Markets | NGI All News Access | NGI Data

Bulls Circling the Wagons Following EIA Storage Data

Natural gas futures plunged following the release of government storage figures Thursday morning that were on the high side of what the market was expecting.

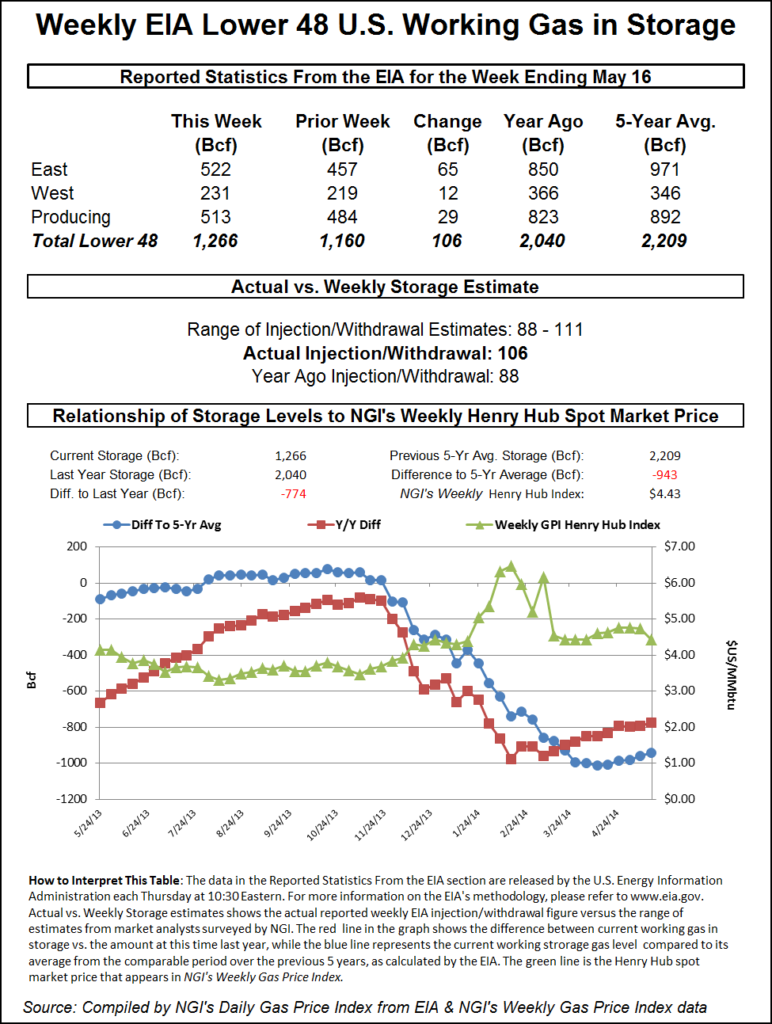

The injection of 106 Bcf was about 4 Bcf higher than market surveys and independent analyst projections. For the week ended May 16, the Energy Information Administration (EIA) reported an increase of 106 Bcf in its 10:30 a.m. EDT release. June futures fell to a low of $4.370 shortly after the number was released but by 10:45 a.m. June was at $4.388, down 8.5 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build just above 100 Bcf. A Reuters survey of 28 traders and analysts revealed an increase of 102 Bcf with a range of 88 Bcf to 109 Bcf. United ICAP forecast a build of 111 Bcf, and Bentek Energy’s flow model anticipated an injection of 101 Bcf.

“Traders were saying anything over 100 Bcf was bearish, and under 100 Bcf bullish, so we made a new low for the day when the number came out. Nothing has really changed. We are still stuck in a range from $4.25 on the downside to $4.75 on the upside,” said a New York floor trader.

Inventories now stand at 1,266 Bcf and are 774 Bcf less than last year and 943 Bcf below the five-year average. In the East Region 65 Bcf was injected and the West Region saw inventories up by 12 Bcf. Inventories in the Producing Region rose by 29 Bcf.

The Producing region salt cavern storage figure increased by 14 Bcf from the previous week to 140 Bcf, while the non-salt cavern figure rose by 15 Bcf to 373 Bcf.

Tudor, Pickering, Holt & Co. analysts Dave Pursell and Brandon Blossman said Thursday morning that they still believe storage will reach 3.6 Tcf by the end of the refill season in mid-November.

“We need to see an incremental 600 Bcf in total, 20 Bcf per week, or 2.7 Bcf/d go into storage over this injection season,” they wrote in a morning note. “At the beginning of April (the start of injection season), natural gas storage stood at 825 Bcf, or 800 Bcf below the 1.6 Tcf 10-year norms. A normal injection season puts an incremental 2.1 Tcf into the ground, getting to an average annual max of 3.8 Tcf. We continue to expect injection season to end with 3.6 Tcf — that means versus the historic norms we need an incremental 600 Bcf to be injected over 32 weeks of the injection season.”

Pursell and Blossman said a combo of normal weather and gas-to-coal switching is needed to get to 3.6 Tcf. “The main show will be gas power gen market share as summer weather heats up. What if we see above normal temperatures? Then storage likely trends closer to 3.4 Tcf and have to acknowledge a more bullish 2015 price outcome (say $4.5/Mcf-plus). With normal weather, 3.6 Tcf is achievable and 2015 priced at $4/Mcf is more likely.”

The TPH analysts said supply is currently setting up to surprise to the upside, with all the year-over-year growth coming from the Northeast currently, with the more recent sequential growth occurring in nearly all regions.

“Current data indicates we are running at 3-plus Bcf/d of incremental year-over-year gas supply. Supply is up 4-plus Bcf/d from the Northeast, but netting back to 3 Bcf/d largely on Gulf Coast onshore declines. The recent trend is for sequential growth from most regions with the last couple of months showing 500 MMcf/d of incremental production driven by smallish contributions across all non-eastern basins. Much of this looks to be seasonal recovery but, if the trend continues, Producing and West storage levels will be incrementally easier to refill, driving summer 2014 Henry Hub prices lower.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |