Privatization Inevitable in Mexico, Sempra Exec Says

As a result of the economic reforms begun last year in Mexico under its new president, many of the energy enterprises that currently are in government hands will be privatized in the years to come, according to George Liparidis, CEO of Sempra Energy’s international businesses.

One of the drivers for that outcome, Liparidis said at the company’s annual analyst day meeting Thursday in San Diego, is the growing integration of the energy sectors in the United States and Mexico.

“Whatever you say about energy reform in Mexico, some time years from now in one of these meetings I guarantee that you will see more and more of this infrastructure that now is in mostly government hands under private ownership,” Liparidis said.

“There is a lot of discussion about energy reform, and it is going to happen. The only question is the timeline and how quickly we will see private investment coming into the market.”

Liparidis said the Mexican Congress moved very quickly with the first phase of the new laws (see Daily GPI, Dec. 12, 2013). “We are now waiting for what they call ‘secondary laws,’ and there is a target to issue these laws some time in April,” he said. “In essence, these will be the rules of the new market to tell people how they will operate.”

The Mexican government will have to create some new entities to make the markets more open, Liparidis said. And this will mean private investors will need to take a few months to assess the situation. For example, Mexico plans to create independent system operators for the nation’s gas and electric grids.

“The secondary legislation is going to come very soon, and by this time next year for sure, I think we will be talking about new projects that have come out of the energy reform bills,” Liparidis said. “With reforms, we just see an opportunity to do more of what we are already doing in natural gas and hydrocarbons.”

Ultimately, he thinks the reforms will usher in more oil/gas production in Mexico, and that will create opportunities for Sempra and other companies to build gathering systems, including transportation of refined products.

Independent of the reform that is winding through Mexico’s legislative process, there are a lot more gas and electric infrastructure projects moving forward, and Liparidis said that is because there is increasingly more integration of U.S. and Mexican gas markets.

“Development continues to move ahead independent of the energy reforms,” said Liparidis, adding that this applies to Peru and Chile, too, where Sempra has growing investments.

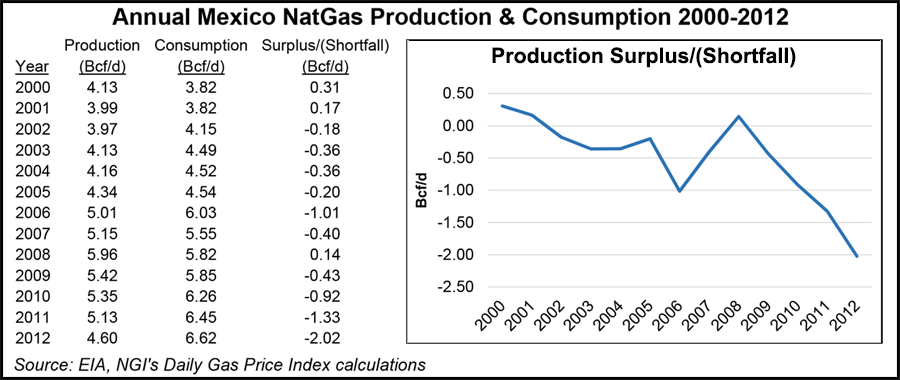

Between 2000 and 2012, natural gas production in Mexico failed to keep up with the pace of domestic consumption. Mexican production grew at an annual trend-line growth rate of 2.7% versus yearly growth in consumption of 5.1%. That has sent domestic production-to-consumption from a slight surplus of 0.3 Bcf/d in 2000 to a 2.0 Bcf/d deficit in 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |