Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Regulatory Activity to Dominate in the Bakken, State Official Says

Oil and natural gas operators in the robust North Dakota production fields are facing a lot of new regulatory requirements potentially from both state and federal government, beginning June 1 with a new state requirement for gas capture plans with each new drilling permit application, as underscored Tuesday by the state’s chief oil/gas official.

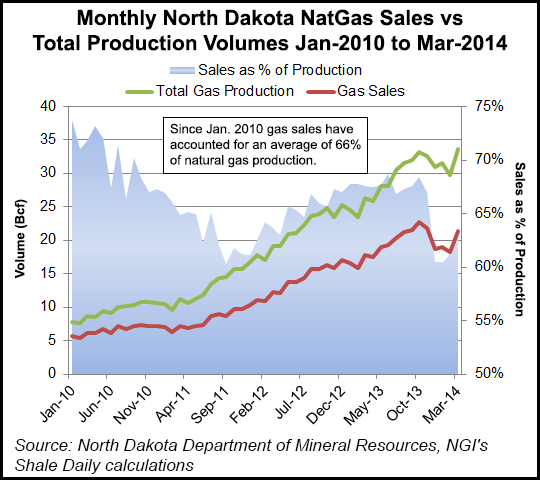

While noting the percentage of flared associated gas dropped in March after climbing higher earlier in the year, Lynn Helms, director of the Department of Mineral Resources (DMR), said his division has notified all operators to clarify the six parts of required information in the gas capture plans that will soon be required (see Shale Daily, March 5).

“In the absence of a gas capture plan, permit applications will be put on hold and they won’t move through the system without a plan,” said Helms. DMR will send letters in the next few days to oil/gas attorneys and operators to detail what a capture plan for applications for increased density drilling should look like. “[The latter] will be almost the same with the difference being information for the increased density drilling is not confidential,” Helms said.

“The first weeks of June will be really focused on gas capture and flaring reduction.”

During a webinar announcing the state’s latest oil/gas production statistics, Helms said the industry’s reaction to the capture plans is generally a feeling of uncomfortableness and uncertainty about the process, even though the industry has embraced efforts to address flaring.

“I think it would be fair to say that the operators are extremely nervous at this point,” Helms said. “Overall, there has been an enormous amount of cooperation. But they definitely want to know exactly what is required because they want to comply.”

He predicted that there are going to be some companies that are “in really good shape in terms of the 76% capture goal by year-end, and then there are going to be some companies that are not.” But the nervousness continues, Helms said, as the state Industrial Commission focuses more intently this year on flaring reduction.

There is equal concern about activities at the federal level, particularly the latest moves at the U.S. Environmental Protection Agency (EPA) related to hydraulic fracturing (fracking), publishing an advanced notice of proposed rulemaking. EPA is responding to petitions from groups that are unhappy with the use of FracFocus as a registry for reporting fracking chemicals.

The groups want EPA to set up its own system for receiving chemical disclosure information. “What will come out of this, I don’t know,” said Helms, adding that people will have 90 days to comment on the EPA’s notice after it appears in the Federal Register.

The Department of Interior’s Bureau of Land Management (BLM) also is pushing to have both fracking and flaring rules separately launched by the end of this year (see Daily GPI, May 17, 2013), and this will impact production at the Fort Berthold reservation in North Dakota, which accounts for one-third of the state’s production, Helms said.

“There is a lot of focus on hydraulic fracturing, still, by the federal government,” said Helms, reporting on his recent meetings with BLM officials. “In light of the recent GAO [General Accountability Office] report, there is some agreement with a ‘states first’ approach with the states being the place where oil/gas regulation should be centered, but that is not what is happening inside the beltway, so there is a real diversity of opinions there.”

Helms said BLM officials did not give him a lot of details on the final rules regarding fracking, but he was told there would be a lot of emphasis on well construction and water resource protection. “I think the BLM has settled in its mind the issues of chemical disclosure, and that FracFocus is the way to go,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |