Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Marcellus Gas Needs a Western Market, REX Executive Says

The word “Marcellus” doesn’t need a translation anywhere in the world; now all its developers have to do is find new markets for their products.

“One thing in my travels I learned was that when you’re in India or Japan, or any other country outside the U.S., there’s one word that you don’t need to translate and that word is Marcellus,” Dominion Transmission Inc. Vice President Donald Raikes told a Pittsburgh audience. “When you mention Marcellus, they know, they know what it is.”

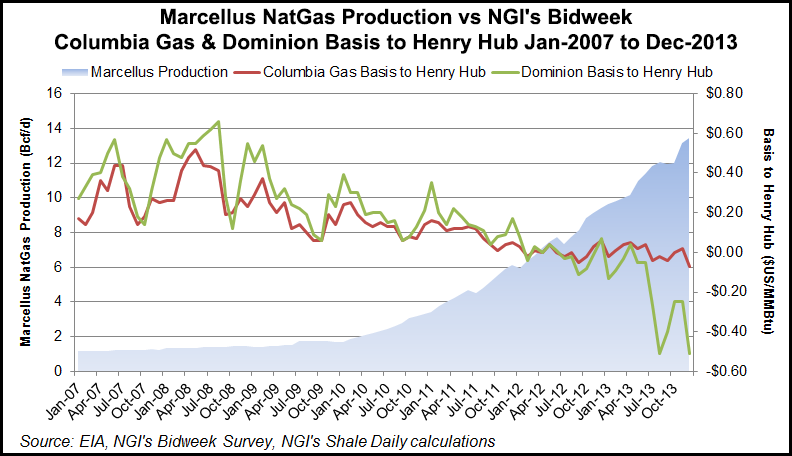

Raikes said production in the Appalachian Basin continues to defy the expectations of midstream companies and analysts. He shared one forecast from an analyst that estimates production will reach 18.2 Bcf/d by 2020. In February, the U.S. Energy Information Administration expects production in the Marcellus to reach 14.23 Bcf/d (see Shale Daily, Jan. 14).

Raikes and others underscored a broader theme at Hart Energy’s Marcellus-Utica Midstream Conference Wednesday, one that points to a rapidly changing Northeast market in which rising production has turned the region into a major supply source. Nearly every speaker who took the stage Wednesday and early Thursday spoke about a need for Appalachia to find new outlets as the Northeast grows oversupplied and discounted.

One answer is to go West. Rockies Express Pipeline LLC President Matt Sheehy said, “Midwest markets are particularly attractive to the Northeast,” and a reversed REX could do just that.

“REX was conceived and built as a producer-driven product. Producers in the Rockies contracted for it on a long-term basis because they had long-haul takeaway needs. REX did what it was intended to do; it increased netbacks and put workers back on rigs after a three-year lull,” Sheehy said.

“REX was constructed to help a basin, and we think it can do it again. What people are beginning to realize — even the Rockies producers — is that much has changed since 2009 when REX went into service.

Owned now by Tallgrass Energy Partners LP (50%), Sempra U.S. Gas & Power (25%) and Phillips 66 (25%), the 1,698-mile line that stretches from Colorado to Clarington, OH, was built by Kinder Morgan Partners to carry Rockies supplies East. It went into service at about the same time the eastern Marcellus Shale was starting to develop. Tallgrass bought the line in 2011 with a view toward having the eastern portion serve as an alternative for producers in the Appalachian Basin struggling to find ways to move rising volumes from the region. Kinder had sold the line to comply with antitrust stipulations related to its acquisition of El Paso Corp. (see Daily GPI, Nov. 14, 2012).

The REX pipeline is seeking authority from the Federal Energy Regulatory Commission to reverse the flow on the line from Audrain, MO to Clarington, OH. Given production growth, Tallgrass has been considering an expansion of REX to provide 2.5 Bcf/d of westbound takeaway capacity for Appalachian producers. On Wednesday, the company launched a much-anticipated open season to gauge the region’s interest in a westward expansion. The open season will end Feb. 12.

Flows from the Midwest-eastward have slowed significantly, Sheehy said. He added that the REX expansion will not be a “total solution,” saying “there is another pipe needed that will head to the west…REX is a piece of the puzzle, but we’re still 2-3 Bcf/d short in some directions, and we expect another one or two greenfield projects in the next couple years.”

Bradley Olson, managing director of midstream research at energy investment bank Tudor, Pickering, Holt & Co., reaffirmed the growing belief that the Northeast is no longer a new market but a discounted one now capable of providing much of the country’s natural gas supply. He said long-haul pipeline projects will see the most capital in the years ahead. He added that production growth will likely continue in both the Utica and Marcellus Shales for at least the next seven years, while production in other basins across the country is mostly expected to stay flat.

With the exception of price spikes in recent weeks driven by the brutal cold of this winter, supply from the Marcellus has been sitting on the Northeast-Henry Hub basis. What was once a premium market in the Northeast has seen discounted trades in recent years (see Daily GPI, Aug. 5, 2013). A REX reversal, Sheehy said, could significantly increase spreads and alter how the market trades physical gas and moves the product in the Northeast.

“I think REX, in particular, is going to fundamentally change the thought process around Appalachian basis, especially Dominion South Point and Clarington, OH, because you’re going to see a new path out,” Sheehy said. “I think its effect on local prices remains to be seen.

Sheehy said regulated utilities, in particular, like the “optionality” of a reversal and a long-haul line heading west.

“Historically, gas was slung from the Gulf Coast to markets in the Northeast, but now times have changed; production is in the north, demand is in the north. What is needed is a system to distribute there and REX is in the north,” he said. “If you look at it from a LDC or end-market-user standpoint, REX is particularly attractive and I think its important for you guys to have a real flavor for how we’re looking at the world. As [utilities] consider what they’ve had historically, which is a single-basin supply, whether it be a Gulf Coast or a Canadian supply, with the Rockies they’re interested in optionality.”

In this sense, Sheehy said utilities on both coasts could take advantage of different prices. For example, if it’s cold in the Northeast a utility could purchase gas from a warmer market in the Midwest.

But Tallgrass, Sheehy said, has had challenges in convincing Rockies producers that the plan would not adversely affect their business.

FERC cleared the way for REX to offer westbound capacity in December making a ruling at REX’s request for a declaratory order that would relieve it of any obligation to match its west-to-east anchor shippers with the lower rates it will charge initially for the new westward service (see Shale Daily, Dec. 2, 2013).

Sheehy said the ruling was a major one for the company, and he sought to set the record straight about a fight with Rockies producers during his conference presentation.

“[REX’s] entrance was heralded in the market and many people thought it was an engineering feat,” Sheehy said. “REX quickly gained a bit of a bad reputation in the marketplace, with many Rockies producers and shippers lamenting the lack of Clarington, OH basis. Somehow the REX was held responsible for putting the Marcellus and the Utica where it is today and the negativity was contagious.”

Sheehy said anchor shippers will not be affected by westward service, at least not the way it’s conceived at the moment. REX will offer Appalachian producers takeaway capacity to its Zone 3 in Ohio, Indiana and Illinois and no further.

Sheehy called REX Zone 3 a “deep” and “attractive” market with delivery points north and south bound, as well.

“You forget how many people live in these states until election night,” he said. “These areas are home to a reinvigorated manufacturing base, fertilizer plants, chemical plants and they’re looking not only to convert to natural gas, but they’re also looking at new greenfield builds.”

Ahead of its REX reversal, Tallgrass is currently constructing a 14-mile lateral from its Rockies mainline to the tailgate of Markwest Energy Partners Seneca processing plant in Noble County, OH. Sheehy said the open season for that project was incredibly successful, with more than enough interest. He expects the open season on the westward expansion to be just the same.

All interested parties must email bids to rexopenseason@tallgrassenergylp.com by 3 p.m. MST on Feb. 12.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |