NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Winter in Rear View, Williams Eyeing ‘Tremendous Appetite’ for NatGas Infrastructure

Well freeze-offs and severe winter weather that stormed across North America beginning in late November had minimal impact on Williams and its extensive natural gas pipeline operations, CEO Alan Armstrong said Thursday.

The network crosses major basins from coast to coast and into the Gulf of Mexico (GOM), offering a bird’s eye view of how processors fared to this point.

“We had great operations despite the different environments,” the CEO said during a conference call to discuss quarterly and 2013 results. “I would say the West continues to do pretty well against the normal freeze-offs. I will tell you that we continue to perform up against the [winter] norms for the Rockies in the western area. The San Juan Basin actually had one of the better periods than we normally see.”

In the Northeast, Transcontinental Gas Pipe Line (Transco) proved its reliability, said Armstrong. “We had some freeze-offs upstream on producer equipment..but our facilities remained very reliable…We pushed through challenging times. We have had some freeze-offs in the wet Marcellus Shale area, but again, it’s not on our systems. It’s been upstream and producers are working quickly to overcome that.”

The reliability of the pipe systems didn’t translate into overall profits, but shortcomings should be overcome this year as new projects come online in the deepwater GOM and in the Appalachian Basin, he said.

Net income for 2013 was less than half that of 2012 at $430 million (62 cents/share) from $859 million ($1.37). For 4Q2013, net losses totaled $14 million (minus 2 cents/share) versus year-ago profits of $149 million (23 cents). The declines were offset by increasing fee-based revenues at Williams Partners and equity earnings from majority owned Access Midstream Partners. Adjusted net income for 2013 was $550 million (81 cents/share).

The one-time charges resulted from lower natural gas liquids (NGL) margins for pipeline behemoth Williams Partners LP. Also absent was $207 million of income from 1Q2012 associated with the former Venezuela business; $144 million was recorded as discontinued operations. And a big loss for the year has followed more than six months of lost output at the Geismar, LA, olefins plant following a tragic explosion and fire last June (see Daily GPI, June 14, 2013). Because of an “extended loss” in steam and electric utilities, Geismar has had to be extensively rebuilt and won’t be ready to restart until at least mid-year, Armstrong noted.

For natural gas and NGL pricing, it’s a push-me, pull-you situation for Williams.

“Certainly, natural gas pricing is one that is bittersweet for us in the short term,” Armstrong told analysts. “It puts pressure on NGL margins and ultimately, the ethylene spread as well. The good news is, just as we have stated, we are working toward a volume-driven company. With this shot in the arm for producers [on higher gas prices], we think it will spur additional drilling and additional volumes into our system. In the long term, this is very healthy for the business.”

Contract restructuring is ongoing to move more toward fee-based revenues, which would “push out the importance of NGL margins…We’re always looking to reduce the risk to exposure, and it has to be done with an eye to net present values. We see great value in more predictable cash flows.”

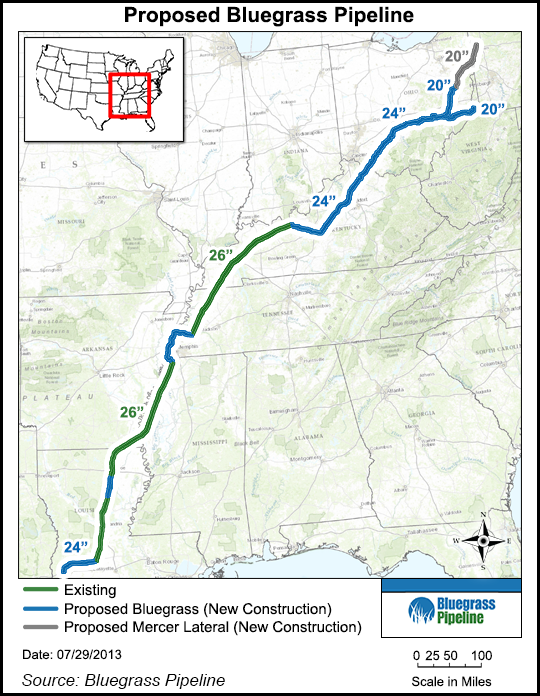

The lack of predictability is delaying to mid-2016 the proposed Bluegrass Pipeline, a joint venture with Boardwalk Pipeline Partners LP, to carry NGLs from Appalachia to Gulf Coast markets. The Bluegrass plan was launched last October, offering 200,000 b/d of mixed takeaway capacity from Ohio, West Virginia and Pennsylvania (see Shale Daily, Nov. 1, 2013). Sponsors also are offering a liquefied petroleum gas export terminal near Lake Charles, LA.

The delay will “better align with the needs of producers,” said Armstrong. “We continue to see tremendous appetite for additional firm natural gas transportation capacity from a range of industry participants, as evidenced by our fully contracted Atlantic Sunrise project, and we’ve identified abundant opportunities to help connect the very best supply basins with the fastest growing markets by building out large-scale, market-integrated infrastructure.”

Transco’s Atlantic Sunrise, which is to carry northeastern Pennsylvania gas to Atlantic Seaboard markets, has received binding commitments from nine shippers for 100% of 1.7 million Dth/d of firm transportation capacity. The project brought in 15-year shipper commitments from producers, local distribution companies and power generators. Assuming regulatory approvals, the pipe could be in service by the second half of 2017.

As gas production in the Northeast continues to surge, the economics of the north-to-south Bluegrass will prove too tempting for producers to ignore, said Armstrong. Regardless of market rumors, Bluegrass remains a must project, he added. Since Bluegrass was launched last year, several smaller projects have joined the competition (see Shale Daily, Nov. 11, 2013). But those other guys don’t worry him.

“As to the smaller projects, I think those are great projects. They are needed. But they don’t provide the kind of long-term underground storage opportunities from the Gulf Coast or diversity of markets. There is a growing petrochemical business, export opportunities, that are large-scale in nature” now proposed for the Gulf Coast region. I think we’re excited that other projects exist, but I think the growth in volumes will be dictating those kinds of solutions. We haven’t seen as big a deterrent to committing to Bluegrass.”

There’s also no question that Boardwalk management remains committed, Armstrong said. Boardwalk recently cut its quarterly distribution by 81% following a disappointing fourth quarter performance (see Daily GPI, Feb. 10). However, general partner Loews Corp. “stands behind the capital commitment,” said Armstrong. “You need not worry about the recent distribution cut or the impact on the company…We don’t see any issues there because of the strong backing from Loews on the project.”

As to the timing of Bluegrass, Armstrong noted that the monumental commitments by producers, requiring 15-year contracts, are a bit tough to absorb at this point.

“If look at what it costs for a producer to make the kind of commitment…it has to be someone that has 30-70 barrels a day of commitment on 30 cents a gallon to pay for transportation, fractionation…That piles up for 15 years. That’s a very, very large commitment…If you do the math, I really think that’s the practical issue we’re dealing with. We have very engaged customers,” including interest from international players interested in the petrochemical opportunities the takeaway would provide. “We see this as an opportunity…that’s an essential piece of infrastructure.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |