Marcellus | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

Eagle Ford, Marcellus, Niobrara Topped M&A Interest in 4Q

Dealmakers in late 2013 mostly were drawn to the Eagle Ford Shale in South Texas, where five mergers and acquisitions (M&A) led to $6.5 billion total in transactions, compared to the Marcellus Shale, where four captured $1.5 billion, a new analysis by PwC found. The Niobrara formation’s two transactions were valued at $1.2 billion, while two in the Utica Shale contributed $263 million.

Eagle Ford deal volumes were skewed by one mega deal, which also was the biggest of the year: Devon Energy Corp.’s $6 billion purchase of privately held GeoSouthern Energy, a South Texas heavyweight (see Shale Daily, Nov. 20, 2013).

PwC’s Oil & Gas M&A analysis provides a quarterly compilation of announced U.S. transactions that are valued at more than $50 million. Transaction data is compiled using IHS Herold information.

“In the fourth quarter of 2013, shale deal activity increased along with broader conventional industry activity, especially in the Marcellus Shale,” said PwC energy practice partner John Brady. “That basin bounced back in the quarter, as stronger performance per well has reinvigorated returns, driving additional interest in acreage in the Northeast.

“If shale plays continue to adapt more efficient production processes to optimize the play and improve returns, activity in unconventionals will continue to be robust.”

Twenty-seven transactions in 4Q2013 were related to unconventional plays, contributing a total of $23.8 billion — a 338% increase from 3Q2013. For the year, 79 unconventional transactions together were valued at $53.2 billion; there were two more shale-related deals than in 2012, when total values were $51.7 billion.

Overall, domestic M&A accelerated last year, particularly in the final three months. A total of 182 transactions contributed $115.9 billion in total values for 2013. The uptick in late 2013 bodes well for 2014, PwC said.

“During 2013, oil and gas companies focused on maximizing shareholder returns,” said PwC’s Doug Meier, U.S. energy sector deals leader. “This focus resulted in increasing dividends and share buybacks. Companies increasingly utilized divestitures of noncore assets to fund these cash returns to shareholders.”

Overall, U.S. M&A activity has been robust for several years, he said.

“We see that continuing as companies in the space focus on portfolio optimization — further investing in those assets that are generating strong returns and divesting those assets that are generating lower returns…”

In 4Q2013, 51 deals were valued at a total of $41.7 billion, a 154% increase sequentially from 3Q2013 when 43 transactions worth $16.4 billion were announced. However, total volumes year/year in 4Q2013 fell by 36%. PwC pins part of the drop off from 4Q2012 to pending changes in U.S. tax laws.

In 2012, there were 212 total deals announced worth a total of $152.8 billion. By comparison, there were 154 deals in 2013 worth $77.5 billion.

On a sequential basis, domestic upstream and midstream deal values/volumes rose. Nineteen upstream onshore deals represented $11.0 billion in total value, versus 3Q2013’s 15 worth $5.0 billion. Eight midstream deals represented $12.8 billion in the final period.

Upstream deals accounted for 59% of the quarterly activity on 30 transactions worth $19.8 billion, almost half (47%) of total values.

The number of oil deals within the upstream sector totaled 10, compared to four natural gas-related deals in 4Q2013, PwC said. Nine midstream deals contributed $14.1 billion, a 994% increase sequentially. Seven downstream deals contributed $4.0 billion, while five oilfield services transactions were worth a total of $3.7 billion.”

Master limited partnerships (MLP) in 2013 were involved in 54 transactions — about 30% of all deal activity. That’s consistent with recent historic levels, PwC said.

“MLPs remain attractive investment vehicles because of their strong yields and efficient tax structures,” Meier said. “However, the pressures on MLPs to keep cash flows high and bring in new assets will keep these operators on the lookout for more acquisitions, including new dropdowns in the midstream space.”

Financial investors — private equities — continued to be keen on making deals in 4Q2013, resulting in 11 total transactions worth $10.6 billion, a 48% jump year/year.

“Increased activity by financial investors illustrates the continued interest in the energy sector,” said PwC’s Rob McCeney, a deals partner in U.S. energy and infrastructure. “Sellers outweighed buyers,” particularly in the exploration and production sector, “with robust transaction values. Financial investor buyers added more midstream and oilfield services as corporate owners refocus on core operations.”

During 4Q2013 eight mega deals contributed $26.4 billion, versus three worth $6.4 billion in 3Q2013. Also, foreign buyers announced four deals in 4Q2013 worth $541 million, versus 10 deals valued at $3.4 billion in 4Q2012.

Asset deals dominated in the latest quarter, with 42 contributing 82% of the total; together the transactions were worth $22.7 billion, or more than half of total values (54%). Nine corporate transactions in 4Q2013 represented almost half of all the deal values for the year, with $19.0 billion, versus 28 deals total in 2013 worth $38.4 billion.

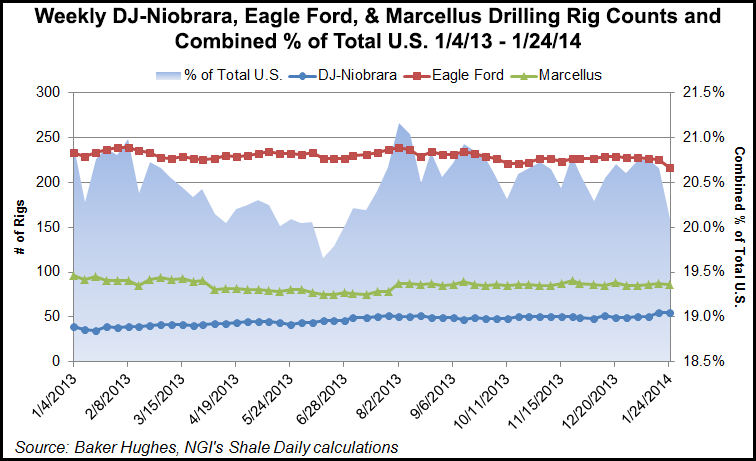

Drilling rig counts in the DJ-Niobrara, Eagle Ford and Marcellus remained relatively stable throughout 2013 and made up about 21% of the U.S. total, according to Baker Hughes data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |