NGI Archives | NGI All News Access

Pengrowth Continues Shift to Canadian Oilsands

Pengrowth Energy Corp. executives said the company was continuing its shift toward oil, with construction of the first commercial phase of its Canadian oilsands terminal in east central Alberta remaining on schedule and on budget.

On Monday, Calgary-based Pengrowth reported 4Q2013 and full-year 2013 production that was above guidance — at 77,371 boe/d and 84,527 boe/d, respectively — but both figures were below production achieved in 4Q2012 and full-year 2012. For the quarter, production had declined 17.7% (from 94,039 boe/d), and for the year it was down 1.4% (from 85,748 boe/d).

Production guidance for 2014 ranges from 71,000-73,000 boe/d. The company also plans to spend C$700-730 million on capital expenditures (capex) in 2014. It spent C$695.8 million on capex in 2013, C$74.2 million below its C$770 million guidance.

“Today, Pengrowth’s production is just over half oil and liquids with the balance natural gas, but our mix is about to shift decisively towards oil as we bring our new production from our Lindbergh thermal projects only a year from now,” CEO Derek Evans said during an earnings conference call to discuss 4Q2013 and full-year 2013 results. “We’ve chosen thermal bitumen as our commodity of choice, because it offers long life reserves, lower declines in better capital efficiency than alternatives like natural gas or light oil.”

The company holds conventional assets, with an average working interest of 90%, in the Groundbirch area of the Montney Shale, in northeast British Columbia (see Daily GPI, July 14, 2010). It also holds conventional assets in the Greater Olds/Garrington and Swan Hills Trend areas in Alberta. Both are prospective for light oil, but the former also holds liquids-rich gas. Pengrowth plans to use revenue from its conventional assets to fund development of the Lindbergh terminal.

Evans said the pilot program at the Lindbergh terminal, located near Cold Lake, AB, “continues to perform exceptionally well.” He said production from two well pairs was approximately 1,900 b/d on Feb. 1, and total cumulative production from the two-well pilot had exceeded 1.1 million bbl.

“On the drilling side, we’re about 50% complete on the drilling,” said COO Marlon McDougall. “We’ve got one pad where we have drilled seven well pairs, 14 wells in total. The completion rig has set up half of the wells for initial steaming. On the second pad, we’re about 50% complete on the drilling. And on the third pad, we are just drilling surface hole right now.

“There is probably three to four months worth of drilling and completion activity still in front of us. And there is a significant amount of activity to install the pipelines that will join the well pads to the central processing facility.

Pengrowth hopes to complete an expansion of Lindbergh in three phases by the end of 2018, boosting bitumen production to 50,000 b/d. The company plans to export bitumen via railway to the U.S. East Coast, Midwest, Rockies and West Coast.

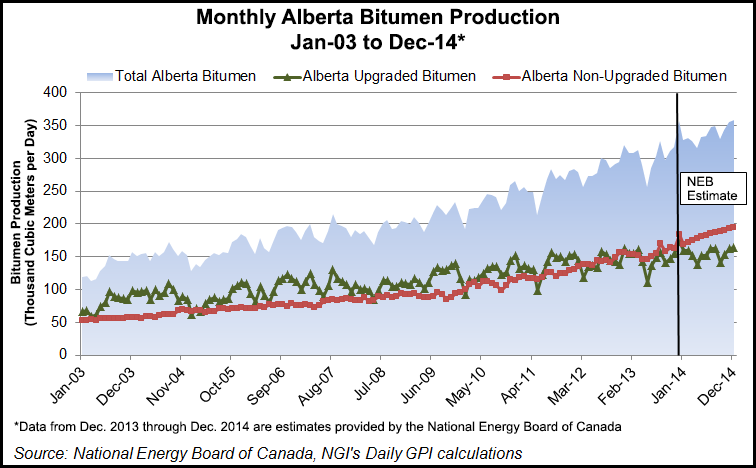

Alberta’s bitumen production has been increasing for more than a decade, but upgraded bitumen production has been relatively flat since mid-2011, while non-upgraded bitumen production has increased steadily, reaching 194,000 cubic meters per day in December, according to National Energy Board data.

Pengrowth reported an adjusted net loss of C$37.3 million during 4Q2013 and an adjusted net loss of C$183.8 million for the full-year 2013. By comparison, the company reported adjusted net income of C$24.1 in 4Q2012 but an adjusted net loss of C$89.7 million for all of 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |