Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access

Refinery Constraints Argue for Oil Exports

Underlying the most recent proposal by Sen. Lisa Murkowski (R-Alaska) to eliminate the long-standing ban on exporting U.S. crude oil are some infrastructure and regulatory bottlenecks, particularly in the West, a Senate Energy and Natural Resources Committee staff member for Murkowski told NGI‘s Shale Daily on Wednesday.

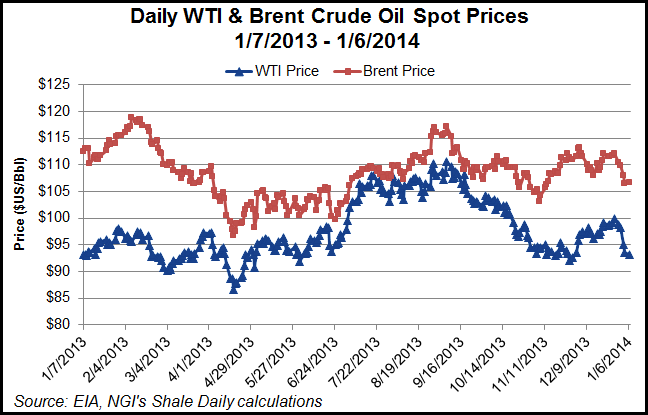

“We’ve got an infrastructure problem with lack of refinery capability to handle light tight (sweet) crude oil and pipeline issues because the light tight oil is not getting to markets where it could be used,” said Robert Dillon, communications director for the Senate energy committee. “There is this glut in Oklahoma where WTI [West Texas Intermediate] prices are lower than the [global] Brent price.”

Dillon said Murkowski believes the nation needs to build more refineries to use more of the crude in domestic markets, but “the fact is you can’t build the refineries in this country.”

In a speech to the Brookings Institution and a related Senate committee white paper earlier this week, Murkowski said freeing crude and condensate exports to go with natural gas liquids and liquefied natural gas exports already under way will make the United States a global energy leader (see Daily GPI, Jan. 7).

Because of infrastructure bottlenecks in the shale plays like the Bakken in North Dakota and the West Coast refineries’ inability to handle the burgeoning light crude supplies from the Bakken and the Eagle Ford plays, ideally the nation needs new refineries or retrofit refineries, according to Dillon.

“The problem is you can’t get a permit to build a new refinery in this country,” said Dillon, adding that it is “very expensive and very difficult” to get a permit to retrofit refineries to handle the light crude supplies. “Anytime you propose to do anything new you run into a new legal process and the [U.S. Environmental Protection Agency] EPA comes in and says you have to meet a whole new set of standards.”

Dillon said the fear of congressional members like Murkowski is that the U.S. oil/gas industry soon is going to run out of places for the Bakken light crude supplies to go in North America, and producers will start shutting in production when that happens.

Murkowski said she had two goals in distributing the white paper, “A Signal to the World: Renovating the Architecture of the U.S. Energy Exports.” The first goal is to spread some facts about the current U.S. position as a global production leader. The second is to “frame a [national] conversation” on global energy trade.

Murkowski, the ranking minority member on the Senate Energy and Natural Resources Committee, cited reports done by the nonpartisan Congressional Research Service.

“The facts tell me that we must modernize the regulations that govern energy exports, demonstrating to the world that we are committed to leading on issues of energy, the environment and trade,” Murkowski told her Brookings audience on Tuesday.

“Modernizing the export architecture would reduce volatility by making world energy markets more efficient,” Murkowski said.

Whether it’s possible that restraints on crude exports could be loosened in time or sufficiently to deal with the predicted domestic oil glut, is a question so far without an answer.

According to ClearView Energy Partners LLC, “with coming leadership changes likely to put two oil-state Senators in charge of the Senate Energy and Natural Resources Committee [Sen. Mary Landrieu (R-LA) is likely to be chairman in the next Congress], that committee could potentially pass what Murkowski described yesterday as ‘a small, targeted bill.’ Getting that bill through the Democrat-controlled and closely divided Senate, however, could take years, especially if yesterday’s events draw redoubled opposition from export foes,” ClearView added.

The other avenue would be for the Commerce Department’s Bureau of Industry and Security, which regulates crude oil exports, to interpret existing regulations to allow for greater exports, but that is not likely to happen without the sanction of the Obama administration. It’s one more political football to toss into the current energy policy morass involving carbon and renewable fuels.

The gap between WTI and Brent prices, which had narrowed to as little as $1.30/bbl in mid-2013, has once again widened, reaching $13.60/bbl on Monday (Jan. 6), according to Energy Information Administration data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |