NGI Data | NGI All News Access

Weekly Gains Send Chicago Citygate To 2 1/2 Year High

At first glance weekly gas prices were kind to neither the bulls nor the bears. For the week ended Dec. 27 the NGI National Weekly Spot Gas Average fell by just a penny to $4.47, but major swings were recorded throughout the country. Chicago Citygate bulls enjoyed the highest NGI weekly price in 2 1/2 years at $4.81. Of the actively traded points the Northeast was home to market points showing the greatest gains as well as losses. In New England Iroquois Zone 1 recorded the largest advance rising 81 cents to $5.77, and at the other end of the spectrum deliveries to Algonquin Citygates tumbled $4.41 to $9.75.

Regionally the Northeast suffered the greatest and only setback dropping 48 cents to $4.38 and the Midwest posted the highest advance tacking on 24 cents to $4.79.

California prices rose a modest 4 cents to $4.54 and deliveries to Rocky Mountain locations gained 7 cents to $4.35.

South Texas and East Texas gained 10 cents and 12 cents to $4.27 and $4.34, respectively and South Louisiana and the Midcontinent rose by 15 cents and 21 cents to $4.37 and $4.54, respectively.

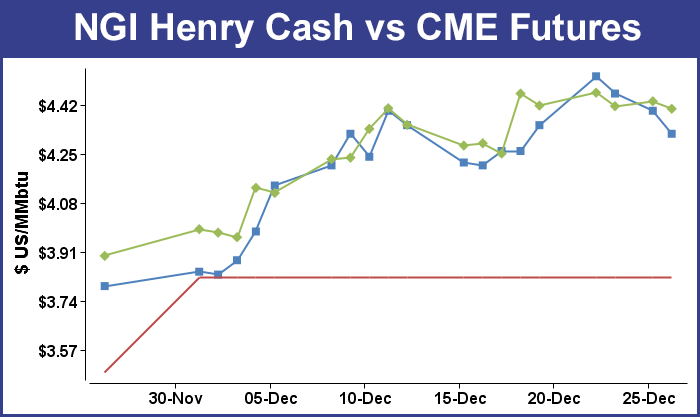

January futures expired Friday at $4.407, down 1.1 cents for the holiday-shortened trading week.

In Friday’s trading deliveries of weekend and Monday gas were unchanged on average. Eastern and Northeast weakness was for the most part offset by gains in the Midwest. The Energy Information Administration reported a withdrawal of 177 Bcf in its 10:30 a.m. EST inventory report, an amount largely anticipated by the market, and prices initially dipped but finished close to pre-report levels. At the close January had fallen 2.6 cents to $4.407 and February was down 10.8 cents to $4.368.

Futures traders felt the market was “heavy” after the day’s trading, but “overall its cold outside and you have to think this market will keep looking up,” said a New York floor trader.

“I think there was some profit taking today, and I think the market can rally up to $4.60 to $4.62, but after that you may be looking at a top,” he said.

Analysts see a bullish tone to the market. “[T]he subdued overnight trade that is seeing fresh one-week lows could prove to be the calm before the storm ahead of today’s unusual Friday release of the EIA storage report that is coinciding with expiration of the January futures contract,” said Jim Ritterbusch of Ritterbusch of Ritterbusch and Associates. “While a strong storage withdrawal of around 175 Bcf has likely been priced in, we feel that surprises within the numbers are much more apt to be bullish than bearish. This opinion is based on the possibility that some additional weather-related production disruptions could be accentuating seasonal supply declines. And even if the draw is in line with average street forecasts, the psychological impact of another triple-digit expansion in the year-over-year supply deficit will tend to limit selling interest.”

The EIA report was right in line with traders’ expectations. A Dow Jones poll of 12 traders and analysts showed an average 178 Bcf decline. Industry consultant Bentek Energy predicted a decline of 175 Bcf utilizing its flow model, and IAF Advisors was looking for a pull of 176 Bcf.

“The number was pretty much smack on. We were looking for 175 Bcf or thereabouts,” said a New York floor trader. “It was basically exactly what we were expecting.”

Tim Evans of Citi Futures Perspective remarked “The market may not be impressed by the numbers as they were already discounted into the price to some degree, but the report still removes an element of uncertainty from the market.”

Inventories now stand at 3,071 Bcf and are 591 Bcf less than last year and 313 Bcf below the 5-year average. In the East Region 115 Bcf were withdrawn and in the West Region 21 Bcf were pulled. Inventories in the Producing Region fell by 41 Bcf.

Weekend and Monday prices rose a dime or more in the Midwest as brutal cold was forecast to make its way south over the weekend. Forecaster Wunderground.com predicted that Minneapolis’ high of 41 on Friday would fall to 35 on Saturday and plunge to only 5 by Monday. The normal high in Minneapolis is 24.

Chicago’s Friday high of 46 was seen sliding to 41 on Saturday before nose-diving to 11 on Monday. The seasonal high in Chicago is 33. Omaha, NE’s high on Friday of a balmy 60 was anticipated to drop to 50 by Saturday and make it to only 30 by Monday. The normal high in Omaha in late December is 33, the forecaster said.

The National Weather Service in the Twin Cities said their “Immediate long term concern continues to be timing of [an] Arctic cold front and potential for blizzard conditions developing late Saturday afternoon and continuing through Saturday night across west central into south central Minnesota. Following that will likely be the coldest air of the season…which will linger into at least midweek next week “

Quotes for weekend and Monday gas on Alliance added a nickel to $4.73 and gas at the Chicago Citygates was seen at $4.76, up 7 cents. Deliveries to Northern Natural Ventura gained 18 cents to $4.76 and gas at Demarcation rose by 14 cents to $4.69. Gas on ANR SW added 9 cents to $4.31.

Eastern points, on the other hand, for weekend and Monday were lower as a warming trend was forecast. Gas on Transco-Leidy fell a couple of pennies to $3.35 and on Dominion gas was quoted at $3.50, down 7 cents. Gas on Tetco M-3 plunged 36 cents to $4.03 and gas headed for New York City on Transco Zone 6 fell a dime to $4.47.

The National Weather Service in suburban Philadelphia forecast that “the high to our southwest will start to move to the east on Saturday, pushing offshore Saturday afternoon/evening. A weak [low] will cross the region Saturday morning but with limited moisture in place, it should remain dry across the forecast area.”

It added that “The continued southwest flow will help to keep US much warmer than normal. Maximum temperatures will generally be around 10 degrees above normal across the forecast area. Expect maximum temperatures to be in the lower to middle 40s across the north to around the middle 50s as you head toward the coast.”

New England points proved to be the day’s biggest movers, and in spite of some recent quotes on Algonquin as high as $20 or more, analysts saw prices vulnerable to a decline. “A [LNG] ship arrived at Cannaport on Dec. 22 so they are OK for the time being,” said a northeast marketer. “You’ve got [production from] Sable as well as Distrigas [into Boston] so I think there is more downside than upside with that $20 [Algonquin] basis.”

Gas at the Algonquin Citygates fell 50 cents in thin trading to $8.50 and deliveries to Iroquois Waddington added 32 cents to $5.63.

The longer-term weather outlook for eastern energy markets turned somewhat milder overnight. WSI Corp. in its 11- to 15-day outlook shows a broad ridge of colder than normal temperatures from Chicago and Wisconsin west to the Pacific Northwest. Above-normal temperatures are found in the Southeast, and the remainder of the country is shown to be normal. “[Friday’s] forecast has trended colder over the West and warmer over the East when compared to the previous forecast. Forecast confidence is considered near average as the medium-range ensemble model guidance solutions have rounded into better agreement this morning.”

It added that risks to the forecast are “in place for the West down in through CAISO [California] late under what looks to be another cold trough passage. Temperatures could run colder than forecast over the Midwest and Great Lakes region late in the period if the ensemble model solutions are too retrogressive with the pattern.”

In Thursday’s trading physical gas for Friday delivery slipped a few cents as outsized gains at New England points could not offset broader losses in the Midwest, Gulf Coast and California. Weather forecasts show no warming in sight, and futures prices inched higher on light volume ahead of what is expected to be a government report Friday showing another above-normal withdrawal from inventories. At the close January had risen 1.7 cents to $4.433 and February had gained 0.7 cents to $4.476.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |