NGI Data | NGI All News Access

Weekly NatGas Prices Travel Every Which Way But Loose

It was a wild and wooly week of gas trading where multiple dollar gains and losses were commonplace throughout the country as frigid temperatures in some regions were offset by more temperate conditions in others. Pipelines strained under the high demand. No matter the weekly gain or loss, prices were regionally and nationally high across the country for the week ending Feb. 7, with the NGI National Weekly Spot Gas Average vaulting $1.67 to a stout $9.43.

The market point showing the greatest gain was Northern Natural Demarcation in the MidContinent with an $8.66 advance to $14.21 and the week’s greatest losses were seen at Dracut in the Northeast with a dive of $32.74 to average $20.46.

Regionally the Rocky Mountains enjoyed the greatest gains, rising $6.21 to $11.24 with both CIG and Opal averaging $11.20 and $11.84, respectively, the highest NGI weekly prices seen at these locations since December of 2005. The largest regional loss was the Northeast, which lost $4.45 to average $8.31.

The Midwest lost $1.66 to $12.54 and South Louisiana added 97 cents to average $6.27. South Texas rose $1.00 to $6.17 and East Texas gained $1.79 to $6.95. Regionally California gained $4.52 to $9.64 and the Midcontinent rose $4.79 to $13.32.

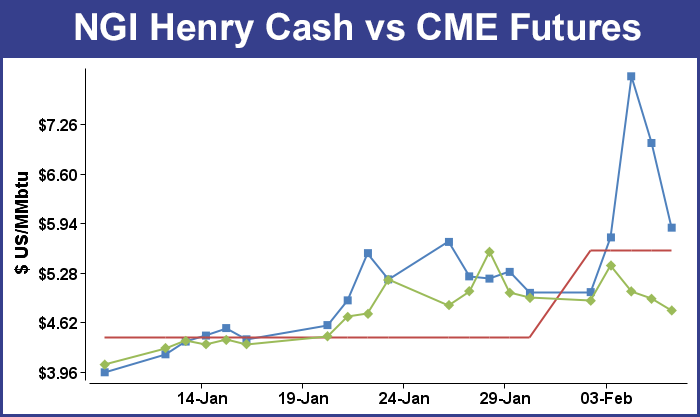

March futures for the week fell 16.8 cents to $4.775 after absorbing Thuersday’s Energy Information Administration (EIA) storage report for the week ending Jan. 31, which revealed a withdrawal of 262 Bcf, with an 8 Bcf revision to the previous week’s report that effectively made it a 270 Bcf draw.

An industry veteran remarked that “it will be interesting to see how this all plays out. Storage is going to be a big driver this summer, and if we get mild weather prices won’t push up one way or the other. Any kind of hot weather that drives power prices is likely to drive natural gas, but if prices get too high, everyone will switch to coal and prices will come back down. Some people are calling for $6 gas, but I think it will be more like $5 on a month-to-month basis for the summer.”

Others are more than just interested and see market risk to the upside. Teri Viswanath, director of Commodity Strategy, Natural Gas for BNP Paribas, noted that current storage inventories finished January at a 10-year low. “EIA revised last week’s stockpiles lower, from 2,193 to 2,185 Bcf,” she said. “The 8 Bcf reduction means that despite a slightly lower than anticipated draw last week, total inventories are roughly in line with market expectations. What’s more, this is the lowest ending stock level for end January since 2004!”

Considering the low level of inventories, Viswanath said the March contract’s decline Thursday might not make sense to some. “It appears to us that the direction of natural gas futures is slightly off-kilter given developments unfolding in the physical market this week. While the slight warm-up in the weather forecasts certainly translates to reduced heating demand ahead, the North American pipeline network is now clearly showing signs of deliverability stress as traditional sources of swing supply have been depleted. Translation? There are still significant upside risks for March gas deliveries and, hence, futures prices.”

Inventories now stand at 1,923 Bcf and are 778 Bcf less than last year and 556 Bcf below the five-year average. In the East Region 143 Bcf was withdrawn and in the West Region 26 Bcf was pulled. Inventories in the Producing Region fell by 93 Bcf.

The Producing region salt cavern storage figure dropped by 41 Bcf from the previous week to 137 Bcf, while the non-salt cavern figure fell by 52 Bcf to 565 Bcf. Resubmissions of data resulted in lowering estimates of working gas stocks in the Producing salt region by approximately 8 Bcf for the week ending Jan. 24, EIA said.

During Friday’s trading spot natural gas prices for weekend and Monday delivery overall took a hard fall, but weather and transportation-challenged Midwest points were able to post multi-dollar gains as temperatures were forecast to plunge by Monday. The gains were more than offset by losses at Northeast, East and California locations.

Industry consultant Genscape in its Friday morning report said, “U.S. production has yet to fully recover from the past weeks’ freeze-offs. Spring Rock is estimating production in the Lower 48 is at 65.5 Bcf/d versus this January’s average of 66 Bcf/d.” Recover indeed. In its November Monthly Natural Gas Gross Production Report, EIA pegged Lower 48 gross withdrawals at 75.95 Bcf/d.

Futures traders were looking for a market bottom. “We may a bottom as low as $4.50, but I think we’ll get a few more price spikes,” said a New York floor trader.

Some don’t see any moderation in weather but still think the market is vulnerable to further declines. “This market is seeing significant downside follow-through and is currently challenging this week’s lows established on Monday. With existing long position holders looking for even minor reasons to accept partial profits ahead of a weekend that could bring some significant shifts in the temperature views, we are not ruling out some additional selling that could bring a test of our expected $4.68 support,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients.

“We viewed [Thursday’s] weekly storage data as about price neutral with the bulk of the post report selling emanating from further moderation in the one- to two-week temperature outlooks. But we will also emphasize that there is still no normalization or mild trends showing up in the outlooks that we monitor. As a matter of fact, this morning’s forecasts would appear to favor additional supply deficit expansion out to the EIA report to be issued on the 27th of this month. Consequently, the market likely needs to price in an end of season supply of around 1.1 Tcf in our opinion, smallest supply cover in 10 years with which to begin the injection cycle.”

Overnight Thursday prices eased as more distant weather forecasts called for warmer “risks.” Commodity Weather Group in its Friday morning one- to five- and six- to 10-day outlooks still showed below-normal temperatures over the eastern half of the country, but the 11- to 15-day outlook is showing some moderation. “Significant changes on the European ensemble overnight introduced stronger warmer risks to the forecast by the latter half of the six-10 into the 11-15 day forecasts,” said Matt Rogers, president of the firm.

“The main adjustment was a flattening of the West Coast ridging pattern, which offers a more westerly zonal flow solution that erodes cold air over the eastern two-thirds of the U.S. There is still a Hudson Bay low in place that should offer some colder weather, but the cold shot mid to late next week looks weaker now, and new warmer weather risks are emerging mid to late 11-15 day in the East as more cold air begins to dip toward the Plains and Rockies.

“The American ensembles are still colder overall for both periods, and the rather sudden shift on the Euro after a week of consistency warrants some caution until better model consistency is achieved.

Weather forecasts may be showing milder temperatures in the longer term, but in the near term the Great Lakes and Upper Midwest are expected to run 20 or more degrees below normal. Weekend and Monday gas prices advanced. AccuWeather.com forecast that Minneapolis’ high of 12 degrees Friday would reach 13 by Saturday before dropping to minus 2 on Monday. The seasonal high in Minneapolis is 27. Chicago’s Friday high of 14 was expected to rise to 21 by Saturday before plummeting to 9 on Monday. The normal early February high in Chicago is 33. Detroit’s high Friday of 15 was expected to reach 18 on Saturday and Monday. The normal high in Detroit is 33.

“After a storm unleashed snow and ice on the city this week, low temperatures will provide no relief from winter’s fury in Detroit,” said AccuWeather.com’s Kristen Rodman. “Temperatures through the weekend will range from the low 20s into the teens with overnight lows in the single digits. A nearby storm could bring some afternoon snow to Detroit on Saturday, but the event will be nothing of consequence. Some more flurries are possible again on Sunday. Heading into [this] week, the air will be frigid for the beginning of the week with temperatures around 20 F. Although Monday will feature a little bit of sunshine, which could help melt some of the city’s snow. By midweek, temperatures will rise to the 30s and provide a little bit of relief from the frigid cold.”

Buyers trying to move gas into the Great Lakes region were experiencing high prices and availability issues. “We didn’t buy too much [Friday] because it was going to be too ugly on Consumers,” said a Michigan marketer. “We only bought 750 Dth on Consumers at $9.25. What we are hearing is that Chicago is taking so much of the gas it isn’t coming up to Michigan it’s so darn cold.

“We are hearing there have been [pipeline] issues and this adds to the price. They haven’t called us and said we couldn’t get gas, but just one pipeline having problems would not be good.”

A major pipeline into the Chicago area did report difficulties at an Illinois compressor station. “[NGPL] experienced an outage early this morning, Friday, Feb. 7, 2014, at Compressor Station 113 located in Will County, IL, (directly related to the Horizon posted Force Majeure outage), resulting in lower pipeline pressures in the Market Delivery Zone,” the company said in a critical notice. “Natural is diligently working on resolving the issue [and] this is a Force Majeure event. The full impact of this outage is still being determined.”

On Alliance, weekend and Monday gas rose by $2.88 to $12.33, and gas at the Chicago Citygates rose by $3.14 to $12.23. Deliveries on Northern Natural Ventura rose $1.46 to $10.70, and at Demarcation gas for weekend and Monday added 60 cents to $9.52. On the NGPL Amarillo Line, gas added $3.91 to $12.27.

Packages on Consumers for the weekend and Monday added $1.53 to $10.71, and on Michcon gas was quoted at $9.36, up 89 cents.

Transportation issues were not limited to the Midwest. Northwest Pipeline reported reduced flows at its Jackson Prairie storage facility south of Seattle, WA. “Effective Thursday, Feb. 6, 2014, Northwest will reduce capacity at Jackson Prairie from 1,300,000 Dth/d to 900,000 Dth/d. Current storage levels do not support maximum flow out of Jackson Prairie. The maximum withdrawal volume will continue to decrease as Jackson Prairie storage levels decrease,” the company said.

In the East and Northeast prices eased as a high-pressure system was expected to move into the region. The National Weather Service in New York City said, “high pressure builds into the region through Saturday with low pressure moving off the Carolina coast Saturday into Sunday. A series of upper-level disturbances move across Saturday night through Monday. Strong high pressure from western Canada builds in late Monday through Wednesday with low pressure from the south late Wednesday into Thursday.”

Gas for weekend and Monday delivery into New York City on Transco Zone 6 fell $5.72 to $12.38 and deliveries to Transco Leidy fell 92 cents to $2.16. Gas on Tetco M-3 eased 44 cents to $9.40. At the Algonquin Citygates, parcels shed $1.23 to $22.50, and on Tennessee Zone 6 200 L gas changed hands at $21.57, down $1.86. California prices eased as the market started to realign. Both market centers and producing region prices fell, but the producing regions gave up a significant piece of earlier market premium.

Gas at PG&E Citygates fell 57 cents to $6.67, and at SoCal Citygates weekend and Monday gas shed 71 cents to $6.53. At the SoCal Border gas was also quoted at $6.54, down $1.01, and on El Paso S Mainline gas was seen at $6.66, down $2.30.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |