NGI Data | NGI All News Access

Storage, Refill Optimists Gain Upper Hand in Weekly Trading

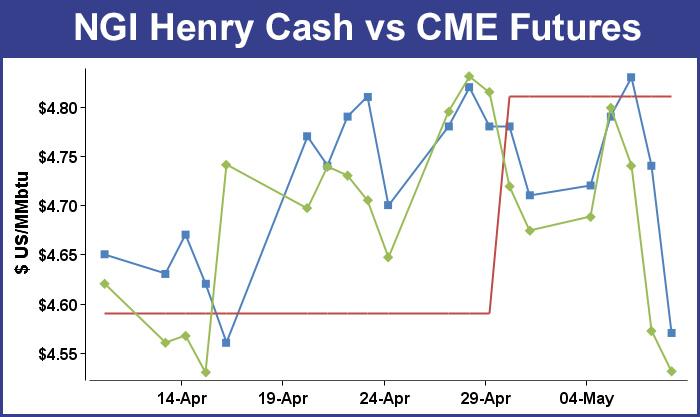

Buyers seeking to replenish thin working gas inventories got something of a break for the week ended May 9. Nearly all market points recorded losses and the NGI National Weekly Spot Gas Average finished 8 cents lower at $4.55. A slightly bearish inventory report may augur a changed storage/refill outlook.

Of the actively traded points quotes, the Algonquin Citygates proved to be the week’s biggest gainer, sporting all of a 3 cent rise to $4.36. The infrastructure-challenged Marcellus turned out to be the week’s biggest loser, dropping $1.05 to $2.90. All regions were solidly in the red, anywhere from 14 cents to as little as just a couple of pennies.

The Midcontinent was down 14 cents to $4.50 and the Northeast was off 13 cents to $4.13.

Quotes in the Midwest were seen 10 cents lower at $4.78, the Rocky Mountains shed 8 cents to $4.51 and East Texas came in 6 cents lower at $4.62.

South Louisiana and California each fell 3 cents to $4.66 and $4.91, respectively, and South Texas was off just a couple of cents to $4.59.

June futures tumbled 14.3 cents to $4.531.

The Energy Information Administration’s (EIA) 74 Bcf build storage report Thursday caught the bulls off guard. “We had heard anywhere from 65-72 Bcf injection, so it was clearly a bearish number,” said a New York floor trader. He noted that longer term, the issue of storage refill was still the 800-pound gorilla in the room, and “I think you have to look for a spot to buy this thing.”

Tim Evans of Citi Futures Perspective said “it was also a clear step up from our model’s 62 Bcf forecast, implying a weakening of the underlying supply/demand balance that could carry over into somewhat larger injections going forward.”

Going in to the report, traders had expected an injection in the low 70 Bcf range with little in the way of surprises expected. Houston-based IAF Advisors calculated an increase of 71 Bcf and industry consultant Bentek Energy saw a 66 Bcf build. A Reuters survey of 24 traders and analysts resulted in an average 71 Bcf addition with a range of 61 Bcf to 79 Bcf.

Bentek noted that “Demand increased from the previous week by 1.1 Bcf/d, which was largely centered in the Producing Region from an increase in power burn demand. Bentek estimates that power burn demand rose 1.2 Bcf/d within the region. The increased demand was reflected in Bentek’s sample of deliveries to power plants, which rose to their highest levels since the Feb. 13 storage week and averaged 6.9 Bcf/d during the week.”

The report “is looking very much like the advertised sample of low 70’s,” said John Sodergreen, editor of Energy Metro Desk (EMD). “Nothing we saw this week points to a surprise, but, then again, so far this year, those weeks which don’t produce a surprise report (5 Bcf-plus than the EIA report) are now the exception. Nonetheless, 70-75 Bcf should be right on the money this week; last week’s true up should suffice for the time being…Next week we may possibly see our first three-digit build — not soon enough as far as we’re concerned.” The EMD survey came in at 72 Bcf.

Inventories now stand at 1,055 Bcf and are 797 Bcf less than last year and 982 Bcf below the 5-year average. In the East Region 35 Bcf were injected and the West Region saw inventories up by 12 Bcf. Inventories in the Producing Region rose by 27 Bcf.

The Producing region salt cavern storage figure increased by 9 Bcf from the previous week to 113 Bcf, while the non-salt cavern figure rose by 18 Bcf to 342 Bcf.

In Friday’s trading gas for weekend and Monday delivery swan-dived as traders saw little incentive to purchase gas for what forecasters were calling mild weekend weather. Marcellus points took the hardest fall, aided by the well-known supply glut in the region, but New England, California, and the Midwest were right behind. Futures continued on their downward trek as analysts saw something of regime change with storage refill concerns becoming less of an issue. At the close June was off 4.1 cents to $4.531 and July had fallen 4.3 cents to $4.540.

Futures traders saw Thursday’s 17-cent plunge in the June futures as a bit overdone, and with the additional losses posted Friday saw the ball clearly in the bulls court. The EIA report was just a couple of Bcf above expectations and “hardly enough to merit such a big selloff, but nonetheless that’s what we had, and I wonder if it was due to something besides just the storage number,” said David Thompson, vice president at Powerhouse LLC, a Washington, DC, trading and risk management firm.

“The market had been advancing in slow, steady chops and didn’t seem that suspect to that much of a washout on a percentage basis. It broke the 20-day moving average, and our MACD (Moving Average Convergence Divergence) is in negative territory. Clearly the advance has been busted. Monday will be an important day to see if the bulls can make any kind of counter attack.”

Others also saw Thursday’s plunge as a game changer. It “prompt[ed] some selling that gathered momentum when three week lows were violated. The fact that [Thursday’s] supply build was the 3rd consecutive larger than expected injection also conjured up ideas of an evolving trend in which production could finally be accelerating,” said Jim Ritterbusch of Ritterbusch and Associates.

“Should this prove to be the case, constructing a bullish case on fundamental merits would be challenged until the hot temperature factor becomes more meaningful. At the same time, today’s fresh three-week lows have applied enough chart damage to shift this market into a near-term range that we would estimate at about $4.50-4.65, parameters that are roughly 15-20 cents lower than what we had been anticipating until today. In the absence of significant bullish assistance from the weather factor during the next couple of weeks, we feel that this market will simply be drifting into a new and lower trading range. We are, however, suggesting holding any bull spread positions.”

Deliveries to the Algonquin Citygates for the weekend and Monday tumbled 33 cents to $3.83 and deliveries to Tennessee Zone 6 200 L fell 24 cents to $3.92. Gas at Iroquois Waddington shed 18 cents to $4.44.

Biggest declines were noted for Marcellus deliveries with Tennessee Zone 4 Marcellus falling 23 cents to $2.08 and gas at Transco-Leidy losing 64 cents to $2.03.

Gas bound for New York City on Transco Zone 6 fell 19 cents to $3.81 and packages at Tetco M-3 Delivery lost 23 cents to $3.72.

Midwest storage operators seem to be in the position of restocking into a falling market. “Midwest storage injection has been stronger this year in April with the low inventory level. The storage injection rate averaged 0.7 Bcf/d for April compared to 0.2 Bcf/d in the previous year,” said industry consultant Genscape. “Storage injection averaged 1.0 Bcf/d so far in May, the same level as last May, [and] with the growth in Marcellus production, Midwest exports into Appalachia are being pushed back by about one Bcf per day.”

Genscape added that “Demand at the same time is declining year on year as cash price increases resulted in a decrease in coal-to-gas switching. The decline in imports so far are concentrated on sources from Western Canada, [and] the balance in Midwest in the near future heavily depends on gas consumption from power plants and back-haul flow on ANR and TGT. Midwest hub prices will likely receive strong downward pressure from the Gulf hubs for gas to flow south and strong downward price pressure from the coal-fired power plants for gas-fired plant generation to stay in the generation stack.”

Downward price pressure was indeed at work in the Midwest for weekend and Monday deliveries. Gas at the Joliet Hub dropped 16 cents to $4.52 and deliveries to Alliance were off by 18 cents to $4.51. At the Chicago Citygates weekend and Monday packages were seen at $4.54, down 17 cents and on Consumers gas changed hands at $4.69, down 14 cents. Deliveries to Michcon skidded 16 cents to $4.70.

Any significant heat to spark a weather rally may be a stretch near term. Commodity Weather Group in its Friday morning forecast was looking for a mixed pattern with accumulations of market-bending heat perhaps limited to California. “While 80s should still surge into the Mid-Atlantic again Mon-Tue of next week with risks for near 90-degree temperatures from DC southward, there are more complications showing up today with regard to a potential backdoor cool front for the Northeast by Tue (maybe slipping as far south as Philly) and then even into the entire Mid-Atlantic by next Wed.”

“The overall 6-10 day is same-to-cooler today with changes mostly to the cool side for the Deep South, including Texas, as well as over toward the East Coast. Heat in the West still looks very strong toward the middle of next week with near 100F highs for Sacramento and Burbank peaking next Wed. The 11-15 day looks more variable, but should lean seasonal to cool for the Midwest, East, and South with more warm to hot chances in the West again,” said Matt Rogers, president of the firm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |