Shale Daily | Bakken Shale | E&P | NGI All News Access

South Dakota Sand Deemed Not Suitable for Fracking

Although South Dakota officials had been hoping to cash in on the oil and natural gas boom in the Williston Basin, there is little chance operators would be able to use sand mined in the western part of the state for proppant required to hydraulically fracture (frack) wells, a study has found.

The South Dakota Department of Environment and Natural Resources (DENR) said a study by the University of South Dakota (USD concluded that the state’s grains don’t meet American Petroleum Institute (API) specifications for proppant sand.

Among the deficiencies found by the Akeley-Lawrence Science Center at USD were the lack of a 99%-plus quartz composition, grains that are too coarse or fine, and grains that are not the correct shape or too tightly cemented together. Six researchers at the science center authored the assessment in “Sand and Alumina Resources for Use as Proppant.”

The current high demand for proppant throughout the United States prompted South Dakota officials to undertake the project, which involved sampling various sand-bearing formations for potential proppant use. They said 256 samples were taken and they all failed to meet the API-recommended weight distribution specifications for natural proppant.

“None of the sand in South Dakota could likely be mined solely as hydraulic fracturing sand,” the report said. “In order to fully utilize a sand deposit and extract a marketable volume of sand from these sources, significant data to indicate the presence of coarser or finer material would have to have a market as well.”

The study said that if other uses for the sand could be developed, it might be economical to mine South Dakota’s supplies.

Proppant, water and chemicals are used extensively across North America’s unconventional basins, including the Bakken/Three Forks formations in the Williston Basin. Proppant can be natural sand grains, resin-coated sand or synthetic ceramic spheres and is used to prop fractures open (see Shale Daily, Feb. 5). The fracks create a steady flow of oil or gas into a wellbore.

DENR took on the study at the request of the state’s legislative oil and gas summer study committee, “looking for ways to benefit from the North Dakota oil boom,” said DENR Secretary Steve Pirner. “While the study did not produce the desired results, DENR’s geologists gained a better understanding of sand resources in western South Dakota that may prove useful in the future.”

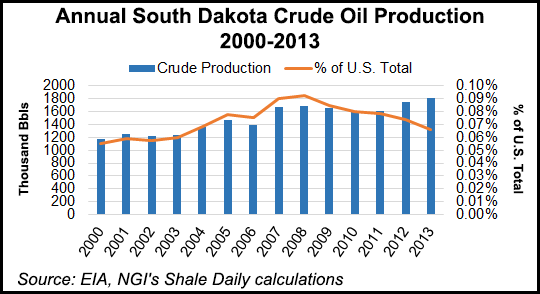

The ability to produce “frack-worthy” proppant might have made South Dakota a more meaningful contributor to overall U.S. crude oil production. The state typically produces less than 0.1% of annual U.S. crude production. To put this in perspective, South Dakota produced 1.8 million bbl during all of 2013, while Texas churned out 2.6 million b/d last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |