NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Daily GPI | NGI All News Access

Chesapeake Takes Another Step to Spin Oilfield Unit

Chesapeake Energy Corp. on Monday advanced plans to jettison its oilfield services unit, first by creating a corporation that eventually would trade on the New York Stock Exchange.

The information was contained in a Securities and Exchange Commission Form 10-12B filing.

For more than a year Chesapeake management has pondered separating the services business, which handles all of its onshore oilfield services, as well as those for several third parties. The decision to spin the business was detailed last month (see Daily GPI, Feb. 24).

By itself, Chesapeake is the second largest natural gas producer in the United States and a top 15 oil and liquids producer. It also remains the most active onshore driller.

The stand-alone would be created by Chesapeake Oilfield Operating LLC from Chesapeake Oilfield Services Co. (COS). The new company, to be named Seventy Seven Energy Inc. (SSE), could be worth $3-4 billion, by analyst estimates. Once all approvals are in place, SSE would be traded on the New York Stock Exchange.

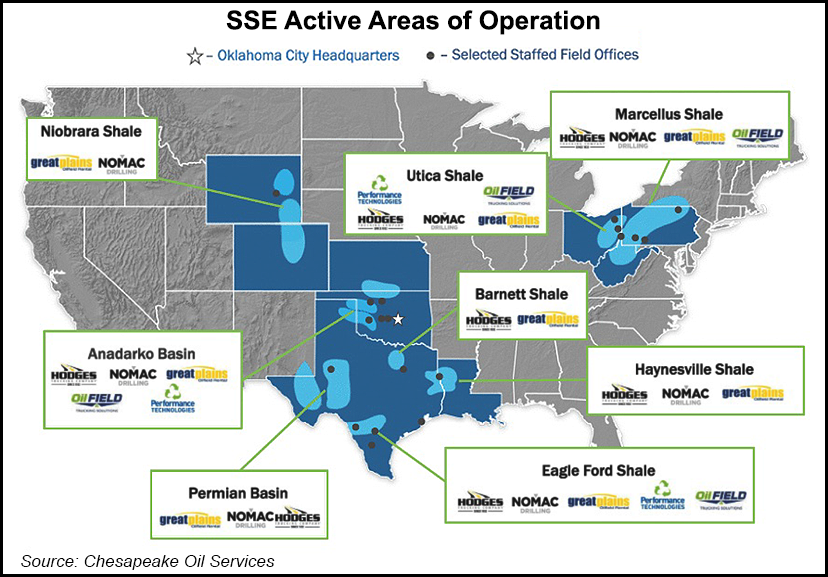

COS, formed in 2011, provides services through affiliates Compass Manufacturing, Great Plains Oilfield Rental, Hodges Trucking Co., Keystone Rock & Excavation, Nomac Drilling LLC, Oilfield Trucking Solutions and Performance Technologies (see Daily GPI, Sept. 20, 2011). Nomac now is the fourth largest U.S. drilling contractor.

The units operate in almost every major onshore U.S. basin: Anadarko, Appalachia, Fort Worth (Barnett Shale), Denver-Julesberg (Niobrara formation), and the Haynesville Shale. Services include contract drilling, hydraulic fracturing, oilfield rentals, rig relocation, fluid transportation and disposal, and natural gas compressor manufacturing packages.

Seventy Seven as it now is packaged, could be comparable in size and offerings to Patterson-UTI Corp., one analyst has suggested.

“We intend for the spin-off to be tax-free to our shareholders for U.S. federal income tax purposes,” the filing noted. “To that end, we have obtained a private letter ruling regarding the spin-off from the Internal Revenue Service…The spin-off is also subject to other conditions, including necessary regulatory approvals.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |