Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Record-Setting Storage Pulls Likely to Intensify Appalachian Drilling, Magnum CEO Says

This year’s record-setting gas storage withdrawals, combined with developing acreage positions, superb reservoir quality and the momentum it’s driven at his own company, has Magnum Hunter Resources Corp. CEO Gary Evans predicting at least five years of sustained and heavy drilling in the Appalachian Basin.

Evans, whose company is headquartered in Houston, made a quick stop in Pittsburgh on Thursday to address a crowd gathered there for the inaugural Northeast Oil and Gas Awards Conference for Excellence. After selling its assets in the Eagle Ford Shale last year (see Shale Daily, April 4, 2013), it’s been no secret that Magnum’s focus has since narrowed on the potential of the Utica and Marcellus shales.

On Thursday, though, Evans provided insight on how an ever-improving learning curve and the burgeoning Appalachian Basin has managed to slowly lift the fortunes of his young company and other independents that have hitched their futures to the prolific gas plays unfolding there. He also underlined some of the more obscure challenges that face the region as it grows at an astonishing rate.

“We feel like we’re only in the first inning of a nine-inning game. Of all these areas across the country, we have really been focusing very much on the Utica and Marcellus,” Evans said. “I mean, we can make money at $2/Mcf, but other parts of the country can’t compete with the quality of gas in the reservoirs up here, with our finding costs as low as they are. It’s a bright future. I see five years, easy, of solid drilling going on in this area, probably longer than that.”

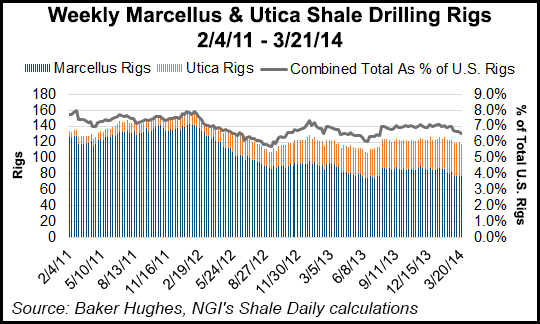

For now, however, what’s expected to drive that push is nuanced. Earlier this month, the Energy Information Administration once again lifted its projection for Marcellus production. In March, operators are expected to produce 14.4 Bcf/d. Next month, about 288 MMcf/d more is expected to be produced, with volumes growing to 14.7 Bcf/d and setting the play on a path to 16 Bcf/d by the end of this year. When counting the Utica and market dynamics, the outlook for the next year or more is bullish, Evans said.

“We’ve been very fortunate that we had such a cold winter, even though everyone had to suffer through it, it did wonders for the gas business for the next 18 months,” he said. “We are going to end the storage season here in the month of March at less than 1 Tcf in the ground. It will be very difficult for us to get back to full storage by the time next winter comes. That’s going to keep gas prices up in the $4 to $5 range and give some opportunities for more companies here the ability to make lots of money.”

Although natural gas futures continue to weaken with warmer weather forecasted and the off-peak season ahead, many financial analysts remain mixed about how the record setting storage pull will affect drilling and production from April through October. Overall, U.S. gas production this year is expected to increase by up to 2.5 Bcf/d in 2014, but those at Thursday’s conference agreed that would likely not be enough to fill the storage gap.

Still, with a backlog of Marcellus and Utica wells expected to be the focus in the coming months after a winter that delayed some production (see Shale Daily,March 3), a need to fill the Northeast’s depleted storage and an April-October strip that could go higher as a result, Appalachian operators are poised for heavy drilling in the second half of the year, Evans said.

Beyond that, the plans that operators like Magnum have in the basin are expected to keep volumes soaring.

“The Appalachian Basin has become a much bigger piece of our pie, about 70% of our reserves are now located in this part of the world. I would imagine that a year from now, it’s going to be more like 80% to 90%,” Evans said. “The nice thing about the West Virginia Marcellus is that it’s very, very wet, about 1,300 to 1,400 Btu. You can extract the liquids and get a price lift, while the Utica is very dry, about 97% methane, it’s pipeline quality and you can go right into the trunkline with it.”

Evans said Magnum has about 461,000 net acres in West Virginia and Ohio. The terrain in the region, he said, is “tough country,” and because of it the company and others are focused on pad drilling to optimize returns and cut costs. Evans likened Magnum’s Stalder Pad, designed to handle 18 wells in Monroe County, OH, to the size of an offshore rig, which he said is unheard of in the industry. Magnum turned inline on Thursday a Utica well on the Stalder pad that tested at 32.5 MMcf/d in February, along with another Marcellus well.

He said once all 18 Stalder wells are online, the pad is eventually expected to produce 250-300 MMcf/d. The company will also flow eight new wells into sales in the next two months (see Shale Daily, March 14).

Magnum isn’t the only company getting a grip on its acreage and reporting improving results in the basin, Evans and others acknowledged on Thursday. Midstream executives who addressed the Pittsburgh audience said demand for their services is rising at an unprecedented rate. In recent weeks, top officials at some of the region’s biggest midstream operators have said the transmission focus should soon shift to handling the rising volumes of natural gas liquids (NGL) and condensates in both the Marcellus and Utica (see Shale Daily, March 10).

But Thursday, the crowd heard about the stubborn need to handle the basin’s residue gas, with Brett Nixon, director of business development at PVR Partners, chiming in to highlight a reversal of problems as gathering infrastructure begins to outgrow interstate pipelines.

“You have to look for the total solution here; it’s not just gathering and processing. You have to have that NGL solution; you’ve got to have a residue takeaway solution. You can have the best drilling program, but with no way to get the gas out, you’re basically shut down,” said Tony Blando, vice president of marketing for the Columbia Pipeline Group, in response to Nixon’s comment. “We’re thinking now that you’re going to be looking at 43 Bcf/d of additional capacity that will be needed on the residue side in the coming years just to make things happen.”

Chad Zamarin, COO of midstream services at Columbia, agreed. He said not only is the company’s vast northeastern storage severely depleted, but the basin is once again slowly becoming constrained on the residue side. Zamarin and others said the lessons of this winter and producers that show no signs of slowing down will require larger, more costly midstream projects in the near-future, with the region’s bottleneck not expected to break until at least 2017 (see Shale Daily, March 20).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |