EIA Says U.S. Domestic Crude Production Stabilized Global Prices in 2013

The U.S. Energy Information Administration (EIA) said rising crude oil production in the United States helped stabilize global prices for crude oil in 2013 and kept them close to the same annual average for the previous two years.

According to EIA, transportation infrastructure improvements gave crude oil from Cushing, OK, better access to refineries. There was also improved access to refineries for tight oil produced in the Bakken Shale, the Permian Basin and the Eagle Ford Shale.

Domestic crude oil production increased by 1.0 million b/d in 2013, EIA said, reaching its highest level in 24 years and also eclipsing a worldwide combined increase in production. The agency said it was the largest observed annual increase in production in U.S. history.

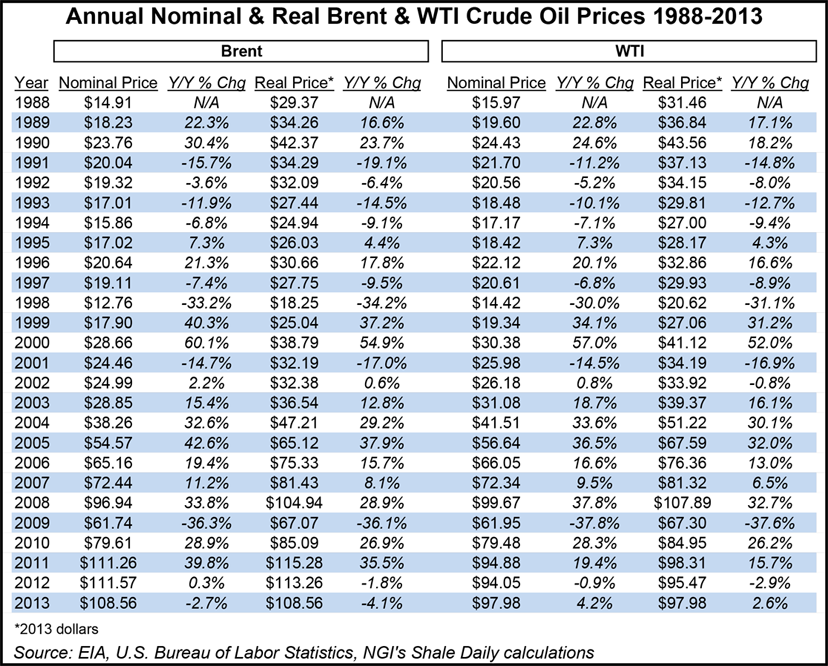

West Texas Intermediate (WTI) spot prices averaged $98/bbl in 2013, up 4% from 2012 and the highest annual average since 2008, according to EIA. Meanwhile, the North Sea Brent spot price averaged $109/bbl in 2013, down 3% from 2012.

“New pipeline and railroad infrastructure alleviated transportation constraints that had put downward pressure on WTI prices,” EIA said, adding that Brent prices fell “as rising U.S. light sweet crude oil production reduced the need for U.S. imports, thereby increasing supplies of Brent-quality crude oil available on the global market.”

On Jan. 3, the agency predicted that U.S. crude oil production will rise by another 1.0 million b/d in 2014, but changes and challenges are ahead, especially downstream.

“Refiners and midstream companies have spent the past three years investing and adjusting to cope with growing volumes of light sweet crude,” EIA said. “This challenge is expected to persist in 2014 because the glut of crude oil that once mostly affected the Midcontinent hit the Gulf Coast in December 2013.

“Growing volumes of crude oil in the Gulf Coast market will likely keep Light Louisiana Sweet prices at WTI levels plus pipeline tariff. With U.S. prices discounted to those abroad, producers will continue to ship crude to the East Coast of the United States and Canada, where refiners have an incentive to displace higher-cost, globally-traded light sweet crude streams. Such flows could further ease global market balances as other crude streams are diverted away from North America.”

On the world stage, the EIA said on Thursday that in 2013, China accounted for almost one-third of the growth in global crude oil demand, and surpassed the United States to become the world’s largest importer of crude oil.

The EIA said it estimates that unplanned supply disruptions worldwide averaged 2.6 million b/d in 2013, a nearly 37% increase (0.7 million b/d) above 2012. The agency said producers of the Organization of the Petroleum Exporting Countries (OPEC) accounted for more than 69% (1.8 million b/d) of the disrupted volumes.

“Despite significant production disruptions, international crude oil prices were relatively stable last year because higher U.S. production and seasonally elevated Saudi Arabian production — Saudi Arabia maintained peak summer production levels into the fall — offset outages elsewhere,” EIA said.

According to EIA, total liquid fuels production from OPEC members fell by 0.9 million b/d in 2013. Meanwhile, the United States led non-OPEC countries to boost liquid fuels production by more than 1.4 million b/d in 2013, which more than offset the decline in OPEC production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |