NGI Archives | NGI All News Access

North American Energy Supply Needs Steady Investments, Clear Policymaking, Says IEA

North America’s oil and natural gas output could begin to plateau in the early 2020s without adequate investments, the International Energy Agency (IEA) predicted on Tuesday.

Meeting global energy demand will require more than $48 trillion in total worldwide investments to 2035, according to the special report by the global energy watchdog, the first investment update in more than a decade.

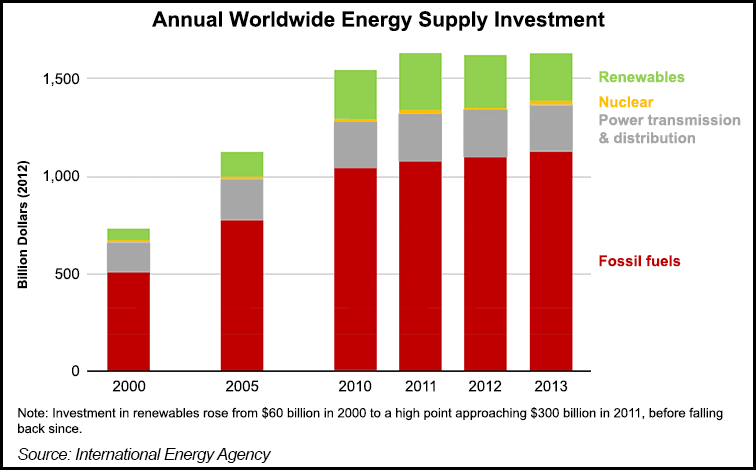

Today’s annual investments in energy supply, averaging around $1.6 trillion worldwide, will need to increase steadily over the coming decades to around $2 trillion by 2035. Annual spending on energy efficiency, measured against a 2012 baseline, will need to increase from $130 billion today to more than $550 billion.

“The reliability and sustainability of our future energy system depends on investment,” said Executive Director Maria van der Hoeven, who presented the report. “But this won’t materialize unless there are credible policy frameworks in place, as well as stable access to long-term sources of finance. Neither of these conditions should be taken for granted.

“There is a real risk of shortfalls, with knock-on effects on regional or global energy security, as well as the risk that investments are misdirected because environmental impacts are not properly reflected in prices.”

Global oil and natural gas exploration and production spending should increase by 25% over the period to keep pace with current output, reaching more than $850 billion/year by 2035. That investment is part of the $2 trillion in annual energy needs over the next two decades, up from about $1.6 trillion in 2013.

“More than half of the energy supply investment is needed just to keep production at today’s levels; that is, to compensate for declining oil and gas fields and to replace power plants and other equipment that reach the end of their productive life,” said van der Hoeven.

More than $700 billion also is expected to be spent to 2035 for liquefied natural gas (LNG) infrastructure. Those significant investments add to the costs, which will slow the rate at which new LNG may globalize gas markets.

There are “expectations in some places that new supplies from the United States can transform gas markets by exporting not just U.S. gas, but also by exporting U.S. natural gas prices that are a fraction of those in Europe or in Asian markets,” said van der Hoeven. “LNG — from the U.S. and elsewhere — indeed plays a very important role in our outlook for gas markets, but it is worth remembering that moving gas over long distances is expensive — up to 10 times higher than moving an equivalent amount of coal or oil around the world.

“Understanding the scale of this investment in new liquefaction facilities and LNG tankers, and what this means for the costs of delivering LNG, should help to provide a realistic assessment of the price at which future LNG will be available.”

Many experts see North America becoming energy independent over the next two decades, but IEA economists warned that the U.S. oil boom likely will fizzle in the early 2020s. Growth in oil demand is seen becoming “steadily more reliant” on investments in the Middle East.

In the main investment scenario, IEA predicted that $40 trillion of the $48 trillion total in investments to 2035 will be directed to ensuring enough energy supply, with $23 trillion earmarked for fossil fuel extraction, transportation and oil refining.

“The total requirement for energy investment emerging from this analysis is huge: more than $40 trillion in energy supply over the period to 2035 in our main scenario, alongside an additional $8 trillion of investment in energy efficiency,” said van der Hoeven.

“Of the $40 trillion in energy supply, more than half is required just to keep the energy system producing at today’s levels, that is, to compensate for declining output from existing oil and gas fields, to replace power plants that are retired, or equipment that reaches the end of its operational life. In geographical terms, nearly two-thirds of the energy-supply investment takes place in emerging economies,” but “aging infrastructure and climate policies” would require large investments in developed nations also.

The newly compiled data indicate how annual investment in new fuel and electricity supply has more than doubled in real terms since 2000, with investment in renewable source of energy quadrupling over the same period, thanks to supportive government policies.

Interestingly, the IEA found that investment in renewables in the European Union has been higher than investments to date in natural gas production in the United States. Renewables, together with biofuels and nuclear power, now account for around 15% of annual investment flows, with a similar share also going to the power transmission and distribution network.

However, most of today’s investment spending, well above $1 trillion, is related to fossil fuels extraction, transportation, refining or building processing/transportation infrastructure.

“Investment decisions are increasingly being shaped by government policy measures and incentives,” van der Hoeven said. “While many governments have retained direct influence over energy sector investment, some stepped away from this role when opening energy markets to competition: many of these have now stepped back in, typically to promote the deployment of low-carbon sources of electricity.”

The U.S. Environmental Protection Agency on Monday proposed rules to cut carbon emissions from the power generation sector 30% below 2005 levels by 2030, a decision that could upend future investments in coal-fired generation to the benefit of natural gas and renewables (see Daily GPI, June 2).

“In the electricity sector, administrative signals or regulated rates of return have become, by far, the most important drivers for investment,” IEA noted. The share of investment in competitive parts of electricity markets has fallen from about one-third of the global total 10 years ago to around 10% today.

“Policymakers face increasingly complex choices as they try to achieve progress toward energy security, competitiveness and environmental goals,” said IEA Chief Economist Fatih Birol. “These goals won’t be achieved without mobilizing private investors and capital, but if governments change the rules of the game in unpredictable ways, it becomes very difficult for investors to play.”

Close to $10 trillion is forecast for power generation, with low-carbon technologies taking the lion’s share, including $6 trillion for renewables and $1 trillion for nuclear. Another $7 trillion is expected to be spent on transmission/distribution.

If the Middle East producers don’t invest now to cover the predicted shortfall created by declining U.S. oil output, the average cost of a barrel of oil could climb $15.00 by 2025, IEA predicted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |