NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Permian Still ‘Heart’ of Baker’s Operations, Says CEO

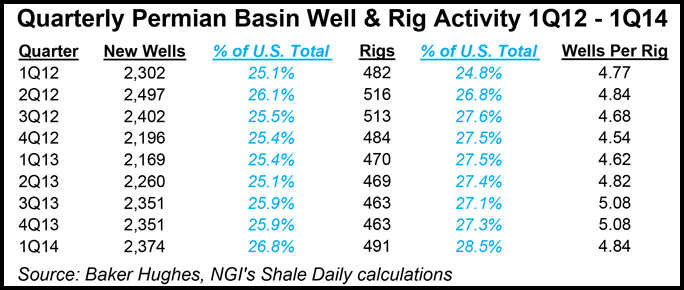

The Permian Basin rig count should increase by 10% in 2014, one of the key reasons it continues to be the key to Baker Hughes Inc.’s U.S. operations, CEO Martin Craighead said Thursday.

Craighead shared a conference call microphone with CFO Peter Ragauss to discuss quarterly results and provide an outlook for the year.

Baker’s Permian activity during the three-month period exceeded all other onshore activity, and it was at the center of all U.S. activity. Rig activity in the Texas/New Mexico basin and sub-basins rose 6% year/year during the first quarter, and it should continue to rise throughout the summer and fall, Ragauss said.

“This growth in the Permian is expected to contribute to a 4% increase in the overall U.S. rig count for the year with an average rig count of 1,830,” the CFO said, with a big uptick in the Gulf of Mexico deepwater.

U.S. working gas in storage is about 1 Tcf below the five-year average and that should drive more drilling, Craighead said.

“Getting storage levels back to average before next winter’s drawdown would require an addition of another 3 Tcf of gas, and that sort of addition would require injection levels to approach record levels every week between now and then. With gas storage at this level, the prices are higher than many would have guessed only a few months ago.

“When coupled with favorable oil prices, this environment fares well for our customer’s cash flow and spending capacity. Therefore, it’s not surprising that activity is increasing in most regions of the world.”

There’s also a big need for “higher technology” in the Permian because operators are moving to more horizontal drilling, longer laterals and more reliance on new products. “This trend of increasing service intensity is being replicated around the world,” Craighead said.

“Wells are deeper and harder, completions are more complex, production curves are declining faster, and the aging midstream infrastructure is working well beyond its time.”

Across the board, the demand “for both innovative and integrated products and services has never been greater. We are continuing to redefine the technical limits for our customers in drilling efficiencies, production optimization,and ultimate recovery.”

Asked about pricing power in the onshore for service operators, which has been eclipsed by overcapacity for more than two years, Craighead said there remain “some pockets of tightness…But there is still some spare capacity. Overall I would say that it’s getting better, it’s going in the right direction, but I wouldn’t bank a whole lot on a lot of pricing traction…My instincts tell me that it will be a little bit better by the end of the year than it is now.”

The Permian remains at the “heart of our North American business,” said the CEO. “It has been for a long time on every product line. We are well situated. We have great relationships with the operators, and the application and technology…in the Permian is…very ripe as these stack plays continue to surprise to the upside.”

Baker also is “getting a lot better at the efficiency side of the business on a couple of fronts” in the Permian, particularly for the well stimulation business, which remains in the learning curve, “getting more stages per day on a per headcount, if you will, and per fleet.”

There are issues with finding enough workers for the Permian. Rumors have persisted in the energy world that Baker was sold out in the Permian for part of the first quarter — not due to a lack of horsepower but due to a lack of labor. Craighead said he has “concerns about everything, but I can tell you that our folks out there are managing it pretty effectively and I am not worried about us…not being able to take care of our customers or generate our numbers because of the labor.”

Despite the onshore weather challenges in North America between January and March, Baker increased revenues and profit margins. Most of the revenue growth was attributed to the seasonal peak in Canada, but there also was structural improvement in North American profitability by leveraging demand for technologies in the onshore shale and the ultra deepwater market.

Net profits totaled $328 million (74 cents/share), versus $267 million (60 cents) in 1Q2013. Profits also rose from the fourth quarter’s $248 million (56 cents/share). Total capital expenditures were $439 million.

Revenue growth in the United States climbed 1% sequentially and 7% year/year to $2.78 billion. North America operating profit margin was 10.8%, an improvement of 200 basis points sequentially. The increase was attributed entirely to peak activity levels in Canada. Severe weather across the Rockies and Northeast resulted in reduced revenue, offset by increased activity and favorable mix in the Permian.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |