NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Americas’ Regional Output Altering World Energy Markets, EIA Says

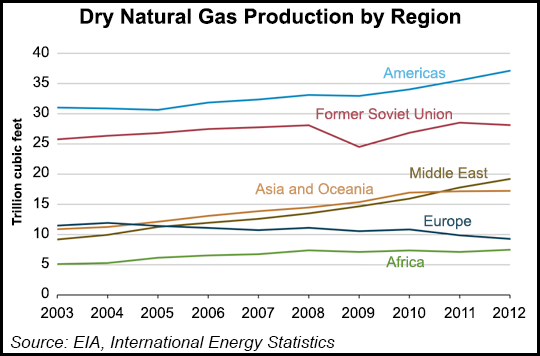

The Americas have become a significant contributor to global energy markets, rivaling the Middle East in oil production and exceeding the former Soviet Union in natural gas production, and the trend is likely to remain positive, according to a recent report from the Energy Information Administration (EIA).

“The Americas region holds an abundance of existing proven reserves, as well as the promise of abundant resources of both oil and natural gas,” EIA said in its “Liquid Fuels and Natural Gas in the Americas” report. “While the Americas have accounted for a considerable portion of the global markets in liquid fuels and natural gas and have attracted sizeable investments, the region has the potential for further expansion and development.”

At the beginning of 2013, the Americas accounted for one-third of proved worldwide reserves of crude oil (536 billion barrels) and one-tenth of proved natural gas reserves (688 Tcf), as well as immense recoverable resources of oil and gas including reservoired resources, tight oil and shale gas, EIA said. Countries in the region produced 29% of the world’s liquid fuels supply in 2012 (almost 26 million b/d) and consumed one-third of the world’s liquid fuels (nearly 30 million b/d). They also accounted for 25% of global crude imports, 9% of global crude exports and 22% of global petroleum product imports and exports. And the Americas imported 4 million b/d and exported 3 million b/d of refined petroleum products, much of it coming from the United States.

“For much of the past decade, the United States has been a major crude oil, petroleum product and natural gas trading partner with other countries in the Americas,” EIA said. “From 2003 to 2012, the United States imported about 5 million b/d of crude oil from other countries in the region — primarily from Canada, Mexico and Venezuela. However, the quantities and shares of imports from those countries are shifting. With U.S. crude oil production continuing to increase, domestic production has displaced some imports of crude oil, including those from Latin America, defined as Mexico plus Central America, the Caribbean and South America.”

The United States’ significance as a petroleum product supplier “has grown considerably in recent years,” according to EIA.

“In 2003, the United States exported 0.6 million b/d of petroleum products to other countries in the Americas, primarily Mexico and Canada. In 2012, U.S. exports to the countries in the region totaled 2.0 million b/d, still primarily to Mexico and Canada, but increasingly to other countries, most notably Brazil and Chile. As a result, the United States recently became a net exporter of petroleum products.”

An abundance of hydrocarbon resources in the region and the availability of technical capabilities to produce them has prompted companies both within and outside of the Americas to invest heavily in developing and producing liquid fuels and natural gas. “Both international oil companies and state-owned oil companies in the Americas have made the most substantial investments, followed by companies based in Europe and in Asia and Oceania,” EIA said. Countries with the most open regulatory structures, like Canada, Brazil, Colombia and the United States, have attracted significantly more investment than others in the region.

“Mexico, which recently adopted new energy reforms that allow some types of foreign private investment in the energy sector, looks to join their ranks,” EIA said (see Daily GPI, Feb. 7).

In the United States, overall U.S. natural gas production reached a historic high in November, lifted by record production from the shale-rich Lower 48 category, according to EIA’s most recent Monthly Natural Gas Gross Production Report (see Daily GPI, Feb. 3). And production of North American natural gas, natural gas liquids (NGL), crude oil and condensate is expected to continue increasing through 2035, according to a recent report from ICF International (see Daily GPI, Feb. 13).

The Feb. 15th issue of The Economist, a respected British-based publication, offers the prospect of North America reclaiming to the role of swing oil producer that it lost to OPEC in the 1960s. And, in fact, the article “Saudi America” cited analysts’ observations that “America’s” booming crude oil production may already have helped stabilize prices despite global losses from Iran, the Sudan and declining North Sea production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |