Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Outdated Natural Gas Regulations, High Costs Challenge LDC Markets, Says IHS

Domestic natural gas demand is falling even as supplies proliferate, but the local distribution company (LDC) market could be reinvigorated if regulations put in place long before the boom in unconventional supplies are updated, IHS Inc. energy analysts found.

In an IHS CERA report, “Fueling the Future with Natural Gas: Bringing it Home,” analysts and advisers on Thursday offered a resource and suggestions for gas LDCs, their customers, regulators, legislators and other policymakers to makeover the system as traditional gas use diminishes while supplies flourish.

IHS experts said they see “little, if any growth in residential gas demand” as customer growth is offset by continued improvements in energy efficiency. However, LDCs still have avenues to expand their customer bases in ways “that make sense economically and that can be developed under the umbrella of state and local regulation,” said the researchers, led by principal author Rita Beale, senior director of power, gas, coal and renewables.

“Much of the prevailing natural gas regulation was developed in a time of perceived scarcity. Thus, it may be reasonable to review regulations and identify hindrances to natural gas use that may no longer be appropriate for today’s and tomorrow’s natural gas markets.”

Many LDCs already have growth initiatives ongoing in residential and commercial markets, with conversions from oil heat to natural gas heat accelerating. The trend is particularly strong in the Northeast, partly in response to cost considerations and partly on some government initiatives. Gas growth in the Appalachian Basin also hasn’t gone unnoticed (see Daily GPI, Oct. 1, 2013).

For example, New York City is in the midst of a large-scale conversion from fuel oil use to gas use (see Daily GPI, May 17, 2012). Connecticut LDCs are working on expansion plans (see Daily GPI, June 24, 2013). In Maine, gas LDCs are expanding to deliver supplies into sparsely populated areas serving paper mills, which provides a base level of support for the infrastructure to connect new customers along the way (see Daily GPI, Sept. 21, 2011).

Growth can be found elsewhere, said the report, because gas offers increased efficiencies, reduced air emissions and economic development for a variety of ancillary manufacturing industries. However, increasing the customer base will take some effort and money.

“Challenges include recovering the often high up front costs of investments by gas LDCs and consumers, conflicting federal, state, and local policy objectives, regulations grounded in outdated assumptions regarding natural gas supply and cost, and developing a consensus as to the new realities of the natural gas market,” authors said.

Specific gains vary from one region to another but many may require regulatory changes, along with financial and technological innovations, to achieve growth.

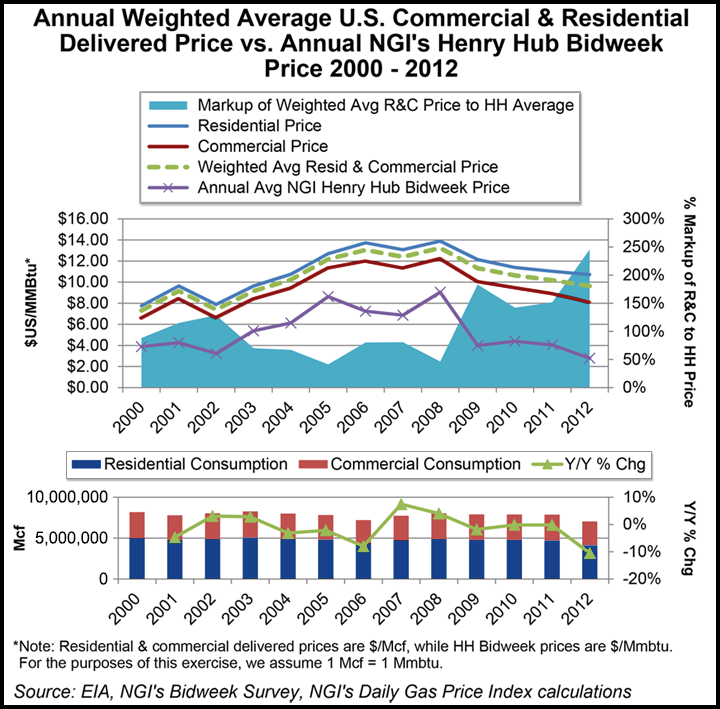

There also are those common denominators: gas costs and gas prices. A lot of gas supply is expected to be cost-effective to produce at Henry Hub prices of around $4.00/Mcf, which would indicate that gas is not only abundant but low cost. However, there are caveats.

“Low cost” doesn’t suggest that gas would cost less than other fuels, said the authors. The price of coal is expected to remain well below that of gas on an energy-equivalent basis. It also doesn’t mean that gas costs and prices would be lower than ever before, they said, because historically, wellhead prices in 2012 dollars have remained below $4.00 except for two periods: 1981-1985, and 2000-2008.

Volatility in prices also would continue to reflect “unexpected events and temporary misalignment of physical demand and supply, often caused by variations in weather. In the context of the unconventional gas supply abundance, though, “low cost” gas indicates that prices would not have to increase materially because the huge resource base is available at a full-cycle breakeven price of about $4.00/Mcf.

The low cost of gas also indicates that prices “will remain significantly lower than had been expected prior to the ‘shale gale,’ while retail prices would remain lower over the long term on a Btu equivalent basis than refined oil products or electricity.”

In core gas LDC areas, the big opportunities ahead, said the authors, include converting single/multi-family households from fuel oil or electricity; switching customers to gas furnaces from electric heat pumps, and as the market grows for natural gas vehicles, installing home refueling units.

The prices of natural gas delivered to U.S. natural gas residential and commercial users have not fallen at the same pace as those at the Henry Hub in recent years. For each year from 2003 to 2008, the weighted average delivered-to-residential and commercial end-user price came in anywhere between a 41% to a 81% mark-up to the average Henry Hub index price. However, that markup soared to 183% in 2009, and after falling back a bit to 142% and 152% in 2010 and 2011, respectively, it rose to 246% in 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |