NGI All News Access | E&P | Infrastructure | LNG | Markets

IHS Says Russia Won’t Interrupt Gas Supplies, But One Pipeline Doomed

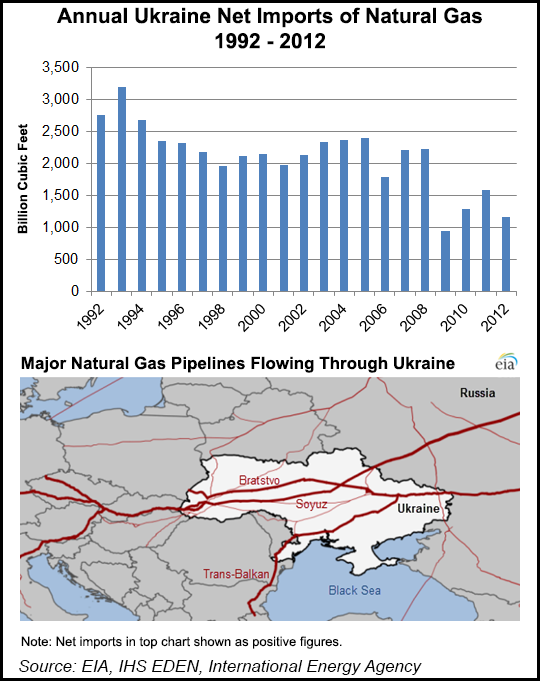

Analysts with IHS Inc. said Wednesday the crisis in Ukraine could continue to evolve, but it is unlikely that Russia would cut off natural gas supplies to its neighbor and to Europe, as the continent puts new emphasis on efforts to reduce dependence on Russia for gas. They added that the crisis could cripple talks over a proposed gas pipeline under the Black Sea.

Meanwhile, former Department of Energy (DOE) Secretary Bill Richardson said the United States must help its European allies become less dependent on Russia for energy supplies. And Igor Sechin, CEO of OAO Rosneft, Russia’s state-owned oil company, said the company would defend its assets in Ukrainian territory.

Analysts on Monday and Tuesday said economic sanctions from the United States and the European Union (EU) designed to punish Russia for its actions in Ukraine were “modest” at best, and could potentially damage business relationships that western oil and gas companies spent years building with OAO Rosneft, and OAO Gazprom, Russia’s state-owned gas company (see Daily GPI, March 18).

In a note Wednesday, IHS analysts said the most likely scenario was for Russia to maintain control over Crimea, and for the United States and the EU to respond with diplomatic and limited economic pressure. They added that additional incursions by Russia’s military into other parts of Ukraine appear unlikely, and Ukraine’s interim government faces severe political and economic challenges.

“More disruptive outcomes are possible if turmoil develops in Russian-speaking eastern Ukraine and if Russia seeks to extend its area of control beyond Crimea,” they said. “The energy implications of this scenario would be more severe than those sketched out here; they will be considered in future IHS research if events should move in this direction.”

Despite this, IHS does not foresee a cutoff of Russian gas supplies to Europe. “The only plausible scenario in which Russian gas supply to Europe is reduced or cut off would be one in which the Kremlin actively chooses this path by reducing supplies to Ukraine and/or Europe. [We don’t] believe that Russia will take this step.”

According to IHS, the 28 countries in the EU are better prepared for a potential reduction in gas supplies from Russia after previous disruptions in 2006 and 2009. Since then, the EU has sought to diversify its sources for natural gas.

“The current Ukraine crisis will reinforce this policy and contribute to a continuation of a tough stance on regulatory issues related to Russian gas supply,” IHS said. “However, the powerful realities of infrastructure and gas economics will limit what Europe can ultimately achieve in this area. Russia will remain a substantial gas supplier to Europe, although this occurs within both a diversified gas supply portfolio and a broader context of considerable diversification in total energy supplies.”

But IHS said the crisis comes at a bad time for the South Stream pipeline, a project sponsored by OAO Gazprom, also state-owned by Russia. The pipeline, which was to begin in Russia and run under the Black Sea to Bulgaria before branching off to Greece, Italy, Serbia, Hungary, Slovenia and Austria, was rejected by the European Commission last December.

The pipeline, according to IHS, “was not in compliance with European regulations and would not be allowed to operate on EU territory. A tentative dialogue between the two sides began. This dialogue is unlikely to proceed constructively in the current circumstances, which casts a shadow over South Stream while also holding out the eventual possibility of a serious deterioration in Russian-EU gas relations. But stemming from the crisis, Russia is likely to be more anxious than ever to promote the latest of its Ukrainian bypass pipelines.”

Meanwhile, IHS said U.S. exports of liquefied natural gas (LNG) to Europe “are still a few years off and, despite political discussion, can have no real impact on the current situation.

“Although the United States is currently on track to become one of the world’s three major LNG exporters by 2020-22, [we expect] the ultimate impact on European gas supply to be limited. However, the Ukrainian crisis may promote a shift to simplifying (and expediting) the U.S. government export approval process.”

The House Subcommittee on Energy and Power is scheduled to meet on Tuesday (March 25) to review a bill sponsored by U.S. Rep. Cory Gardner (R-CO) to expedite exports of LNG from the United States to its allies. The subcommittee said the bill, HR 6, was in response to Russia’s intervention in Crimea and the slow LNG export approval process by the DOE. However, it still would take at least two years for any facility to be built and ready for commissioning.

In a column inTime Magazine on Tuesday, Richardson said the United States and Russia need “to build a more mature and cooperative relationship,” but that the West needed to create a level of transatlantic energy security.

“The pace of these efforts must increase rapidly,” Richardson wrote. “We know how to do this. Back in the 1990s, one of my main assignments when I was Secretary of Energy was creating the Baku-Tbilisi-Ceyhan pipeline…So I know that Europeans and Americans can work together to create strategically sound solutions to provide reliable sources of energy to Europe and Eurasia.

“Transatlantic energy security has never been fully achieved, however, because Russia’s tactics in politicizing natural gas exports have worked. And they will continue to work in strengthening Russia’s influence until Berlin, Brussels, and Washington are on the same page.”

Richardson said two proposed pipelines that would bring Caspian Sea gas to Europe — the Trans Adriatic Pipeline (traversing Greece, Albania and Italy), and the Trans Anatolian Pipeline (Azerbaijan, Georgia, Turkey, Greece and Bulgaria) — would help the continent decrease its dependence on Russian energy supplies.

“At the same time, Washington is deciding whether it will leverage the United States’ energy bounty in order to advance its foreign policy goals during the most serious East-West crisis in a generation,” Richardson said. “The United States’ shale gas revolution has boosted its economic competitiveness and helped reduce U.S. carbon emissions to their lowest levels in 20 years. Exporting this natural gas would decrease European and Eurasian dependence on Russia, empowering U.S allies while sending Moscow a clear signal of the seriousness we place on transatlantic energy security.”

At a forum in Tokyo on Wednesday, Sechin said Rosneft would “defend our assets in Ukraine,” including an oil refinery the company owns at Lisichansk, which is in Ukraine’s eastern region. The refinery’s operations were halted in March 2012, but the facility is currently being upgraded.

“Everything is alright so far; we are modernizing the plant,” Sechin said, according to the Voice of Russia. “The crisis will not last for such a long time to impede the project’s implementation. [We are] looking at the situation [in Ukraine] rather calmly, as it cannot last long.”

Russia triggered an international crisis with Ukraine in late February. Following a revolution in the Ukrainian capital of Kiev, pro-Russian forces began to take control of Crimea on Feb. 26. After a referendum on Sunday, the Russian Federation formally annexed the peninsula on Tuesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |