NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Dominion Sees Customer Interest for Increased NatGas Capacity

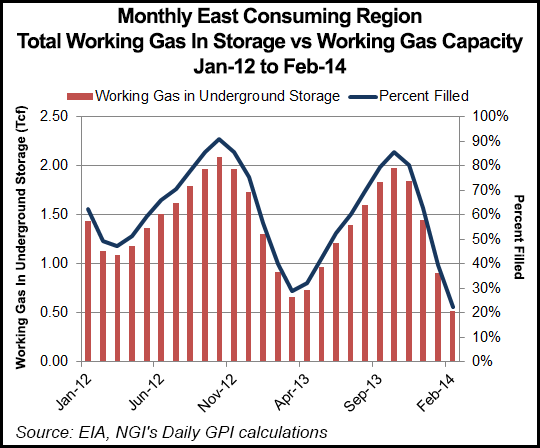

Dominion Resources Inc.’s natural gas storage systems in the Northeast had a record turn of about 241 Bcf in the first quarter, and customers are expressing more interest in expanding storage, executives said last week.

“We’ve certainly seen some customers that had contracts that were expiring renew and extend their contracts,”said Paul Koonce, executive vice president.He and other executives discussed the company’s first quarter earnings last Wednesday.

“That’s the first thing that I’ll take as a positive. We’re still meeting with our customers following this winter and assessing their needs, but we have a couple of other customers that have expressed a desire to increase capacity. So hopefully, we will be announcing something along those lines later this year. Certainly, interest is up,” Koonce said.

The Appalachia consuming region on Jan. 6 set a peak demand of 19,730 MW, an increase of more than 9% above the previous record set in 2007, CEO Tom Farrell said during the call (see Daily GPI, Jan. 7). “That same day, gas transmission also set a new peak with a one-hour sendout rate equal to 7.65 Bcf/d. Even higher winter peak electric demand was set on Jan. 30, at 19,785 MW.”

Koonce said there has been “somewhat of a standoff” between producers and local distribution companies (LDC) to see which is going to build the next incremental capacity. “Is it going to be the producer to get the gas out of the basin, or is it going to be the customer to secure reliability? Frankly following this winter, I think we’re beginning to see some movement back to LDC customers placing a premium on reliability, as they should.”

Dominion’s customers own the space and the storage, so the rate at which they refill storage is their call, Koonce said. This past winter strengthened the interest in storage, “certainly as it relates to our thoughts about a new pipeline in the Southeast. The nature of that load will be somewhat on and off, and so I think our storage capabilities…play nicely into that.

“We needed this winter to remind folks why they contract for firm transportation and firm storage, and it performed, and I think we should be rewarded for that. So hopefully, we’ll see some projects resolved.”

Dominion last month launched a nonbinding open season for the Dominion Southeast Reliability Project. If it gains support and approval, the pipeline would extend through Appalachia producing regions to markets in Virginia and North Carolina. Service could begin as early as November 2018.

The project is in a “sensitive phase of scoping, so we’re not really prepared to talk about type size or number of miles,” said Koonce. “I would just say that we have substantial assets already with our gas transmission business throughout the Marcellus and the Utica. We certainly saw the need for gas infrastructure in the Virginia North Carolina region, coming out of this February and the reliability issues associated with that. We also know there are customers in the communities that are served throughout that area. So, we are bullish on the Southeast pipe…The open season is not closed yet. We are still gathering expressions of interest and really expect more to come later this summer.”

Regardless, Dominion’s pipeline queue is at “full strength through at least the remainder of the decade,” said Farrell. “Construction is under way on the Allegheny Storage Project, and we have begun to accept injections. Construction has also begun on our Natrium-to-Market project. Both projects are on budget and on schedule to commence full service by November.”

Last fall, Dominion announced the New Market Project to expand service to two LDCs in New York for 15 years beginning in November 2016; an application is being prepared for the Federal Energy Regulatory Commission.

“In addition, we have had continued success in providing incremental transportation service as a result of the growing production within our region,” said Farrell. “We describe these as producer-outlet projects, taking advantage of the flexibility of Dominion Energy’s pipeline network to provide incremental services with shorter lead times and relatively small capital investment.”

Dominion in the fourth quarter said it had binding precedent agreements for firm transportation service covering 1.2 Bcf/d by 2016. The newly announced Lebanon West 2 project would provide 13,000 Dth/d of firm transportation service for 20 years. It is designed to move Marcellus Shale output from Butler County, PA, to Lebanon, OH.

“Precedent agreements have been signed, and the project is expected to be operational in late 2016,” said the CEO. One of the agreements is with Rex Energy Corp., which has secured two separate agreements — one with Dominion Transmission Inc., the other with Texas Gas Transmission LLC — to carry gas volumes to the Midwest and Gulf Coast (see Shale Daily, April 30).

Excluding the weather impacts in the first three months, sales were up about 1% year/year, “somewhat below expectations, particularly in the commercial sector,” said Farrell. “We believe most of this slower growth was due to the numerous snowstorms in the area this winter, which results in a significant number of commercial and governmental customers being closed for business. We still expect annual weather normalized sales growth of 1.5%.”

On Friday, subsidiary Dominion Virginia Power (DVP) asked the Virginia State Corporation Commission (SCC) for a 4.1% increase in residential customer rates to cover the higher cost of fuel used in its power stations, primarily because of the extremely cold winter. If approved as requested, the increase would take effect July 1.

A typical 1,000 kWh residential bill would increase to $112.45/month from $107.99; large business customers would see a proportionately higher impact.

“This winter we saw days and weeks so cold — driven by the polar vortex phenomenon — that the price of natural gas and purchased power soared,” said DVP President Robert M. Blue. “While gas was available, there were pipeline constraints at certain points on the coldest days. Had it not been for our diverse sources of generation, including nuclear and coal, electricity shortages might have occurred and this proposed fuel increase be even higher.”

Pending SCC approval, the company would delay collecting $133.7 million in higher fuel expenses until July 1, 2015. Without the proposal, a typical residential customer’s bill would be $2.00 higher, or about 6% more.

In a second filing Friday, DVP asked the SCC to allow it to increase its transmission rider by $1.91, or about 1.7%, for a typical residential customer to support efforts to strengthen the transmission network. If approved, the increase would take effect Sept. 1.

Dominion exceeded its expectations in 1Q2014 with profits of $379 million (65 cents/share), versus earnings of $495 million (86 cents) in 1Q2013. Dominion previously said it expected to earn 85 cents to $1.00/share in 1Q2014. Operating earnings amounted to $607 million ($1.04/share), versus $486 million (83 cents).

The lower earnings reflected charges related to Dominion’s repositioning last year, which involved rounding up the gas assets and forming a partnership that initially could generate up to $2 billion a year in earnings (see Shale Daily, Dec. 10, 2013).

“While favorable weather in our electric service territory was a benefit of about 5 cents/share, we are pleased that other factors, including improved merchant generation margins, higher ancillary service revenues and lower operating expenses, produced results that were above expectations,” said Farrell.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |