E&P | NGI All News Access | NGI The Weekly Gas Market Report

Associated Natural Gas Growth Arrests Canada’s Declining Supplies, Says NEB

Canadian natural gas supplies have resumed growing regardless of whether producers want to keep on fueling the North American supply glut, the National Energy Board (NEB) said Tuesday.

Drilling for shale liquids and provincial resource conservation regulations that ban flaring of associated gas production have already arrested previous supply declines and will keep output robust, the NEB said in an annual deliverability assessment.

In 2013 the mostly Alberta industry raised total Canadian gas production by 1% to 14 Bcf/d, reversing deterioration to 13.9 Bcf/d in 2012 from the national peak of 17 Bcf/d in 2005, reported the board. Only a deep retreat from current, partially recovered prices brought on by the severely cold 2013-2014 heating season will make Canadian gas supplies resume shrinking, the NEB said.

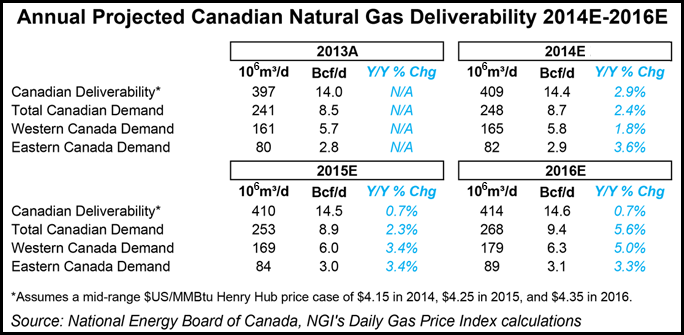

Modest growth continues in the conservative, mid-range all but flat price forecast rated as most likely to come true, with gas fetching an annual average US$4.15/MMBtu this year, $4.25/MMBtu in 2015 and $4.35/MMBtu in 2016. In the all-but-flat price case, Canadian gas production capacity grows gradually to 14.4 Bcf/d this year, 14.5 Bcf/d in 2015 and 14.6 Bcf/d in 2016.

More substantial supply growth lies ahead if the 2013-2014 gas price firming foreshadows material increases to annual averages of $4.75/MMBtu this year, $5.25/MMBtu in 2015 and $6.00/MMBtu in 2016. In the price increase case, Canadian gas production climbs briskly to an average 14.6 Bcf/d this year, 15 Bcf/d in 2015 and 15.7 Bcf/d in 2016, according to the NEB.

The Canadian contribution to the North American glut only shrinks if prices go back to hard times annual averages of $4.00/MMBtu this year, $3.50/MMBtu in 2015 and $3.75/MMBtu in 2016. In the hard times case, Canadian productive capacity goes up slightly to 14.3 Bcf/d this year then deteriorates to 14 Bcf/d in 2015 and 13.6 Bcf/d in 2016, according to the NEB.

The Canadian pattern mimics performance in the United States, but it is stronger north of the border because conservation regulations with a 75-year history prevent any spread of the notorious North Dakota practice of flaring unwanted gas, especially in Alberta.

“Deliverability of natural gas from oil wells — as associated gas or solution gas — or from natural gas wells producing wet gas is largely supported by the revenues obtained from crude oil and natural gas liquids,” the NEB said.

In Canada, the side effects of liquids drilling and conservation “are substantial sources of gas production.” The board also hedged its bets on its scenarios of the future, saying only time will tell how rapidly storage caverns depleted by the cold 2013-2014 winter refill and the response of commodity markets will take months to unfold fully.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |