Shale Daily | NGI All News Access | NGI The Weekly Gas Market Report

Texas Gas Targeting Marcellus for Midwest, Southbound Projects

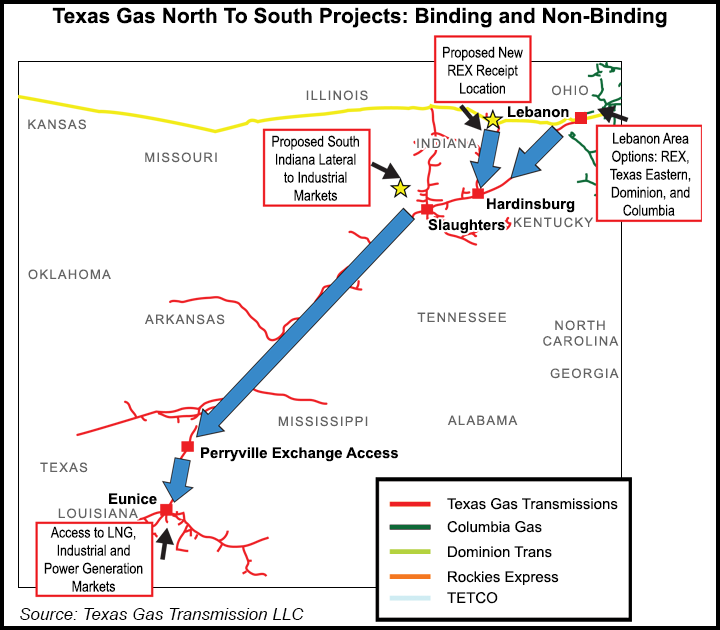

Boardwalk Pipeline Partners LP, which has seen its fortunes fade in the shale gas era, is offering prospective shippers multiple projects via its Texas Gas Transmission LLC that would take abundant Northeast gas to markets in the Midwest and South.

A binding open season is being held for a pipeline lateral that would run from the existing Slaughters-Montezuma Texas Gas lateral near Robards, KY, westward about 30 miles to a location west of Mount Vernon, IN. Capacity on the lateral could range from 53,500 MMBtu/d up to 166,000 MMBtu/d. The targeted in-service date for the Southern Indiana Lateral is July 1, 2016.

In another binding open season, Texas Gas is proposing to expand the capability to access Marcellus/Utica shale gas at Lebanon, OH. This expansion would provide up to 150,000 MMBtu/d of firm service from Lebanon to markets in Texas Gas’ Zones 4 and 3 north of or near Slaughters, KY. The Northern Supply Access Project would provide access to Northeast gas for customers using the proposed Southern Indiana Lateral, as well as existing markets on Texas Gas north of Slaughters. The targeted in-service also is July 1, 2016, but earlier commencement is possible and subject to negotiation and approvals.

And in a nonbinding open season, Texas Gas is offering additional firm capacity on its Northern Supply Access Project [previously called the Ohio-Louisiana Access Project (see Shale Daily, Nov. 26, 2013)], which would enable transport of more Marcellus and Utica gas to Gulf Coast markets. The expansion of the project would provide about 335,000 MMBtu/d of firm service to markets in Texas Gas Zones SL, 1, 2 and 3 south of Slaughters. The ultimate facility design would be determined by market interest, location of receipt points (Lebanon or a new Rockies Express Pipeline interconnect in Indiana) and the location of deliveries. The targeted in-service of the additional expansion is Nov. 1, 2016 but it could begin service earlier subject to negotiation and approvals.

Texas Gas has historically moved gas from Gulf Coast and Fayetteville Shale supply areas to on-system markets in the Midwest and to off-system markets in the Northeast via interconnections with third-party pipelines. It originates in the Louisiana Gulf Coast area and in East Texas and runs north and east through Louisiana, Arkansas, Mississippi, Tennessee, Kentucky, Indiana and into Ohio, with smaller-diameter lines extending into Illinois.

If the projects are successful, at least a portion of Texas Gas could be transformed to a predominantly southbound system. “I think you will see gas moving south on Texas Gas from our terminus in the north and I think you’ll still see some gas from the south coming up north,” said Kathy Kirk, Texas Gas senior vice president of origination and marketing.

She said the projects are not interdependent and that one could move forward without the others. She said shipper interest will determine the facilities required and the costs involved. Work is expected to include modification to compressor stations and the addition of pipeline looping.

She added that telescoping of the system from larger diameter to smaller in the historic market area is not that big of an issue for the pipeline. Capacity through Greenville, MS, on the southern portion of the system is about 1.8-2 Bcf/d, she said. In western Kentucky at Calvert City capacity drops to about 1.4 Bcf/d, and then at Lebanon capacity is about 1 Bcf/d.

“There is a little bit of difference there, but actually not huge,” she said. “Northbound delivering to third parties at Lebanon, OH, the throughput has reduced drastically. With all the Marcellus and Utica gas, a lot of the Northeast market that we used to serve are now being served by that supply closer to their system.”

The pipeline is one of six operating subsidiaries of Boardwalk, which earlier this year saw its market value crushed after slashing its distribution to unitholders (see Shale Daily, Feb. 11). Unlike other midstream master limited partnerships, some of which have prospered in the shale era, Boardwalk has found itself stuck with a set of gas assets in the wrong place to carry gas from the new supply areas.

Existing Texas Gas shippers are being invited to turn back firm primary backhaul capacity from Lebanon that could be used to reduce the need for new facilities for the proposed projects. The capacity offerings run through noon CDT April 22.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |