NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Daily GPI | NGI All News Access

Higher Natgas Prices in ’13 Send New England Wholesale Power Prices Up 55%

Higher natural gas prices lifted wholesale electricity prices in New England by more than half in 2013, ISO New England Inc. reported Tuesday.

The grid operator said prices were 55% higher than in 2012, based on preliminary data that showed the average price of wholesale electric power rose to $56.06/MWh from 2012’s $36.09. Compared with the average in 2003, when competitive markets were in their current form, the 2013 average was the fifth highest and 30% lower than the 2088 all-time high of $80.56/MWh.

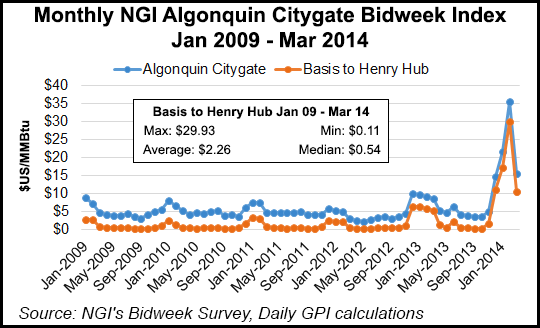

“The wholesale price of power in New England’s competitive markets is based on input costs,” said CEO Gordon van Welie. “Higher fuel prices result in higher power prices. New England sits on the doorstep of the Marcellus Shale, which has increased supply and lowered natural gas prices significantly, at least in areas of the country that can access that gas.

“However, the limited pipeline capacity coming into New England means that sometimes natural gas-fired generators have difficulty getting fuel, and that not only pushes up prices, it also creates a risk to reliable operation of the power system.”

Gas is the predominant fuel used to generate the region’s electricity, about 46% in 2013, and wholesale power prices tend to track the price of gas. Preliminary figures indicate that gas prices averaged $6.97/MMBtu in 2013, 76% more than 2012’s record low of $3.95/MMBtu. In 2008, the highest average price was $10.07.

Even though New England and regional gas prices have declined on increasing — and constrained — Appalachian production, the lower prices led to higher demand, ISO noted.

“The capacity of pipelines serving New England is not sufficient to serve this increasing demand for natural gas to heat homes and businesses and to generate electricity. Pipeline constraints, particularly in winter when home heating needs raise demand for natural gas, have pushed up the average spot price for natural gas in New England to the highest in the country.

“Until new infrastructure alleviates these pipeline constraints, prices for natural gas and wholesale electricity are likely to remain volatile.” More infrastructure is underway across the region (see related story and Shale Daily, March 12).

The higher energy prices increased the total value of the region’s wholesale market to almost $8 billion last year, 54% more than 2012’s $5.2 billion. The value of the region’s market rose to a high of $12.1 billion in 2008.

New England’s governors have proposed to spur gas pipeline infrastructure investments by seeking a tariff that would allow ISO to collect gas pipeline costs from electric market participants. The ISO agreed to work with stakeholders and policymakers to discuss the initiative, which could foster expansions.

The region’s wholesale prices also were affected by last year’s demand for power, ISO noted. That impact was influenced by the economy, weather and energy efficiency efforts.

“Overall, demand for electricity rose slightly in New England in 2013, by about 1.0%, to 129,350 GWh. When annual variations in weather are factored out, which allows demand to be evaluated on a comparable basis from year-to-year, electricity consumption would have dropped 0.4% to 127,754 GWh in 2013, compared with the weather-normalized 128,249 GWh of electricity consumed in 2012.”

Wholesale electricity prices flow and ebb in real time mostly on fuel prices, but retail default service rates generally are set for longer intervals, the grid operator noted. State regulators, who oversee the retail market, and the lag between wholesale prices and retail rates may vary, depending on a state’s procurement process. The wholesale market clearing price is used to establish retail default service rates.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |