M&A | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Chesapeake Tees Up $1B More Asset Sales, Focuses on Fixing Balance Sheet

Chesapeake Energy Corp. won’t be satisfied until it reclaims a top-tier exploration and production (E&P) position, which is going to require $1 billion more in asset sales this year and a more transparent balance sheet, CEO Doug Lawler said Wednesday.

Lawler shared some insight during an hour-long conference call with analysts about what’s been achieved and what’s still to be done since he came aboard eight months ago. He revamped the management team, cut spending and began to optimize business processes.

Last year was “foundational,” Lawler said. From here on out, it’s going to be about growth and a “disciplined” capital budget. He highlighted capital spending in 2013, which ended up 20% lower than in 2012. Another 20% in capital spending is to be lopped off of this year’s budget to 2013’s midpoint of $5.2-5.6 billion (see Shale Daily, Feb. 6).

“We still have lots of work to do,” said Lawler, “but we’ve completed the necessary steps to align our strategy…”

That strategy will be to market a slew of assets not considered vital to growth. 2013 asset sales totaled $4.4 billion. Assets now completed or expected to be sold this year add up to another $1 billion, and that doesn’t include the spinoff or outright sale of Chesapeake Oilfield Services, which may fetch $2 billion-plus (see Daily GPI, Feb. 24).

In 2013 Chesapeake improved its net working capital, long-term debt and long-term liability position by more than $900 million in aggregate — a big improvement from 2012. There’s still much more to accomplish.

“All of the different financial arrangements, commitments, obligations and different instruments used to essentially fund our program…We need to clean those things up,” Lawler said. “We are going to be an efficient, well-run E&P company. We’re not trying to be in the middle of the pack…We are working through some of the challenges, but we see significant opportunities…

“There are residual balance sheet issues…but with the assets we have, we can fix our balance sheet.”

The CEO has “two real, significant priorities…We want to continue to drive greater efficiency into our investment program…not just by reducing capital intensity” but also by improving, among other things, estimated ultimate recoveries from wells. “On the exploitation side, we want to build and expand core areas…I have strong confidence in the initial results from pad drilling, which points to what we believe to be good, solid core expansion”

With those priorities comes cash cost management, which significantly improved from 2012, he said. “We have some efficiencies, but [some of] the metrics are not as high as we believe we can deliver.”

The Oklahoma City operator isn’t turning its back on natural gas, as long as the price is right, said Lawler. The E&P’s portfolio remains almost three-quarters weighted to gas.

There were weather issues during the final three months of 2013 that impacted operations in the Midcontinent (ice and snow) and in the Eagle Ford Shale (flooding). The Natrium liquids processing plant in Appalachia, which was down for repairs, sliced into natural gas liquids (NGL) volumes in the Northeast.

Winter weather’s still an issue, but it has resulted in a “significant improvement in Northeast cash pricing” for natural gas to date, said CFO Nick Del’Osso. “We have very good assets in the Northeast, and we are raising capacity on the line to New York, offering us a great netback in January and February. It’s much better on that front.”

Chesapeake’s 2013 average oil output rose 32%, NGL production climbed 19%, while gas production fell 3%. Liquids accounted for 25% of total production, up from 20% in 2012, but it’s still more than 70% weighted to natural gas. Adjusted for asset sales, total 2013 production increased about 11%, while year-end proved reserves increased 2% to 2.7 billion boe.

The metrics that the management team is most focused on are not necessarily production, but cost efficiencies. Average daily production in the final period rose 2% from 4Q2012 to 669,600 boe/d. Meanwhile, combined per-unit production and general/administrative costs fell 15%.

More important, Chesapeake has reduced some spud-to-rig-release days to as low as eight days. Wells are averaging above $7 million, down from double-digit prices just two years ago. However, the efficiencies aren’t across the board. Choosing what to sell and what to keep will be a dilemma, said the CEO.

“Notably, you will see a difference in asset disposition” going forward. Assets only are to be sold if they aren’t core to the future and “only if we receive what’s appropriate for them.”

The highest return rates today are in the Eagle Ford Shale, Midcontinent properties, Appalachia and, perhaps surprisingly, the gas-weighted Haynesville Shale. The Haynesville has yielded a “100% rate of return with minimum volume requirements,” Lawler noted.

Overall, funding levels across the portfolio are to focus on “how we can capture the greatest value…”

Chesapeake reported a net loss in 4Q2013 of $159 million (minus 24 cents/share) on one-time charges that decreased earnings by $320 million. In the year-ago period, Chesapeake had to write down almost $2 billion in natural gas reserve revisions. It earned $257 million net (39 cents/share) in 4Q2012. Adjusted quarterly earnings in 4Q2013 were $161 million net (27 cents/share), versus adjusted 4Q2012 profits of $146 million (26 cents).

For 2013, net income was $474 million (73 cents/share), with results impacted by $422 million in one-time charges. Adjusted for the charges, net income was $896 million ($1.50/share), versus 2012’s $285 million (61 cents). Operating cash flow rose 26% in 2013 to $4.956 billion in 2013.

Analysts with Tudor, Pickering, Holt & Co. Inc. (TPH) said the quarterly production results were in line with their 667,000 boe/d and ahead of Wall Street’s expectations of 650,000 boe/d. However, oil output missed at 111,000 boe/d versus TPH’s 118,000 boe/d on declines in the Eagle Ford and Midcontinent, which Chesapeake blamed on the weather.

Wells Fargo’s David Tameron called the report neutral, with quarterly earnings “light” versus the Street’s, but production was 2.5% above the analyst expectations and 1.9% higher than consensus.

The earnings delta “was largely to more widespread ethane recovery (minimum volume commitments) in its portfolio than we, and likely the Street, were modeling, in addition to weak Northeast pricing,” said Tameron. “Higher natural gas pricing in 1Q2014 will likely partially reverse this depressed realized price…”

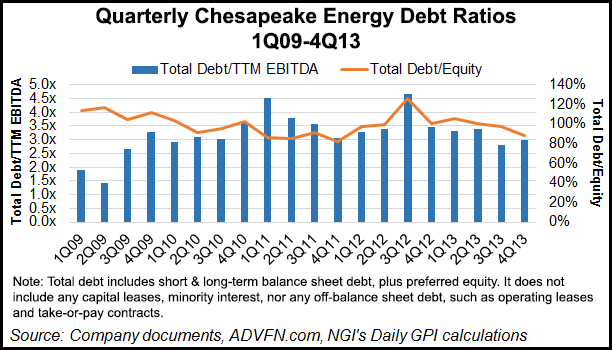

Chesapeake has made some progress on lowering its bank debt in recent quarters, bringing its respective total debt-to-trailing 12-month earnings before interest, taxes, depreciation and amortization and total debt-to-equity ratios down from 4.6 times and 125.8% in 3Q2012 to 3.0 times and 87.9% in 4Q2013. However, these figures do not incorporate other forms of debt, such as capital lease obligations and minority interest, nor do they include off-balance sheet items like operating leases and take-or-pay contracts. The latest off-balance debt figures will be included in Chesapeake’s 2013 10-K annual report filing with the U.S. Securities & Exchange Commission,available within the next few days.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |