NGI Data | NGI All News Access

Expected Warmth Drops April Bidweek Values; Prompts More Float Than Fixed

Perhaps it was the overall trend of falling bidweek prices or maybe the expected arrival of warmer temperatures following a brutally cold and extended winter that forced price spikes, but the consensus of traders and marketers definitely had the feel of “rolling the dice” and going with a higher percentage of float versus fixed for April bidweek.

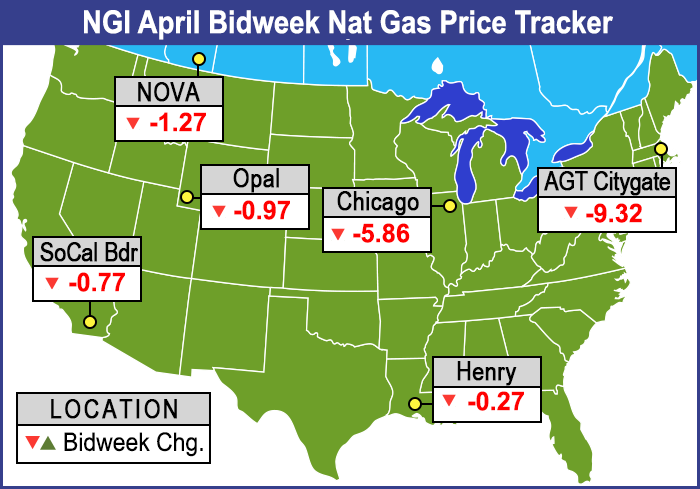

All but a handful of bidweek prices were deep in the loss column, and NGI’s April National Bidweek Average came in at $4.43, down $1.41 from March.

The greatest individual point gain in bidweek pricing took place on Transco Leidy with an increase of 89 cents to average $2.80, and the biggest loser was Algonquin Citygate, which sported a loss of $9.32 to average $6.20.

Regionally, three areas experienced triple-digit bidweek losses. The Midwest was down $5.75 to $5.16; the Midcontinent skidded $1.78 to $4.40, and the Rocky Mountains dropped $1.08 to $4.32.

California and the Northeast were off by 75 cents and 90 cents to $4.68 and $4.12, respectively.

Gulf points and Texas, relatively removed from the icy experiences to the north, declined the least. South Louisiana was down by 26 cents to $4.56, and South Texas and East Texas fell 17 cents and 34 cents, respectively, to $4.49.

The month-to-month declines were also evident in the futures arena, where the April contract went off of the board at $4.584, down 27.1 cents from March futures expiration of $4.855.

In early bidweek trading, next-day Algonquin Citygates settled at $14.76 for delivery March 26, so surely a basis of $1.50 to $1.80 as reported by NGI‘s new Bidweek Alert product — when added to the April futures settlement of $4.58 for an April bidweek of $6.38 — would be a steal!

“Not if the weather is warming up,” said a Houston-based pipeline veteran. “I think the $1.51 to $1.80 is a decent market assessment. The basis represents the average assessment of what the daily price will be throughout the month which is pretty impossible to figure out and is usually based on historical data. The [Algonquin] basis is certainly high relative to where it’s been in past years, but not so when compared to the last three months.”

Other basis differentials at Northeast points came in on the plump side as well. At the end of bidweek, NGI reported that Iroquois Waddington basis was from 95 cents to $1.05 and basis on Tennessee Zone 6 200 L came in at $1.55 to $1.80.

Bidweek always raises the question of whether to allocate more volumes at a safer fixed price or take the chance that milder or cooler weather is likely to push daily spot prices below/above bidweek prices. “I would tend to lean more towards playing the cash market,” the industry veteran said.

“I would assume that the basis would be a little bit lower, and I don’t think the demand will be there at the citygates as the temperature warms up and we stay relatively mild into the 50s. If we drop down into the 40s [New England] and 20s for the lows, then you will see prices pretty high. You are hoping winter is over now, but it is not a foregone conclusion.

“I keep wanting to make an analogy to Noah’s Ark. Do you get on the boat now and shut the doors, or do you wait until the first drops of rain? If I were going to split it out, I would go more on the ‘float’ side [No pun intended]. I would be 60% float or maybe a little higher,” he said.

“I’m relying on my experience with the Northeast, but Chicago, California or other areas are a totally different animal. If you look at the monthly forecast for Boston, you start at 52 for highs, and some cooling off in the second week, and then it really warms up into the 60s for the last two and a half weeks. This is all based on the Farmer’s Almanac, but there is still some heating load. I’ll bet some people are ready to turn their heaters off.”

The Energy Information Administration (EIA) reported a gas storage withdrawal of 57 Bcf for the week ended March 21, a moderately bullish number relative to expectations. Inventories now stand at 896 Bcf, and are 899 Bcf less than last year and 926 Bcf below the five-year average, EIA said in its Thursday morning report. In the East Region 39 Bcf was withdrawn and in the West Region 3 Bcf was pulled. Inventories in the Producing Region fell by 15 Bcf.

The Producing region salt cavern storage figure increased by 3 Bcf from the previous week to 65 Bcf, while the non-salt cavern figure fell by 18 Bcf to 311 Bcf

Some see storage and a rebalanced market as problematic. “While the market currently anticipates that rising production will bring the industry back into equilibrium next season, near-record injections are now required just to satisfy the minimum amount of pre-winter inventories needed to avert possible price spikes this year,” said Teri Viswanath, commodities strategist at BNP Paribas.

“During the last five years, the industry has withdrawn an average 2.18 Tcf from storage during the course of the winter season,” she added. “So it appears to us that the least amount of inventory restocking that must take place this summer would be a 2.37 Tcf cumulative refill (or just 30 Bcf short of the all-time summer injection record set in 2001). This level of stockpiling would enable the industry to exit the upcoming winter with 1 Tcf of working gas in storage, should inventories decline at a five-year average pace. However, this near-record restocking would not keep consumers buffered against price spikes in the event of another repeat of this winter’s weather. Under such conditions, heating demand would deplete stocks below 1 Tcf by mid-February.”

Analysts at Tudor, Pickering, Holt & Co. (TPH) said this coming storage refill season will be one to watch closely. “Currently there is 896 Bcf of storage heading to 850 Bcf (or lower) by March end-of-month versus 10-year minimum of 1,017 Bcf,” TPH said. “Last two weeks suggest the market is 2 Bcf/d oversupplied (draw less than the weather model predicted). 2 Bcf/d oversupplied through the summer only adds 400 Bcf to 2,050 Bcf norms, putting storage at just 3.3 Tcf on Nov. 1. We will need to see a 3 Bcf/d-plus oversupplied market through injection season to get above 3.6 Tcf by the end of the refill season.”

Some traders are bullish, in part sparked by the market’s reaction Thursday to a slightly positive storage report. “While the decline [57 Bcf] was only about 2-3 Bcf more than average street ideas, we feel that last-minute speculative short-covering out of the expiring April contract provided a turbo charge to [Thursday’s] rally,” said Jim Ritterbusch of Ritterbusch and Associates.

Spot trading Monday for Tuesday delivery — first gas traded for April delivery — had prices moving higher as weather-induced strength in the Plains, along with strong performances at eastern, Northeast and Marcellus points, was able to offset broad weakness elsewhere. At the close of futures trading, May was down by 11.4 cents to $4.371 and June had fallen 11.5 cents to $4.404.

Gas buyers working market areas in the Upper Midwest and Great Lakes were having to deal with another round of blizzard conditions that prompted double-digit gains at some points. According to AccuWeather.com meteorologist Kristina Pydynowski, “March is coming to an end with a disruptive blizzard that is shutting down travel across the northern Plains into Monday night. The blizzard will reach from western Nebraska to western and central South Dakota, much of North Dakota and northwestern Minnesota through Monday.”

Northern Border Pipeline Ventura for Tuesday delivery jumped 28 cents to $4.81, and deliveries to Northern Natural Ventura were up a comparable 30 cents to $4.82. Gas at Demarcation gained 30 cents to $4.82, as well.

Deliveries to Consumers were up by 11 cents to $5.03, and gas at Michcon rose by 8 cents to $4.96.

In the Northeast, forecasts of warmth and mild temperatures were not enough to rein in strong next-day prices.

“Temperatures will average near to above normal through much of the coming weekend around Boston,” said AccuWeather.com meteorologist Alex Sosnowski. “Come Tuesday, March will be but a memory, as will much of the chill and lingering wintry weather for the area. Highs most days this week will be within a few degrees of 50 F. The typical high for the city during early April is near 50 F.”

The storm responsible for the chill and areas of rain, snow and thunderstorms to start the week was expected to continue to move away, with mild air from the southwest taking its place. As a front approaches from the west, a few showers were possible on Saturday, when there could also be a thunderstorm, Sosnowski said.

Next-day packages at the Algonquin Citygates rose $1.26 to $6.10, and gas at Iroquois Waddington climbed by 75 cents to $5.66. Deliveries to Tennessee Zone 6 200 L added $1.18 to $6.16.

Rockies prices softened as deliveries to a Williams facility in Washington state were curtailed following an explosion at a liquefied natural gas facility Monday. The fire and explosion damaged one of two storage tanks in Plymouth, on the Columbia River.

Williams spokeswoman Michele Swaner said the company was investigating the cause of the incident. She said the injured person had burns and was expected to recover. Swaner also said Williams shut the connections from Northwest Pipeline to the Plymouth facility, but noted that the mainline was still moving gas to customers. Northwest Pipeline is a 3,900-mile bidirectional transmission system crossing Washington, Oregon, Idaho, Wyoming, Utah and Colorado. It provides access to natural gas from British Columbia, Alberta, the Rockies and the San Juan Basin in the Four Corners region.

Gas for delivery Tuesday on CIG fell 6 cents to $4.26, and deliveries to Northwest Pipeline Wyoming shed 3 cents to $4.34. Gas at Opal fell 3 cents to $4.40.

Futures traders were caught off guard by the day’s drop. Traders noted that within an hour of the open, May was down 12 cents and “it almost looked like an error, but there was substantial volume,” said United ICAP Vice President Drew Wozniak. “Cash at the time was around $4.45, but it [fell] to $4.375, and this just shows the swing into spring and the end of the heating season. That said, at last look, the EIA [Energy Information Administration] storage market is minus 81 prox mid, and this should be more recognized after this last day of bidweek.

“Even with last Thursday’s lift, I am sticking with my projection that after the cash market loses its influence [Tuesday], we could see a gradual rise back above $4.50 within a few days.”

Wozniak said there may be a substantial increase in production” since the 2003 less-than-1 Tcf season closing, but “it is still going to be an uphill climb to restore normal storage levels.” Monday’s “bearish move shows that there is still volatility out there. Bearish today, looking for a turn” Tuesday.

In its Monday morning six- to 10-day forecast WSI Corp. predicted a warming trend followed by a storm. The “forecast has trended warmer in the east early in the period but colder east and warmer west late. Forecast confidence is only about average thanks to the highly changeable, energetic pattern.

“Yet another in a never ending series of storms will impact the East during the middle of next week, and as usual, the track and intensity of the low will ultimately determine regional temps.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |