NGI Data | NGI All News Access

Bulls, Bears Duel To A Tie; Week Ends With Both Still Standing

With the exception of the Northeast, all points were within a nickel of unchanged and the Northeast was only off a little over a dime for the week ended May 2. Buying for storage refill for the most part countered lessened weather load and the NGI Weekly Spot Gas Average nationally fell 3 cents to $4.64. Of the actively traded points Marcellus locations proved to be the week’s strongest gainers. Transco Leidy was up by 15 cents to $3.99 and Tennessee Zone 4 Marcellus added 14 cents to $3.95. Biggest losers proved to be Tennessee Zone 6 200 L dropping 28 cents to $4.39 and Tennessee Zone 4 313 Pool sliding 26 cents to $4.20.

Regionally the Northeast proved to have the greatest difficulty retreating 12 cents to $4.26, but several regions within a couple of pennies of the prior week.

South Texas was 2 cents lower at $4.61, East Texas shed a penny to $4.68, South Louisiana was flat at $4.69 and the Rocky Mountains added a penny to $4.59.

California rose 3 cents to $4.94, and both the Midcontinent and Midwest were a nickel higher at $4.64 and $4.88 respectively.

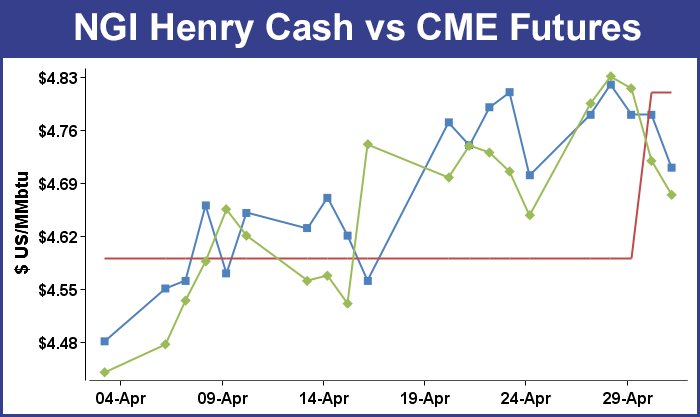

June futures settled 1.6 cents higher at $4.674.

In Friday’s trading gas for weekend and Monday delivery fell hard and fell often as traders elected to not commit to gas they might very well have to turn back on Monday given the mild weather outlook.

Northeast locations took the biggest hit, but a forecast of falling temperatures across California pushed those points to hefty double-digit losses. At the close of futures trading, June had continued Thursday’s trend of lower quotes on the heels of a storage report that showed greater additions to inventory than expected. June futures fell 4.5 cents to $4.674 and July dropped 4.6 cents to $4.704.

Earlier forecasts of a thin storage refill got something of a test this week with the Energy Information Administration (EIA) reporting an injection of 82 Bcf for the week ended April 25, well above consensus estimates for an increase in the mid-70 Bcf range. Bears jumped on the number and pushed the market lower with the June contract dropping below $4.800.

Prior to the 10:30 a.m. EDT eastern report, June natural gas futures were hovering around $4.804, but in the minutes that immediately followed, the prompt month sank as low as $4.718. Later in the session it reached $4.707 before finishing at $4.710.

Citi Futures Perspective analyst Tim Evans called the report “bearish,” noting that it was significantly larger than both last year’s date-adjusted 41 Bcf injection and the five-year average build for the week of 58 Bcf.

“The 82 Bcf in net injections was somewhat more than expected and bearish compared with the 58 Bcf five-year average refill,” Evans said. “This was a second consecutive bearish surprise in the data, helping to confirm an underlying weakening in the supply-demand balance.”

Heading into the report, most market watchers are gunning for an injection in the mid- to high-70s Bcf. Evans was looking for a 78 Bcf build, while a Reuters survey of 22 market analysts and traders produced a 62-82 Bcf injection range with consensus pegged at a 75 Bcf build.

After more than 3 Tcf was removed during the brutally cold 2013-2014 winter heating season, the race — and the bets — are on as to whether domestic production can muster the push necessary to refill inventories prior to next winter. While Thursday’s report was a step in the right direction towards completing the goal, the road to 3.5 Tcf is still a long one.

As of April 25, working gas in storage stood at 981 Bcf, according to EIA estimates, which is still 790 Bcf less than last year at this time and 984 Bcf below the five-year average of 1,965 Bcf. For the week, the Producing Region injected 35 Bcf and the East Region contributed 34 Bcf, while the West Region chipped in 13 Bcf.

Teri Viswanath, BNP Paribas director of commodity strategy, natural gas, said that while Thursday’s report marked “the second consecutive higher-than-anticipated stock build,” she expects the surprises could be coming to an end soon.

“Because the month of May has historically been the heaviest injection month of the season, the market has pinned significant hope on paring the y/y storage deficit this month ahead of the peak summer heat,” she said in a Thursday afternoon note. “With the daily interstate storage receipts beginning to lose ground this week, we see a real possibility that the forthcoming storage reports might soon disappoint.”

Futures traders saw Friday’s lackluster performance as taking the market back to a consolidating phase. “The market has failed to break above $4.81, and I think traders will look to take it down to the $4.50 area where it is likely to find support,” said a New York floor trader.

“This market appeared to suffer a hangover from [Thursday’s] bearish EIA storage injection [report]. Although we felt that the unusually large build was appropriately discounted in yesterday’s trade, buying enthusiasm by the specs was obviously quelled today, especially with weekend temperature updates unlikely to offer significant surprises during this shoulder period,” said Jim Ritterbusch of Ritterbusch and Associates. “[Friday’s] selling was exacerbated by trend line violation just below the $4.70 level. But we don’t see this technical deterioration as igniting a major selling effort on the part of the non-commercial entities. We expect solid support at about the $4.65 level, with values consolidating mainly within the $4.65-4.75 zone ahead of another round of EIA numbers next week.

“Next week’s injection should be downsized appreciably given this week’s cooler temps and an expected upswing in industrial offtake,” he said last Friday. “All in all, we feel that the jury is still out as regarding ample supply for the next heating cycle. As a result, we are maintaining a bullish trading stance and we would suggest holding any long positions established within the $4.70-4.80 zone and employing stop protection below $4.65 on a close only basis. Finally, despite some softening in next-day cash to around $4.65, we still view bull spreads as a viable long-term bullish alternative.”

In Friday’s physical trading West Coast pricing for weekend and Monday delivery fell sharply as soaring temperatures and fire danger in Los Angeles and Southern California were expected to break sharply through the weekend and into Monday. AccuWeather.com predicted that San Francisco’s Friday high of 70 degrees would slide to 63 by Saturday and hit 61 on Monday. The seasonal high in San Francisco is 66. Los Angeles’ oppressive 96 high on Friday was seen dropping to 82 on Saturday and falling to 70 by Monday. The normal early May high in Los Angeles is 74. San Diego’s elevated high of 89 Friday was seen dropping to 76 on Saturday and falling another 9 degrees by Monday. The normal high for this time of year in San Diego is 68.

“[T]he extreme [California] heat will recede this weekend,” said AccuWeather.com’s Kristen Rodman. “For the first day of May, [Los Angeles’] high temperatures were just 1 degree shy of 90 F, reaching 89 F at 3 p.m. local time. As strong Santa Ana winds gusted across Southern California, a fire broke out in the North Etiwanda Preserve just north of Rancho Cucamonga.”

The fire was under control by Friday, but “temperatures will remain in the mid-90s on Friday, approaching the 2004 record high of 98 F, and by Saturday, highs will drop more than 10 F in the city and surrounding area. By the end of the weekend, Sunday’s high temperatures will be even lower, in the mid-70s. Low clouds will hover over the city for the entirety of the day and stay in the area through the beginning of the first full week of May. Looking ahead, temperatures for Los Angeles will fluctuate between the low 70s and high 60s as low clouds keep the sun ray’s hidden from the city during the morning hours through Thursday,” she said.

Hydro supplies in the Pacific Northwest continue to be forecast above normal, thus alleviating some concerns of hydro-driven power supply in the big California import market and making natural gas driven power less competitive.

The Northwest River Forecast Center reported Thursday that forecast April-September flows at the Dalles Dam were expected to be 107% of normal. It said there was a 50% chance of reaching or exceeding 99,046 KAF (thousand acre-feet per second) and a 10% chance of reaching or exceeding 106,097 KAF Normal April-September flows are 92,704 KAF.

Gas for weekend and Monday delivery at Malin dropped 11 cents to $4.60, and packages at the PG&E Citygates fell 13 cents to $5.17. Gas at the SoCal Citygates shed 24 cents to $4.88, and deliveries to SoCal Border points were seen 16 cents lower at $4.73. On El Paso S Mainline weekend and Monday gas skidded 19 cents to $4.76.

Prices for weekend and Monday delivery at eastern points softened as well, as temperatures were expected to hover right around the 65 degree mark, suggesting neither heating nor cooling load. AccuWeather.com forecast that the Friday high in Boston of 69 would ease to 68 Saturday before dropping to 66 on Monday. The seasonal high in Boston is 62. New York City’s 68 high was seen giving up a degree to 67 Saturday before falling further to 65 on Monday. The typical high for New York in early May is 67.

Those mild temperatures were enough to propel eastern locations to a hefty discount to traditionally lower-priced producing regions such as the Gulf Coast. At the Algonquin Citygates, weekend and Monday gas was seen at $4.06, down 34 cents, and on Millennium Pipeline gas changed hands 23 cents lower at $3.90. Gas on Tennessee Zone 6 200 L shed 21 cents to $4.18.

Gulf locations were down anywhere from a nickel to a dime. Gas on ANR SE was seen 7 cents lower at $4.62, and on Columbia Gulf Mainline weekend and Monday parcels also traded 7 cents lower at $4.62. At the Henry Hub gas changed hands at $4.71, down 7 cents. On Tennessee 500 L weekend and Monday gas eased 5 cents to $4.67, and Transco Zone 3 gas was 6 cents lower at $4.68.

That discount of eastern locations to the Gulf may not be in the cards for too much longer. According to industry consultant Genscape, ANR will now have the capacity to move gas out of the Marcellus to the Gulf and Midwest. “Access to ANR means production can reach Midwest markets, the Gulf region, as well as ANR’s four fields of underground natural gas storage with a total capacity of nearly 250 Bcf.”

A TransCanada press release revealed that “ANR has secured almost 2.0 Bcf/d of firm natural gas transportation commitments on its Southeast Main Line at maximum rates for an average term of 23 years. Approximately 1.25 Bcf/d will commence in 2014, with the remaining volume commencing in 2015. The shippers with firm transportation commitment are individual companies that had large positions in the Marcellus and Utica areas and wanted to ship gas south to the Gulf Coast and north into the Midwest market, in Chicago and Michigan and Wisconsin, and also have availability for storage in the summer.” Genscape added that “the ANR system, on the Southeast leg, is now fully contracted and will be capable of flowing gas both north and south. And the Southwest leg is very well contracted, and so the bulk of the system is — the market zone in Michigan, the Chicago area and Wisconsin.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |