NGI Data | NGI All News Access

Bidweek Traders Mulling Power Usage, Maintenance; June Quotes Tumble

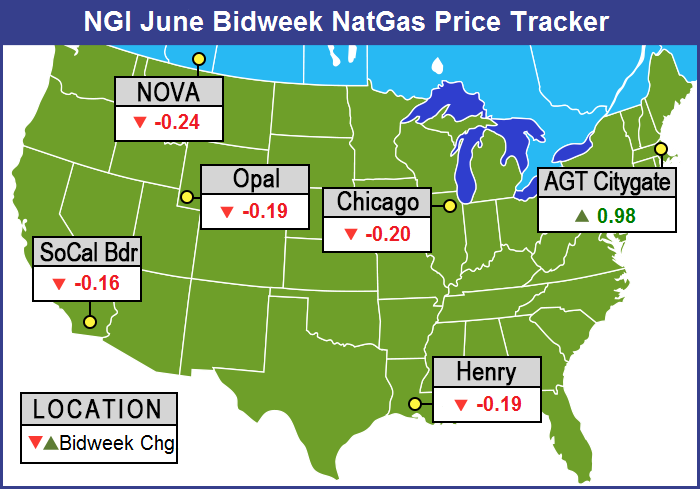

With futures prices stuck in a range, and weather forecasts uninspiring, bidweek traders didn’t have a lot to go on to make their June trades. Utilities, as always, were making sure their bidweek purchases aligned with their need to refill storage, but marketers needing to ensure their customers get the lowest cost gas possible were faced with a different set of challenges. Nationally the NGI Bidweek Average Price for June fell 36 cents from May to $4.12. Most individual points lost about 20 cents and only a few locations made it into positive territory. The Northeast saw the greatest swings, and of the actively traded points June bidweek at the Algonquin Citygates jumped 98 cents to average $5.58 and Tennessee Zone 4 Marcellus dropped $1.01 to average $2.41. All regions declined.

Regionally the Northeast led the declines dropping 66 cents to average $3.42, while East Texas was the next “highest” posting a loss of 21 cents to $4.48.

The Rocky Mountains, Midcontinent, and South Texas all came in with declines of 18 cents to $4.30, $4.27, and $4.50, respectively. Both the Midwest and South Louisiana were off 17 cents to $4.75 and $4.58, respectively, and California lost the least sliding 12 cents to average $4.78.

Natural gas futures losses weren’t too far off those of bidweek. The June contract expired at $4.619, down 17.6 cents from the May settlement.

The June futures settlement of $4.619 drove a lot of bidweek pricing, but some didn’t want to wait around last Wednesday for the futures to settle before stepping up to the plate for their bidweek volumes. “We triggered a portion of it this morning [Wednesday] because we are typically seeing the market go up at the end of the day,” said a Great Lakes marketer.

“Half of what we buy on Consumers we triggered and got it at a $4.785, but the settled price plus our 28-cent basis is going to be a little higher. We just said let’s not go to the close on all of it. Volume-wise we did what we typically do, but not as heavy as last month.”

Other traders seeking to put their bidweek trading to rest said the market is a tough call. “I was talking to a producer who used to work with people that would take a position, and he said that there should be a stronger market going into June than we have had because we haven’t had any heat at all in the Northeast. It’s strictly a power demand deal right now. Are the power plants going to run? and if the nukes are down I think you will see pretty hefty demand and price spikes during the day,” said a Houston-based pipeline industry veteran.

“There’s also a problem with maintenance. Transco, Spectra, and Tennessee are all going to have maintenance, and that’s going to throw some people into a frenzy. People with the right transport won’t be affected, though.”

He added that transport was the hard item to have. “With the demand in the Midwest stronger or equal to the Northeast, who gets the gas? Pipes are basically split down the middle now with gas going to both the Northeast and Midwest. I think you’ll see some 80s in New England and when that happens, does it wait until July or August? Or does it even happen. Are we going to stay in this same [weather] mode? That’s what everybody is trying to figure out right now.”

He said that the market going forward was basically a call on power usage. Overlying that is the issue of pipeline maintenance and if you think you have good transportation, but it’s impacted by maintenance, all bets are off. “I don’t think there are all that many ‘games’ anymore. You see people talking about where prices need to be and whether they will stay in a $4.40 to $4.75 range. I don’t think it’s going to move off that too much.

A trading range could very well be where the market trades for the foreseeable future. Even when the highly anticipated Energy Information Administration storage figure for the week ending May 23 was released towards the end of bidweek on Thursday, a bearish 114 Bcf, the July contract eased only 5.6 cents to $4.559.

A New York floor trader remarked that with futures’ reaction to the storage report “nothing has really changed. We are still in the range of $4.25 to $4.75. It’s not an ‘a-ha’ moment. It was not a significant development.”

Tim Evans of Citi Futures Perspective saw the figure “implying a further modest weakening of the background supply/demand balance that could carry over into future periods. The build was also a clear step up from the 93 Bcf five-year average for the period, with a further 21 Bcf decline in the year-on-five-year average deficit.”

Just as bidweek traders were grappling with the issue of power burn and whether power plants will run, power demand was also on the mind of industry consultant Bentek Energy as it estimated a build of 111 Bcf utilizing its flow model for the week’s storage report. Bentek said, “Total demand fell from the previous week by nearly 1.0 Bcf/d, which was driven by a 1.7 Bcf/d drop in power burn demand, which averaged 19.8 Bcf/d during the week.”

That drop in power burn was central to Bentek’s estimate of a 111 Bcf storage build. “The drop in power burn demand gives a good indication of the high-side risk to this week’s forecast. [Our] sample of storage activity also supports a stronger build week-over-week, with the West and Producing regions reporting stronger injections from the previous week while the East reported weaker injections,” the company said.

“Although [our] sample of injections increased week-over-week and came in significantly above the same period last year, the sample build did not increase as significantly as the drop in demand would have suggested, giving the low-side risk to the forecast, which is centered in the East region because of the weaker injections.”

With the 114 Bcf build inventories now stand at 1,380 Bcf and are 748 Bcf less than last year and 922 Bcf below the five-year average. In the East Region 64 Bcf were injected and the West Region saw inventories up by 19 Bcf. Inventories in the Producing Region rose by 31 Bcf.

Analysts’s near-term bullish stance was not dampened following Friday’s futures slide of 1.7 cents to $4.542. “We were not surprised by [Friday’s] additional selling, but we would continue to advise purchases of nearby futures on a scale down within the $4.40-4.50 zone,” said Jim Ritterbusch of Ritterbusch and Associates. “While we don’t expect violation of this week’s highs of about $4.66 in next week’s trade, a test of such could easily be forthcoming off of any weekend shifts toward warmer temperature expectations.

“Although [Thursday’s] response to a seemingly bearish EIA storage figure was less pronounced than we expected, it did manage to bring a halt to this week’s price rally, and while the market failed to sell off as much as we desired in our attempt to establish fresh longs, we remain resolute in a bullish near-term stance.

“A limiter on [Thursday’s] selling appeared to be some warm weather forecasts, especially across next week, that will likely be translating to a downsized storage injection to be issued two weeks from today,” added Ritterbusch. “As a matter of fact, [Thursday’s] build [report] likely represented the largest injection when looking across the next several months. Preliminary weather indications point toward a modest downsizing in next week’s build.”

Market technicians see a compelling case for near-term weakness based on what they see as a lackluster performance off Thursday’s inventory report.

“It was a constructive day for the bears, but far from convincing at this point. Natural gas tested the upside and failed miserably,” said Brian LaRose, technical analyst with United ICAP in a Thursday evening webcast. “Given the nature of the price action, I would much rather take a short position and work a buy-stop above $4.665. I think that is the safest play at this point given the seasonal cycle.

“If we can recoup [Thursday’s] losses and take out [Thursday’s] high [$4.665], then I see no reason why we can’t test the previous highs around the $4.80 to 4.90 area, but clearly there is potential for further downside here.”

LaRose bases much of his premise of a near-term decline on Elliott Wave analysis. He sees the price action up from the late March $4.289 low resembling a completed A,B,C bear market correction (up, down, now up) with a potential decline to a seasonal cycle low looming. “We need to be extremely concerned for when we look at the June and July contracts we can’t be confident that a market bottom has been put in place.”

He said that one more further push down would be consistent with the seasonal cycle pattern. “Generally speaking, we are looking for an August-September bottom before the next big run up begins. Who is to say it might not start early and that would be the bullish case here.”

In the spot market physical gas traded Friday for Sunday and Monday delivery slumped as weather conditions for the most part were expected to be benign and traders were reluctant to make purchases of gas that might become burdensome and have to be resold.

Only a handful of points made it to the positive side of the trading ledger, and overall most points were within a nickel of a dime’s loss. Marcellus points were hit the hardest, but California locations had to endure double-digit losses. The Energy Information Administration (EIA) reported record gross withdrawals in the Lower 48 for March. At the close of futures trading, July had eased 1.7 cents to $4.542 and August was down 1.6 cents to $4.524. July crude oil shed 87 cents to $102.70/bbl.

Sunday and Monday prices slumped across the Great Lakes as weekend warmth was predicted to give way to temperatures closer to normal by Monday. Forecaster Wunderground.com predicted that Friday’s high of 86 degrees in Minneapolis would ease to 85 by Saturday and reach 75 on Monday. The seasonal high in Minneapolis is 68. Indianapolis’ Friday max of 88 was seen sliding to 85 by Saturday and 81 on Monday. The normal late-May high in Indianapolis is 77. Chicago’s forecast was something of a departure from the trend. The high in Chicago Friday of 76 was expected to weaken by 75 Saturday and rise to 79 on Monday. The typical high in Chicago this time of year is 75.

The National Weather Service in Chicago predicted active weather patterns throughout the area, but no major extremes. “A large ridge of high pressure extending from Hudson Bay south to the Great Lakes region will slowly move to the East Coast Saturday night into Sunday. Full late-May sunshine has allowed temperatures to warm into the Lower/Middle 80s away from the lake and the same is expected on Saturday with temperatures a few degrees warmer. Continued onshore flow will keep the immediate Lakeshore areas much cooler.

“By Sunday southerly flow will allow more humid air to spread back into the area with dewpoints climbing into the Lower/Middle 60s. An upper-level wave is prognosticated by all the models to move across the region during the afternoon or early evening.”

Gas for Sunday and Monday delivery on Alliance fell 8 cents to $4.52, and parcels at the Joliet Hub eased 8 cents to $4.52. At the Chicago Citygates, gas changed hands at $4.52, also down 9 cents, and on Consumers gas came in at $4.70, down 11 cents. On Michcon, gas was seen at $4.73, down 11 cents.

A Rocky Mountain producer sees little problem with storage refill. “We’ll get to 3.5 Tcf, and if it takes $5 gas, so be it,” said a Denver producer. “Those eastern utilities are going to buy gas. They often are on set marching orders from their public utility commissions that by the end of April, May and June they have to have a set percentage of their storage requirements in the ground.”

The producer said the real development on the day was the report by the EIA of record gross production in the Lower 48 for March. EIA said gross withdrawals increased to 76.68 Bcf/d, up 1.6% from February and up 4.3 Bcf/d from a year ago or an astounding 6%.

“Keep in mind we have lost some production in Q1 due to freeze-offs. I don’t have any doubt we will get to 3.5 Tcf,” he said.

Gas in the Midcontinent came in a nickel to a dime lower. Gas on ANR SW was off 11 cents to $4.31, and deliveries to Northern Natural Gas Ventura fell 4 cents to $4.48. Packages at Demarcation were down 6 cents to $4.48, and at the NGPL Midcontinent Pool gas for Sunday and Monday delivery fell 9 cents to $4.36. On OGT, gas slipped 5 cents to $4.18, and on Panhandle Eastern parcels were seen at $4.19, down 4 cents.

Marcellus points were the hardest hit. Deliveries on Transco Leidy fell 23 cents to $2.08, and on Tennessee Zone 4 Marcellus weekend and Monday gas shed 28 cents to $2.06.

In its Friday morning 20-day forecast, WeatherBELL Analytics is looking for a cool pattern. It calculates modest heating degree day requirements below last year and the 30-year average. “There is great model agreement now, which if correct, would mean our June idea is on target,” said Joe Bastardi, WeatherBell meteorologist. “I, for one, am a bit concerned for if I am going to say the orbit of the MJO [Madden Julian Oscillation] into the current phases argued for the coming cooling, last night’s MJO forecast…makes me concerned that it could be too cool in the longer term (Days 15-30). It better be, anyway, because it is colder in the 30-day mean than our monthly forecast. For now, the reversal to the cooler national pattern next week and beyond is well seen on all models.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |