U.S. NatGas Production Hit Another Record High in November

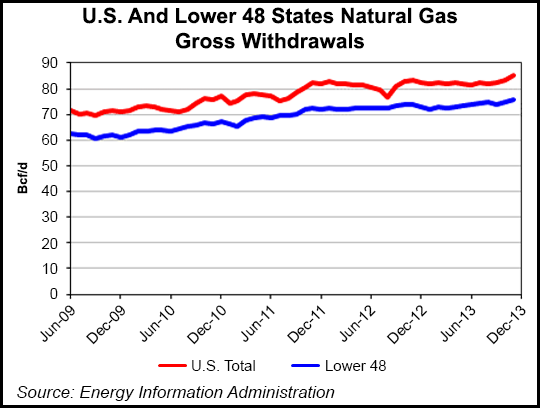

Lifted by record natural gas production from the shale-rich Lower 48 category, overall U.S. production also reached a historic high in November, according to the Energy Information Administration’s (EIA) Monthly Natural Gas Gross Production Report.

Total U.S. production in November was 85.28 Bcf/d, a 2.4% increase compared with 83.25 Bcf/d in October (a number revised by EIA in the latest report), which was the previous record high (see Daily GPI, Jan. 8). Total U.S. production stood at 82.38 Bcf/d in November 2012.

Production from the Other States category, which includes Pennsylvania, Ohio and West Virginia, was a record high 28.41 Bcf/d in November, a 4.1% increase from 27.28 Bcf/d in October and a whopping 5.02 Bcf/d more than in November 2012, according to EIA data. It was the largest volumetric increase from October in the report and came “as many operators reported new wells coming online or wells that returned from shut-ins in the Marcellus Shale,” EIA said.

Production increases compared with October were also reported for Federal Offshore Gulf of Mexico (3.57 Bcf/d, from 3.32 Bcf/d), Oklahoma (6.13 Bcf/d, from 5.99 Bcf/d), Alaska (9.33 Bcf/d from 8.43 Bcf/d) and Lower 48 States ( 75.95 Bcf/d from 74.82 Bcf/d). The surge out of the Gulf was mainly attributed to production returning to normal levels following Tropical Storm Karen (see Daily GPI, Oct. 7, 2013), EIA said.

Weather-related issues and maintenance kept a lid on production in Texas (22.72 Bcf/d from 22.97 Bcf/d in October) and New Mexico (3.58 Bcf/d from 3.69 Bcf/d). Also reporting production decreases compared with October were Louisiana (5.85 Bcf/d from 5.86 Bcf/d) and Wyoming (5.69 Bcf/d from 5.71 Bcf/d).

Frigid temperatures could have a negative impact on production numbers in the next few EIA reports, according to analysts.

“As half of November experienced 10-year low temps across the U.S., we expected some weather related production disruptions and flattish production,” Tudor, Pickering, Holt & Co. Inc. analysts said in a note Monday morning. “Given record low temps in December and January, more extensive freeze-offs [are] likely to impact December and January production numbers.”

While production is expected “to remain in growth mode for the foreseeable future, the next several reports are likely to show month/month (m/m) declines, as numerous wells were affected by widespread freeze-offs across the country,” according to Barclays Capital analysts Biliana Pehlivanova and Shiyang Wang. “Pipeline flow reports point to a 1 Bcf/d m/m drop in production in December.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |