NGI Weekly Gas Price Index | NGI All News Access | NGI Data

Spring Who? NatGas Futures, Physical Record Weekly Gains on Lingering Cold

Even though spring has officially begun, chilly temps for much of the country led physical natural gas prices to move higher for the five trading days ending March 28. NGI‘s National spot gas average increased by 16 cents to average $4.76, with individual point bumps ranging from a couple of pennies at Gulf Coast locations to more than a dollar at a few Northeast sites.

Old Man Winter wasn’t quite done with the Midwest and Northeast, as those two regions recorded the largest weekly gains. The Northeast added 43 cents to average $4.87, while the Midwest tacked on 37 cents to average $5.73.

The Midcontinent added a healthy 16 cents to average $4.71, while the Rocky Mountains and California gained 10 cents and 7 cents, respectively, to average $4.48 and $4.76.

And while no individual major region was in the red, South Texas tried the hardest with an average of $4.30, no change from the previous week.

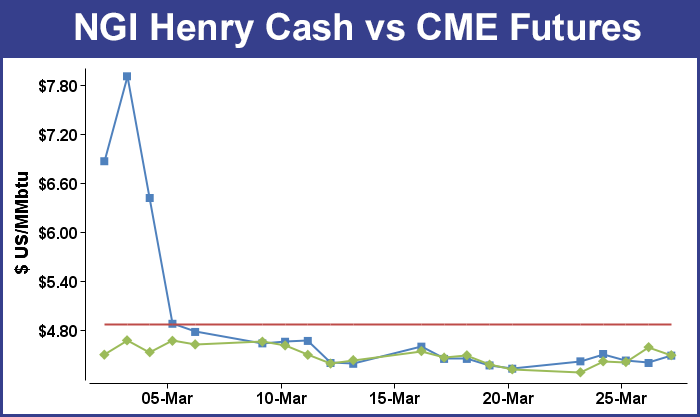

Traders in the natural gas futures arena watched the April contract shoot 18.2 cents higher on Thursday to expire at $4.584, but the May contract, in its first regular session action as the front month on Friday, retreated 5.3 cents from its Thursday finish to close at $4.485, which was still good for an 18.8-cent increase over the contract’s close the previous week.

The Energy Information Administration (EIA) reported a storage withdrawal of 57 Bcf for the week ended March 21, a moderately bullish number relative to expectations, and that along with procrastinating bidweek buyers was enough to send the expiring April contract out the door Thursday on a surge higher.

Inventories now stand at 896 Bcf and are 899 Bcf less than last year and 926 Bcf below the five-year average, EIA said in its Thursday morning report. In the East Region 39 Bcf was withdrawn and in the West Region 3 Bcf was pulled. Inventories in the Producing Region fell by 15 Bcf.

The Producing region salt cavern storage figure increased by 3 Bcf from the previous week to 65 Bcf, while the non-salt cavern figure fell by 18 Bcf to 311 Bcf

Weather forecasters see moderating temperatures in the six- to 10-day period. WSI Corp. in its Friday morning report said, “Today’s forecast has trended warmer in the East and colder in the Midwest early in the period. Forecast confidence is only about average, thanks to the highly changeable, energetic pattern. The trend over the past 24 hours has been to speed up the storm a bit as it moves through the Midwest/East late next week. As usual, minor shifts in the speed/track of the system will have big implications on regional temps on Thursday/Friday.”

Teri Viswanath, commodities strategist at BNP Paribas, said the April futures contract’s bullish expiration Thursday was likely “the combination of short-covering and strong bidweek buying.” However, Friday’s pullback by May futures could likely be attributable to shifting weather forecasts, with overnight forecast changes “generally to the warmer side east of the Rockies.

“Despite overwhelmingly constructive fundamentals, we think that prices will remain range-bound over the next several weeks as exuberant supply expectations lessen the likelihood of an early injection season rally,” she added.

Other analysts agree that the market is likely range-bound until the storage injection pattern begins to come into focus.

“The overzealous trading action that materialized [Thursday] as the April gas futures contract moved toward expiration — and reaped a 4% gain for the April contract in the process — is beginning to back off again this [Friday] morning. In fact, the May contract is down by about 4 cents and trading near $4.50/MMBtu as demand stats for the weekend and early next week have fallen notably in the last 24 hours,” said Alan Lammey, a technical analyst with WeatherBELL Analytics of New York.

“Being that a majority of the market is standing at a crossroads of whether prices should move higher or lower from this point, it’s likely that this market will remain range-bound from the $4.20 to $4.60 area until more solid fundamentals avail themselves, which will primarily surround the consistency of volumes of ‘storage injections’ in coming weeks.”

Some see storage and a rebalanced market as problematic. “While the market currently anticipates that rising production will bring the industry back into equilibrium next season, near-record injections are now required just to satisfy the minimum amount of pre-winter inventories needed to avert possible price spikes this year,” said Viswanath.

“During the last five years, the industry has withdrawn an average 2.18 Tcf from storage during the course of the winter season,” she added. “So it appears to us that the least amount of inventory restocking that must take place this summer would be a 2.37 Tcf cumulative refill (or just 30 Bcf short of the all-time summer injection record set in 2001). This level of stockpiling would enable the industry to exit the upcoming winter with 1 Tcf of working gas in storage, should inventories decline at a five-year average pace. However, this near-record restocking would not keep consumers buffered against price spikes in the event of another repeat of this winter’s weather. Under such conditions, heating demand would deplete stocks below 1 Tcf by mid-February.”

Analysts at Tudor, Pickering, Holt & Co. (TPH) said this coming storage refill season will be one to watch closely. “Currently there is 896 Bcf of storage heading to 850 Bcf (or lower) by March end-of-month vs 10-year minimum of 1,017 Bcf,” TPH said. “Last two weeks suggest the market is 2 Bcf/d oversupplied (draw less than weather model predicted). Two billion cubic feet per day oversupplied through the summer only adds 400 Bcf to 2,050 Bcf norms, putting storage at just 3.3 Tcf on Nov 1. We will need to see a 3-plus Bcf/d oversupplied market through injection season to get above 3.6 Tcf by the end of the refill season.”

Some traders are bullish, in part sparked by the market’s reaction Thursday to a slightly positive storage report. “While the decline [57 Bcf] was only about 2-3 Bcf more than average street ideas, we feel that last-minute speculative short-covering out of the expiring April contract provided a turbo charge to [Thursday’s] rally,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments Thursday to clients.

“We didn’t see a significant shift on the temperature front, but we still view cool weather trends during the next couple of weeks as conducive toward a couple more supply declines. [Thursday’s] reduction that could easily be replicated in size within next Thursday’s EIA report cut storage to below the 0.9 Tcf level and fortified our expectations for an end of season supply south of 0.85 Tcf. [Thursday’s] significant strengthening in the spread curve was also a bullish portent in our opinion. All factors considered, we are maintaining a bullish opinion and would suggest holding any long May positions established earlier this month within about the $4.30-4.35 zone.”

Physical prices for weekend and Monday delivery were a mixed bag as April bidweek wound down Friday, with Gulf Coast, Rockies and California points mostly adding a couple of pennies to a dime, while Midcontinent, Midwest and Northeast locations were in the red — dropping anywhere from a couple of pennies to about a quarter.

Coming out of the most recent chill, Midwest locations Consumers Energy and Michigan Consolidated dropped 11 cents and 18 cents, respectively, to average $4.92 and $4.88.

In the Northeast, prices also eased into the weekend. Transco Zone 6 NY dropped 13 cents to average $4.18, and Algonquin Citygate was down 16 cents to average $4.84.

The highly volatile Marcellus points continued to live up to their reputation, as oversupply and pipeline constraints have been known to move them a dollar or more in one direction or another as the rest of the market remains steady. On Friday, Tennessee Zone 4 Marcellus declined by 95 cents to average $2.47, while Transco-Leidy Line declined by 93 cents to $2.63.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |