Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Antero to Offer Nearly All Midstream Assets in Spin-off

An Antero Resources Corp. unit on Friday filed a preliminary prospectus to create a separate partnership to hold substantially all of the Appalachian midstream business.

Antero Resources Midstream LLC said it wants to raise up to $500 million through an initial public offering (IPO) of its common stock. Once launched on the New York Stock Exchange, it would trade under “AM.”

No timeline for the launch, nor the number of shares to be offered, were disclosed in the Form S-1 filing with the U.S. Securities and Exchange Commission.

The news is not unexpected; in late January management indicated it wanted to spin the midstream unit this year (see Shale Daily, Jan. 30). The proposal comes four months after the exploration and production operator began trading publicly.

In January, Antero set its 2014 midstream budget at $600 million, about $50 million less than it spent in 2013. The budget all is tied into spinning off the business, management said.

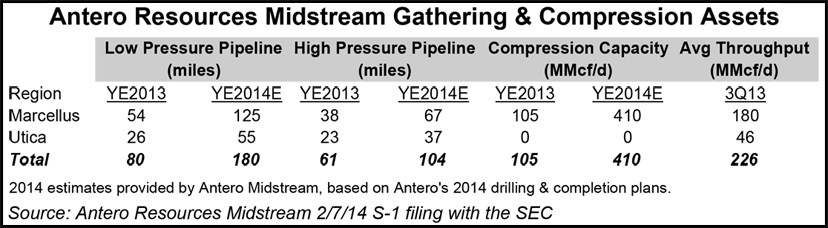

This year the midstream unit plans to build 100 miles more of low-pressure gathering pipelines and an additional 43 miles of high-pressure pipes across the Marcellus and Utica shales.

In addition, five compressor stations in the Marcellus are to be expanded to provide another 305 MMcf/d of compression capacity. Seventy-three miles of permanent pipe for the fresh water distribution system is planned this year as well.

From January through October 2013, the midstream business reported net income of $16.9 million, versus a loss of $3.4 million in the same period of 2012. Revenue increased to $35.3 million from $237,000.

Antero is not scheduled to release its fourth quarter and 2013 results until later this month. However, it has said it plans to have 1 Bcf/d of processing capacity by this year, with 1.3 Bcf/d of firm transport by 2015. Another 20,000 b/d of ethane takeaway capacity also is to be in place this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |