NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

More Indicators NatGas to Grow as Transportation Fuel

Prompted by ever-increasing domestic supplies, more indicators emerged Monday from government and private-sector analyses that natural gas is carving out more niches in the transportation fuels sector.

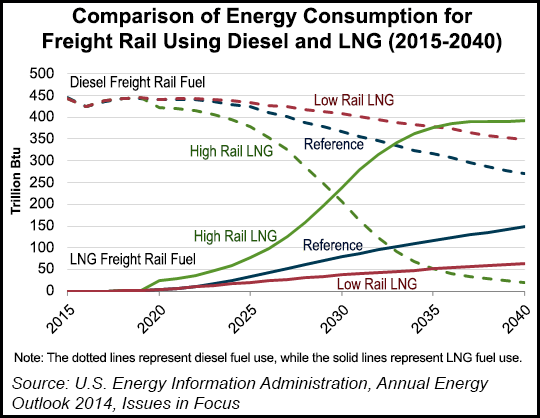

Robust natural gas production and continued relatively low prices for the fuel could push more use of liquefied natural gas in the nation’s railroad locomotives, according to U.S. Energy Information Administration (EIA). Collectively, the seven major U.S. freight railroads consumed more than 3.6 billion gallons of diesel fuel in 2012, or 7% of all diesel consumed nationally, EIA said.

Fuel for the rail operators cost more than $11 billion in 2012, and accounted for 23% of total operating expenses in the industry, according to EIA.

“Continued growth in domestic natural gas production and substantially lower natural gas prices compared to crude oil prices could result in significant cost savings for locomotives that use LNG as a fuel source, ” EIA analyses noted in the agency’s Annual Energy Outlook for 2014.

Railroads are seeing potential “significant fuel cost savings,” along with reductions in fuel operating costs, the EIA analysis said. “Given the expected price difference between LNG and diesel fuel, future fuel savings are expected to more than offset the approximately $1 million incremental cost associated with an LNG locomotive and its tender,” EIA noted.

Meanwhile, on Monday, Boulder, CO-based Navigant Research issued a report saying the domestic shale gas revolution has made natural gas “significantly more competitive” as a vehicle fuel than it was 10 years ago, and its particularly attractive to medium-duty truck and bus fleet operators.

Navigant’s researchers conclude that the number of natural gas-fueled trucks and buses on the roads worldwide will increase from 1.5 million this year to 3.7 million by 2022.

As a result of the shale revolution and the gas infrastructure build out, Navigant predicts “an expansion of the market for medium- and heavy-duty trucks and buses running on natural gas [NGV].”

NGV sales are largely being driven by four key forces, according to Navigant’s principal investigator, Dave Hurst, who lists them as: economic benefits, increased availability of NGVs, environmental benefits, and increased NGV fueling infrastructure.

“Although the NGV market is somewhat tied to the growth of the overall economy and specific industries, makers of NGV trucks and buses have founds some niches that have proven stronger than the overall market,” according to a Navigant spokesperson. The report specifically calls out the refuse truck, day-cab truck and transit bus markets as being primed for growth.

Navigant’s report, “Natural Gas Trucks and Buses,” analyzed the global market for trucks and business in the medium-duty range (10,000 to 26,000 pounds).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |