NGI All News Access | Infrastructure

Four-Company GTL Joint Venture Unveiled

Four diverse companies announced Monday they will pursue a series of gas-to-liquids (GTL) projects starting in Oklahoma and ultimately spreading to Canada, the United Kingdom and China.

The smaller-scale projects intend to apply the Fischer-Tropsch (FT) technology for creating liquids from gases. Velocys plc is a minority partner in the joint venture (JV), along with a unit of Waste Management Inc. (WM), NRG Energy Inc. and Ventech Engineers International LLC.

The JV will target an initial GTL plant at Waste Management’s East Oak landfill site in Oklahoma. The proposed plant would produce renewable fuels and chemicals from biogas and natural gas, applying the FT technology on a small scale.

Waste Management, whose WM Organic Growth Inc. is involved in the JV, said the partnering brings together “the right parties, the right assets and the right capabilities necessary to pursue opportunities in the sector.”

The JV will build on WM’s experience pioneering the use of smaller-scale GTL from landfill gas, including building and operating a demonstration unit at its Oklahoma landfill. The demonstration unit has accumulated more than 10,000 hours of successful operation, WM said.

“Velocys’ leading smaller-scale GTL technology, Ventech’s engineering capabilities, and NRG’s clean energy development expertise will complement Waste Management’s strengths in the joint venture,” Vaillancourt said.

Velocys said that detailed engineering for the first project has been completed and final draft permitting documents have been submitted. The JV will make a final decision on proceeding with the first plant later this year, a spokesperson said.

Velocys CEO Roy Lipski called the project a “milestone in the development of GTL” in the United States. “Smaller scale GTL has the potential to achieve significant installed capacity in North America a long time before any large-scale conventional facility comes on stream.”

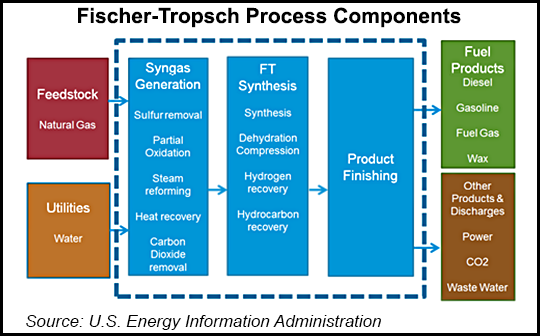

FT synthesis is the most common technique used at GTL facilities, according to an Energy Information Administration (EIA) report issued last month. The cost of building reaction vessels can be considerable and several companies are pursuing alternative methods that use different reactor designs and proprietary catalysts that allow GTL production at much smaller scales.

There are a total of five GTL plants operating in Malaysia, Qatar and South Africa with capacities ranging from 2,700 b/d to 140,000 b/d, and another is under construction in Nigeria, EIA said.

In December 2012, Sasol announced a $16 billion to $21 billion GTL and ethane cracker complex that will be the largest manufacturing investment in Louisiana history (see Daily GPI, Dec. 4, 2012). In January 2013, G2X Energy announced a $1.3 billion GTL facility at the Port of Lake Charles that will yield chiefly gasoline (see Daily GPI, Jan. 18, 2013). And in September, SGC Energia SA of Portugal and Houston-based Great Northern Project Development LP said they would spend $100 million to renovate a dormant steam methane reformer in the Westlake, LA, area and convert it to a GTL facility (see Daily GPI, Sept. 6, 2013). GTL facilities are also planned in Karns City, PA (see Daily GPI, Sept. 12, 2012) and Ashtabula, OH (see Shale Daily, Sept. 24, 2013).

Last year, Royal Dutch Shell plc cancelled plans to build a 140,000 b/d GTL project in Louisiana due to the likely development cost and uncertainties on long-term oil and gas prices and differentials (see Daily GPI, Dec. 5, 2013).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |