NGI Data | NGI All News Access

Polar Vortices Result in February Northeast Bidweek Records

Prodded by January’s arctic blasts and promises of more cold to come, February bidweek prices soared, with the usual eastern suspects notching prices above $25 and $35 dollars, helping boost NGI‘s National Spot Gas Bidweek average up $2.04 from January to $6.58. The Northeast region averaged $8.83, with the Midwest not far behind at $7.78.

One marketer called the price response to the unprecedented polar blasts that swept the continent, reaching at times to South Texas and Florida, as a winter hurricane “Katrina effect.”

Some market points in the Northeast posted budget-busting record price averages. Volumes traded were low but February bidweek at Algonquin Citygates vaulted $13.71 to $35.50, easily eclipsing the point’s previous bidweek average record high of $21.79 set last month. Tennessee Zone 6 200 L bidweek came in at a raucous $26.56, up $5.28, also on low volumes. Regionally the Northeast posted the greatest gains, up $4.08 to an average $8.83.

Locations in and around New York City backed off some of the January spot pricing seen past the century mark and settled in at more “modest” levels. However, records were still recorded. Transco Zone 5 was seen at $15.53, up $9.95, beating the points previous record high of $15.11 set in October 2005, and Transco Zone 6 non-NY added $9.69 to $15.59,

besting its previous record of $15.42 notched during January 2001 bidweek. Bidweek gas headed for New York on Transco Zone 6 came in at $18.60, up $9.63.

“The issue that is always talked about is whether there is going to be enough supply to meet demand. Everyone got a little comfortable once the domestic shale plays ramped up, and I think everyone got comfortable, believing there is so much supply that people were choking on it,” said a industrial end-user. “What is happening now is the bottleneck is the infrastructure — getting the gas from point A to point B. All the gas in the world at the wellhead doesn’t help you if you have someone running a power plant. With more gas-fired plants coming on, this is something to be aware of. They are going to run as hard as they can at $200/kWh costs, so $135 gas works.”

While record bidweek values were recorded at some Northeast locations, the end-user told NGI he doesn’t believe people will renege on their 30-day agreements, whether they are indexed or were the result of bilateral trades. “Most of these are going to be driven by their contracts, so if you are set up on the first of the month index price, you’re going to have to eat it,” he said. “Back in the days when Katrina made prices go a bit crazy, you had to man up and take it, because that is what you signed up for. If folks try to renege on these contracts, if you’re the supplier you are going to call that a breach. The supplier is having to eat some of these same costs too. It is what it is for various reasons. You either abide by your contract, or I think someone is going to have legal discussions later.

“I’ve got a number of first-of-the-month index contracts, and some months you do well, some months you don’t. If you go back to Katrina, I had a couple of months where the index price even worked out a lot better than the day prices.”

Fuel switching isn’t much of an option, he said. “Let me put things into perspective. I just paid $5 for propane, which equates to $54/MMBtu. Does that sound fair? It isn’t just natural gas. All of the other fuels went nuts as well.”

Regionally western locations had the smallest bidweek increases. Rocky Mountain bidweek was $4.99, up 54 cents and California bidweek was seen at $5.17, up 58 cents.

East Texas was higher by 93 cents to average $5.25 and South Texas rose $1.02 to $5.31. South Louisiana added $1.15 to average $5.53. The Midcontinent was higher by $1.20 to $5.68 and the Midwest rose by $2.97 to average $7.78.

February futures expired last Wednesday at $5.557, up $1.150 from the January futures settlement.

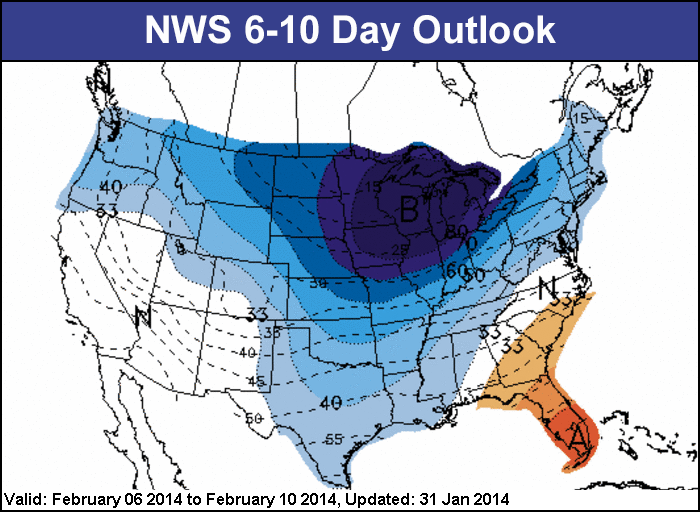

Buyers had good reason to step up to the plate. WeatherBELL Analytics in its Friday 20-day forecast predicted a national accumulation of 489.2 heating degree days (HDD), well ahead of last year’s 370.3 HDD and a 30 year average of 394.1 HDD.

“A stormy, cold front 10-15 days of February is shaping up with some mid month modification, then a turn to colder at the end of the month and to start March, before we snap this completely,” said WeatherBELL forecaster, Joe Bastardi. “I am amazed at how close this looks to 1994. The ECWMF [European model] weeklies show strong cold next week, fading cold the week after, a mild 3rd week but the return of cold the 4th week.”

In early bidweek exchanges a Midwest marketer voiced concerns that the market remains unprepared for winters of the kind that have recently sent brutal cold ripping through the East and Northeast.”They are saying that this is the third coldest winter since 1980,” said a veteran Great Lakes marketer. “Gas-wise I will tell you that it’s a lot worse because there is all kinds of new construction everywhere and a lot more gas is being used.”

He added that he was having difficulty getting a basis quote on Consumers and was hearing quotes ranging anywhere from 75 cents to $2.00. “Consumers lifted their MDQ [Maximun Daily Quantity], you have to call them first, but they will allow you to do that. It was very unusual and very smart on their part. In three weeks this [demand-price surge] will all be over. People are hyping this thing up and traders get nervous anytime it gets cold.”

Others outside of the axis of the polar vortices didn’t express all that much concern. “Who didn’t buy most of their winter gas already? There may be some people that are a little short,” said a Houston-based industry veteran. But all could be paying more if their contracts were based on monthly spot market adjustments.

He said that if your storage volumes had been reduced below expectations, “it all depends on what section of the country you are talking about. The basis on Algonquin is something like $32 or something ridiculous like that. I kind of think that with Nymex coming off, that this will be the last of the cold once it works its way through. Once it gets cold it makes it easier for the atmosphere to make it cold again.”

“It’s going go be in the 70s in Houston by the end of the week. The utilities already have winter buying programs and they are locked in. It’s that 1/3 to 1/4 of their gas that they haven’t bought. A lot of them will probably buy all of it baseload and sell what they don’t need. They make some money or lose some money depending on which way the market goes. They are trying to get the lowest price for the consumer, but they will pass it on and not absorb it.”

He said “some guys are paying $1000 per month just for their heating bill. How do they afford it? They are looking for the window so they can jump out. But then they found that it was frozen shut!”

In Friday’s trading March natural gas futures continued to retreat from Wednesday’s short-covering run-up, leading market watchers to believe that the 52.4-cent jaunt well above $5 was more about the February contract’s termination than it was about current fundamentals. The front-month contract finished the week back below $5 at $4.943, down 6.8 cents from Thursday and 5.5 cents lower than the previous week’s close.

Futures endured a wild ride for the week after spiking 52.4 cents on Wednesday and then immediately dropping 52.2 cents over Thursday and Friday. After closing Thursday’s regular session at $5.011, the prompt-month contract sank below $5 in overnight trading. During Friday’s regular session, March futures traded a wide range between $4.721 and $4.995. Analysts warn that volatility, a staple in gas futures during the 1990s and early 2000s, is making a return.

“The natural gas market is continuing to see profit taking focused in the nearby March futures contract, making it look as though the prior strength was more about the February contract expiration than about the colder than normal temperatures that have been draining storage,” said Tim Evans, an analyst with Citi Futures Perspective in New York. “And while recent forecasts have altered the temperature outlook to some extent, with a bit more cold next week and a bit less in the week to follow, we continue to see enough heating demand to produce above-average storage withdrawals over the next few weeks.”

Evans added that this tightening of the market on a seasonally adjusted basis should continue to reduce downside price risk and add to upside potential. “The trade this week has clearly demonstrated the kind of volatility that is possible here and we wouldn’t rule out a renewed spike to the upside, with a rebound in the March contract back above the $5.00 mark about all it would take to kick that off, in our view.”

David Thompson, executive vice president of Washington, DC-based Powerhouse, told NGI Friday that it was only a matter of time before volatility returned. “For too long, people had lost their fear of natural gas volatility and grown too accustomed to a quiet market. People should never forget that natural gas can do what it can do when you get weather and you’ve converted to a natural gas economy. Look at how much more of a percentage of homes are heated with natural gas now.

“Good old fashioned fundamentals are back. With the amount of gas we’ve burned through in the last month has really opened up some valid discussions that we haven’t had to consider in quite some time. How much will we have in storage at the end of all this and how much will we have to replace to get back up to a satisfactory level when we start considering winter? And oh by the way, what happens if we have a hot summer in between. The amount of gas that has come out is truly staggering.”

Production freeze-offs are still occurring, according to Genscape. For the entire Lower 48 states, freeze-offs collectively offset production by 1.31 Bcf on Friday, although other regions did not have freeze-offs and had production above the Jan. 20 baseline.

Freeze-offs are another part of the equation, Thompson said. “We all know through the shale plays that we have huge gas reservoirs, but when you are talking about getting [storage] down to levels that potentially could threaten the operational integrity of the pipeline and storage systems, that’s another story. You can’t withdraw to zero. You can’t get close to zero even because you need to have pressure in the caverns and obviously in the pipeline system. What we have now is extreme cold using up a lot of gas, but that extended cold is also causing freeze-offs in production that might be used to replace gas volumes, so we’re certainly living in interesting times.”

Thompson added that he believes the current dynamic is that physical gas prices are leading futures around, with their wide swings. “When you look at the number of gas customers who have been interrupted this month, which spills over into other energy markets, it is surprising,” Thompson said. “I suspect the level of interruptible customers has been at record numbers, so the question is how long does that last for? In the past interruptibles might have been a relatively short time phenomenon. Will this be longer than previous historical episodes?”

End-of-season storage levels continue to be a hot topic amongst market watchers. “Current storage of 2,193 Bcf is 258 Bcf (11%) below normal and 632 Bcf (22%) lower y/y,” according to analysts at Tudor, Pickering, Holt & Co. “Assuming a near record draw next week (285 Bcf) and normal draws during February and March, storage ends Q1 at 1.2 Tcf. If temps are 10% colder than normal, storage hits ~1 Tcf.the lowest in over 10 years. Meaningfully lower than 1 Tcf requires 15+% colder than normal.”

Barclay’s Analyst Shiyang Wang has similar concerns for storage, especially considering the current level of freeze-offs. “Given the six-15 day weather forecast, little [freeze-off] recovery could be expected unless normal or warmer weather occurs in the second half of February. Although there are only two months left for this winter season, storage withdrawals could still see large variations depending on weather trends. March alone, for instance, could swing from a small injection to a withdrawal greater than 380 Bcf.

“All eyes remain on the weather forecast for the rest of the season, which can swing drastically from one day to another. Given the current weather forecasts for the first half of February, we highlight downside risks to our end-of-season storage forecast of 1.4 Tcf.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |