Markets | NGI All News Access | NGI Data

Eastern Points Jockey For Position in New Pricing Paradigm; Futures Grind Higher

NGI spot natural gas prices overall were peppered with losses at eastern points in Tuesday’s trading for Wednesday delivery, but rising prices in the Gulf, California, the Midcontinent and Great Lakes lifted the overall market to a proximate 2-cent gain. Physical gas in the Northeast continues to re-align with the Henry Hub, but buyers in locations such as the Southeast are finding it difficult to parlay that re-alignment to their advantage.

At the close of futures trading, June had advanced 3.2 cents to $4.831 and July was higher by 3.4 cents to $4.853. June crude oil gained 44 cents to $101.28/bbl.

Driven by the new realities of production and consumption of natural gas in the Northeast, and with the onset of the shoulder season, market-watchers would be wise to observe a new trend identified by NGI, where low gas demand and plentiful supply from nearby shale basins have triggered key northeastern pricing points to begin trading at a sometimes steep discount to the Henry Hub.

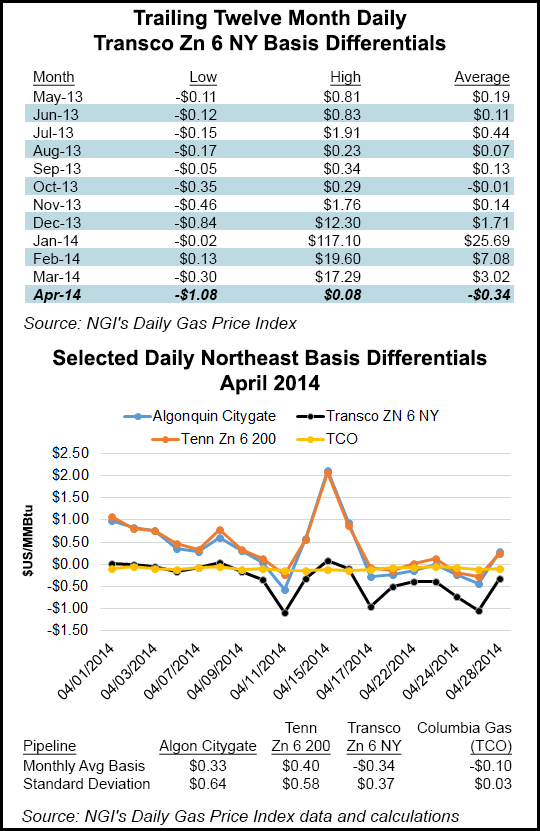

For example, Transco Zone 6 NY — for the second multiple-day period since NGI began tracking the point in 1998 — is currently trading below the Henry Hub. NGI‘s Transco Zone 6 NY next-day gas index has traded at a discount to the Henry Hub during 18 of the last 21 days, with the largest deficit coming in on April 14 at a $1.08 discount. The only other time this phenomenon was observed in the last 16 years was last summer, when Transco Zone 6 NY recorded a number of discount days through the shoulder season and into early January, only to be stopped by the string of polar vortices, which spiked prices.

“Transco Zone 6 New York is now trading below Florida Zone 3 as well as the Henry Hub,” said a Florida utility buyer. He laid the newly developing differential at the feet of New York City being in effect almost a producing zone market point rather than a remote consuming market historically distant from supply.

“Every industry conference you go to you get inundated with the [forthcoming] ability to move [more] gas out of the Marcellus and go directly to the Northeast.” Weather driven price spikes notwithstanding, a producer with Marcellus gas would be better served moving his gas to Florida Zone 3 or the Henry Hub if it were possible.

The Florida utility buyer lamented that he was “really out of it” in terms of being able to move gas out of the Marcellus to his market. “We have [transportation] off Transco Zone 4, but Transco Zone 5 and Zone 6, I am really out of it. The way we get Marcellus gas is off the Columbia Gulf system, but we are really trapped in the Southeast.”

Transco Zone 6 NY traded at a negative basis to the Henry Hub for at least one day in 11 of the last 12 months. April 2014 marked only one of two months in the past year when the average daily basis differential was negative.

May bidweek appears to also be shaping up with this northeastern discount to the Henry Hub. According to NGI‘s Bidweek Alert, on Tuesday the basis range for May gas at Transco Zone 6 NY was tracking 67.5 to 79.5 cents below the Henry Hub.

In spite of the current Transco Zone 6 NY discount, the buyer said he sees a flattening of gas prices from the Gulf to the Northeast as greater LNG export capability is developed. “These hubs will have ability to liquify and compress and will bring gas down from the Marcellus. All the gas [market points] are going to start being very flat to one another. If we start exporting, I think there is going to be parity between the pipes.”

The Henry Hub was quoted Tuesday for Wednesday deliveries at $4.82, up 4 cents, and other historically lofty New England points were close to slipping into a discount to the Henry Hub as well. Gas at the Algonquin Citygates shed 16 cents to $4.90, and packages into Iroquois Waddington eased a penny to $4.96. On Tennessee Zone 6 200 L, next-day gas changed hands at $4.81, down 21 cents.

Deliveries to Dominion South fell 6 cents to $4.31, but gas on Columbia TCO added 3 cents to $4.72.

Parcels bound for New York City on Transco Zone 6 fell 9 cents to $4.38, and gas into Tetco M-3 Delivery was seen 8 cents lower at $4.35.

Futures traders were circumspect about the possibility of $5 natural gas futures. “It seems every day we get a little more support, but I don’t know if we’ll see $5. We might test $4.90 to $4.95 and come off from there,” said a New York floor trader.

The trader said the market seemed to make its moves overnight, and “we just sat here between up 1 cent to up 4 cents all day long. During the day it has been kind of quiet.”

Market bulls may get some weather assistance as forecasters call for warm temperatures to infiltrate the Southeast, Deep South and Texas as well as potions of California. Commodity Weather Group in its Tuesday morning report said, “[Tuesday’s] forecast offers a bit stronger heat in California over the next few days with Burbank estimated to peak in the 95-96 F range tomorrow and Thursday due to decent offshore flow. The other warmer change on the cooling demand side is down across the South next week, with cities like Dallas and San Antonio edging up slightly more into the lower 90s with hotter upper 90s expected to be limited to west Texas instead.

“The Midwest is warmer overall today through the six-15 day but still leans in the seasonal to below-normal temperature range overall. The East Coast continues to be variable enough to have all three forecast periods average in the near-normal category yet again as it contends with both transient warming and cooling events, but no major/sustained demand concerns are expected,” said Matt Rogers, president of the firm.

Analyst Alan Lammey of WeatherBELL Analytics sees Monday’s solid expiration of the May contract hinting at further gains. “The price boost stemmed from unusually cool temperatures for a large percentage of the U.S., not to mention growing concerns over gas inventories. With the size of yesterday’s move, it would not be out of the question to see some profit-taking emerge today, but if prices can close above $4.74, there’s a good chance that June gas may attempt to test the mid to upper $4.80s in the near term,” he said.

Others also saw the May expiration as a bullish portent but are willing to accept trading gains near term. “[W]e are having some difficulty seeing much upside follow-through from current levels in June futures, and we would still be willing to accept profits above the $4.80 mark on any fresh positions established on a scale down within the 4.60-4.70 zone,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Monday to clients. “Some weekend shifts toward cool temperature trends during the next couple of weeks likely won’t equate to enough lift in HDDs to sustain rallies. Furthermore, we don’t expect much bullish assistance from Thursday’s EIA report that will likely provide another sizable upswing in injection from the prior week’s 49 Bcf hike.”

In its Early View Forecast, Energy Metro Desk Friday tabulated an estimated 77 Bcf storage injection for the week ended April 25. Last year, 41 Bcf was injected, and the five-year average build is 58 Bcf.

Tom Saal, vice president at INTL FC Stone in Miami notes portions of the market showing exuberance, if not just a pervasive trend higher. “Back years, Cal ’15, Cal ’17 and Cal ’19, continue to work higher even being overbought. The March 15/April 15 spread (aka “widow maker”) continues to show strength as the injection months show negligible forward carry.”

In near-term trading, his work with Market Profile shows a likely test of Monday’s value area at $4.771 to $4.741 before moving on and testing $4.65 to $4.641.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |