NGI All News Access | Infrastructure

North American Midstreamers Need $30B Every Year to Keep Pace with Output

Close to $641 billion in North American midstream infrastructure will need to be invested over the next 20-plus years just to keep pace with booming energy production, leading natural gas advocates said Tuesday.

ICF International prepared the indepth analysis for co-sponsors America’s Natural Gas Alliance and the INGAA Foundation, the advocacy group of the Interstate Natural Gas Association of America.

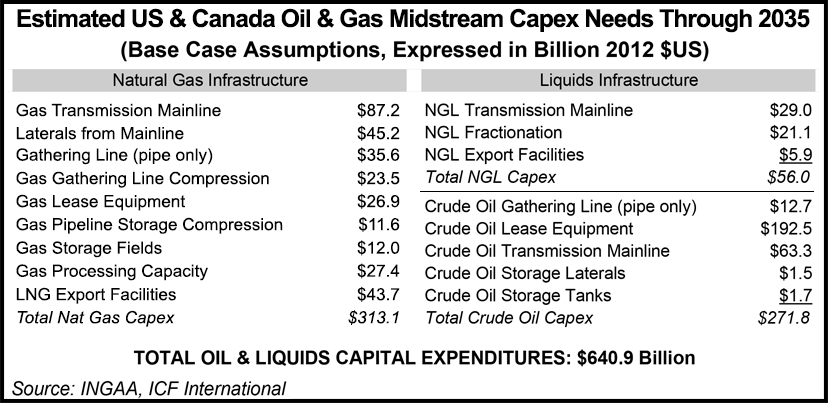

The United States and Canada require average midstream natural gas, crude oil and natural gas liquids (NGL) investments of almost $30 billion a year, or $641 billion in 2012 dollars, from 2014 to 2035, according to the report, “North American Midstream Infrastructure through 2035: Capitalizing on Our Energy Independence.” The report updates ICF’s 2011 infrastructure analysis (see Daily GPI, June 29, 2011).

The updated analysis found that many gas pipeline projects would run shorter distances than projected, but the overall investment levels are similar on rising infrastructure costs. It still would be a “substantial amount of new pipe,” ICF International concluded.

“This report shows a vibrant natural gas market in the future, and it also demonstrates the need for additional midstream infrastructure to support natural gas fulfilling its potential as a foundation fuel for our energy economy,” said INGAA Foundation President Don Santa. “The good news is that the natural gas industry has a proven track record of financing and constructing this level of infrastructure.”

The study assumed that announced near-term midstream pipeline infrastructure projects would be completed. Unplanned projects are included in the projection when ICF’s computer model signaled a need for capacity.

Because of the link between natural gas, crude and NGLs, pipelines need to be viewed in “holistic terms,” said Santa. “While the foundation has done its flagship natural gas infrastructure reports for over 20 years, the last two reports have broken new ground by recognizing the importance of including NGL and crude oil infrastructure to provide a broader prospective on how prices and production of the three commodities can impact the market and infrastructure development.”

North America’s huge pipeline system has made the “shale revolution possible, whether it’s shale gas, tight oil or NGLs,” Santa noted. “Without pipelines, Americans cannot benefit from these bountiful U.S. resources.”

About $14.2 billion/year, or $313.1 billion to 2035, is needed in midstream natural gas investments to accommodate bountiful gas supplies, particularly from unconventional plays, and because of demand in power generation, industrial applications and exports, ICF found. Natural gas midstream infrastructure investments would be needed to construct mainlines, laterals, processing, storage, compression and gathering lines.

For NGL transmission lines, pumping, fractionation and export facilities, ICF estimated that close to $2.5 billion/year, or $56 billion over 22 years, would be needed. Another $12.4 billion ($271.7 billion total) would provide enough crude oil infrastructure for

The total investments over the period would create more than 432,000 jobs, add about $885 billion to U.S. and Canadian economies, and bring in more than $300 billion in federal, state/provincial and local taxes, ICF analysts said. Not every area would require significant pipeline additions, but most areas would need new funding to connect growing supplies to market, said officials.

If midstream infrastructure funding doesn’t keep pace with supplies, energy development in North America could be constrained.

“Sufficient infrastructure goes hand in hand with well-functioning markets,” ICF noted. ” ICF says. “Insufficient infrastructure can constrain market growth and strand supplies, potentially leading to increased price volatility and reduced economic activity.”

Over the period, U.S. and Canada facilities are expected to be capable of liquefying and exporting 9 Bcf/d of natural gas to other countries, as well as 5 Bcf/d by pipeline to Mexico.

ICF’s base case projects real natural gas prices will average around $6.00/MMBtu (2012$) in the longterm. It also assumes U.S. population growth averaging 1%/year, with U.S. gross domestic product growth averaging 2.8% in 2014 and 2.6% from 2015-2035. Electric load is assumed to increase at an average 1.5%/year through 2020 and 1.1% annually from 2021-2035, while oil prices average $100.00/bbl in real terms. ICF also provided a low growth case scenario, regional breakdowns of infrastructure and investment, and projections for jobs and economic growth.

“In recent years, natural gas producers and marketers have been the principal shippers on these new ‘supply push’ pipelines,” ICF analysis found. “These anchor shippers have been willing to commit to the long-term, firm contracts for natural gas transportation service that provide the financial basis for moving forward with these projects. Going forward, producers should continue to be motivated to ensure outlets for their gas supplies via pipeline.”

Most pipeline infrastructure investments today come through tax-advantaged master limited partnerships, which may issue publicly traded shares but are treated like partnerships, with income and tax liability distributed to investors.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |