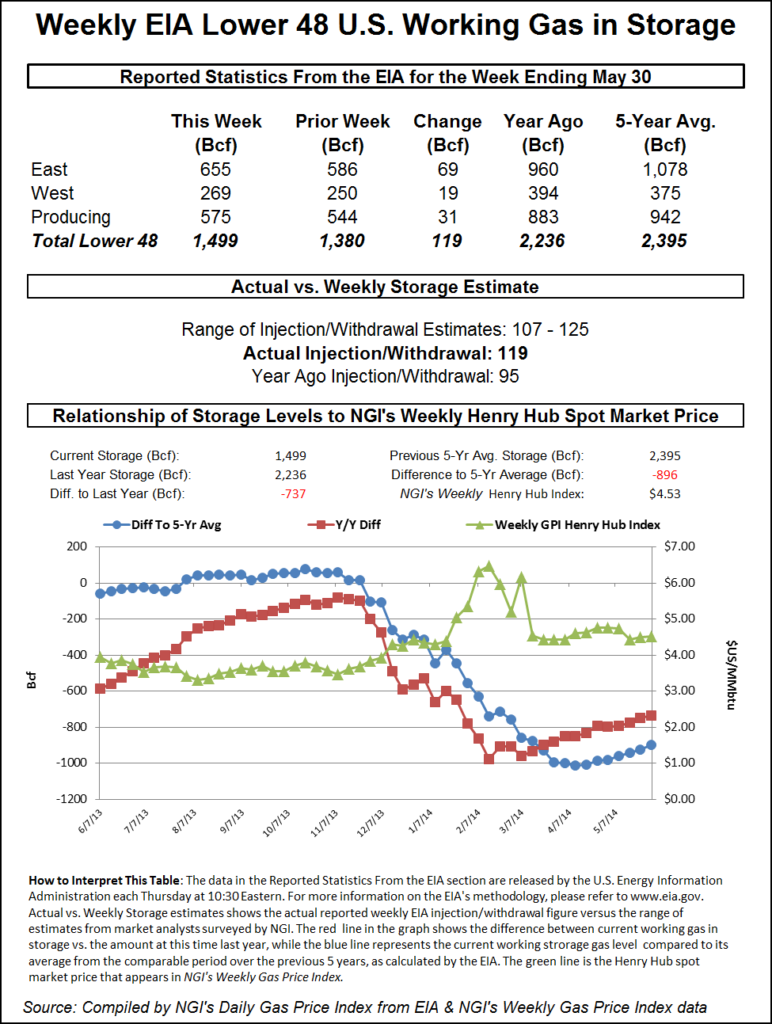

The injection of 119 Bcf was about 4 Bcf higher than market surveys and independent analyst projections. For the week ended May 30, the Energy Information Administration (EIA) reported an increase of 119 Bcf in its 10:30 a.m. EDT release. July futures fell to a low of $4.586 shortly after the number was released, but by 10:45 a.m. July was at $4.612, down 2.8 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build right around 115 Bcf. A Reuters survey of 24 traders and analysts revealed an increase of 116 Bcf with a range of 107 Bcf to 125 Bcf. United ICAP forecast a build of 118 Bcf, and Bentek Energy’s flow model anticipated an injection of 115 Bcf.

“Traders were looking for a 115 Bcf build, and we made new lows once the number came out,” said a New York floor trader. “In the overall scheme of things, this was not much of a reaction at all. Market resistance is $4.75, and we are creeping up towards that.”

Tim Evans of Citi Futures Perspective said, “The gain wasn’t quite as much as our model’s 122 Bcf estimate, suggesting that the underlying supply-demand balance may not have been quite as weak as in the prior week. However, the trend toward bearish surprises relative to consensus expectations continues.”

Inventories now stand at 1,499 Bcf and are 737 Bcf less than last year and 896 Bcf below the five-year average. In the East Region 69 Bcf was injected and the West Region saw inventories up by 19 Bcf. Inventories in the Producing Region rose by 31 Bcf.

The Producing Region salt cavern storage figure increased by 11 Bcf from the previous week to 163 Bcf, while the non-salt cavern figure rose by 21 Bcf to 412 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |