NGI Archives | NGI All News Access

Russian Energy Ministry Looks to U.S. Industry for Cash, Technology Kick Start

Russia’s Ministry of Energy is looking to U.S. energy companies for an infusion of cash and advanced drilling technology in an attempt to kick start development of gas and oil fields in remote areas of the Arctic and eastern Siberia, according to Sergio Millian, president of the Russian-American Chamber of Commerce in the USA (RACC).

“They’re looking for new technologies coming from the United States and also they’re looking for substantial capital investment because it will require trillions of dollars of investment in the next 15-20 years,” Millian told NGI. New deepwater and shale technologies provide the best opportunities to extract oil and gas in areas that were previously unreachable. “Russia is looking for serious partners with adequate resources of technology and capital, and companies that are not afraid to overcome obstacles.”

Some of those obstacles may be daunting. “There are a lot of concerns coming from the United States, in particular tax issues in Russia, policy issues — their political agenda sometimes is not very clear — and recently the risk of terrorism is one of the major factors in question. But the idea is to present U.S. executives with some new projects that they’re not familiar with.”

Russia is the second-largest producer of dry natural gas and third-largest liquid fuels producer in the world, and oil and gas revenues accounted for more than 50% of the country’s budget revenues in 2012, according to the U.S. Energy Information Administration. Most of Russia’s resources are in Western Siberia, between the Ural Mountains and the Central Siberian Plateau and in the Volga-Urals region, extending into the Caspian Sea (see Shale Daily, Dec. 2, 2013). Eastern Siberia holds some reserves, but the region has had little exploration.

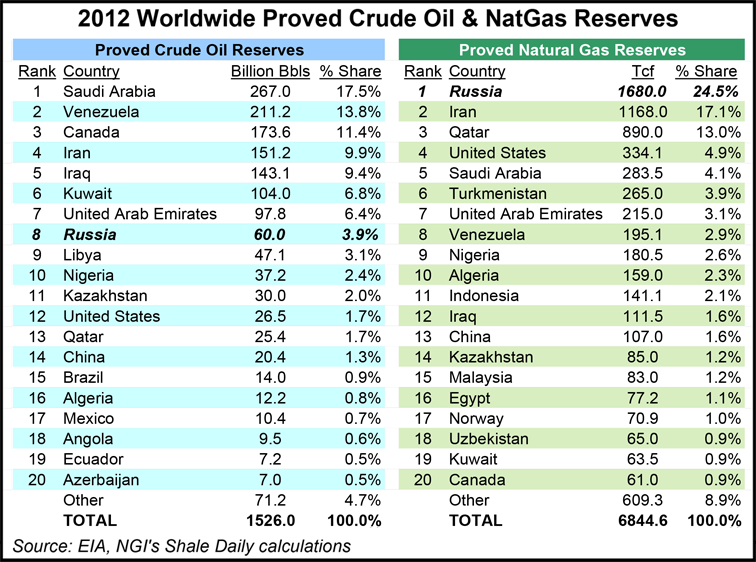

In terms of proved reserves, Russia ranked No. 1 in 2012 for natural gas, with roughly 25% of the world’s proved reserves, well ahead of No. 2 Iran’s 17.1% share. But Russia only ranked 8th for crude oil. Those figures only include proved reserves, so the rankings would likely change somewhat if they included possible and probable reserves, especially among those countries that have good potential for unconventional sources of oil and gas.

About 30% of the world’s undiscovered natural gas and 13% of the world’s undiscovered oil could be trapped beneath the land and waters of the Arctic north, much of it concentrated in Russia, according to a 2009 assessment by geologists at the U.S. Geological Survey (see Daily GPI ,June 1, 2009).

Potential new projects in the Arctic and eastern Siberia will be discussed behind closed doors at the National Oil & Gas Forum in Moscow March 18-20. The RACC is the sole U.S. sponsor of the forum. “It’s something that will be discussed very privately with the right individuals,” Millian said. “We will facilitate meetings, including with top government officials, as well as with the Russian oil companies’ executives. We hope that these meetings and their trips to Russia will result in the creation of much more favorable conditions for the U.S. companies…so that we can further promote the cooperation between the two countries.”

The idea is an offshoot of the U.S.-Russia Bilateral Presidential Commission, which recently formed a subgroup on conventional energy, Millian said. Co-chairs of the commission’s Energy Working Group agreed last month to strengthen the strategic energy partnership between the two countries. They identified next steps in the key areas of their energy dialogue, including promoting natural gas.

“The Russian oil and gas sector today stands on the threshold of new challenges and changes,” Arkady Dvorkovich, deputy prime minister of the Russian Federation, said recently. “We must discuss the questions linked to attracting investments in the country’s oil and gas industry, the fiscal policy in this sphere, replacing our mineral and raw materials reserves, developing of a market infrastructure, and introducing innovative technologies and new engineering solutions.”

As an example of the kind of thing the Ministry of Energy is looking for, Millian cited the 2012 strategic cooperation agreements inked with ExxonMobil Corp. that gave Russian state-owned OAO Rosneft its first investments in North American oil and gas fields and gave ExxonMobil expanded access to Russia’s technically challenging offshore fields in the Kara and Black seas of the Arctic (see Daily GPI, April 17, 2012). “Together they established an offshore Arctic research and design center, because ExxonMobil is sharing some of the technology they possess,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |