Infrastructure | NGI All News Access

Mackenzie Gas Project Floundering Amid Low Gas Prices

While natural gas prices languish, cost hurdles confronting Canada’s dormant arctic production and pipeline scheme are still on the rise.

The total price tag on the Mackenzie Gas Project (MGP) has climbed to a new estimate of C$20 billion (US$19 billion) or more, according to a cost update filed with the National Energy Board. The new estimate for the pipeline and processing elements of the MGP alone now stands at C$16.1 billion (US$15.3 billion), says the filing by senior project partner Imperial Oil.

The recalculation does not include costs of production systems faced by the MGP consortium of Imperial, ExxonMobil Canada, ConocoPhillips Canada, and Shell Canada.

When the MGP obtained regulatory approval three years ago, total costs of all the project elements were estimated at C$16.25 billion (US$15.4 billion), with the total about equally divided between pipeline and Delta production facilities.

The new estimate forecasts costs of the MGP’s proposed Delta gas-gathering lines, processing plant and liquid byproducts pipeline at C$4.95 billion (US$4.7 billion). The new projection pegs costs for the project’s 1,200-kilometer (750-mile) Mackenzie Valley Pipeline from the Delta to a junction with TransCanada Corp.’s Nova grid in Alberta at C$11.15 billion (US$10.6 billion).

The filing updates six-year-old estimates that were made in the midst of a regulatory approval proceeding that lasted from the fall of 2004 until year-end 2010.

“This estimate reflects increased capital costs for material and labor since our last filing in 2007,” said Imperial.

The new filing sums up the state of the project in a single sentence: “The Mackenzie Gas Project proponents have not yet made a decision to construct the project because of the current natural gas market conditions.”

Imperial previously disclosed that the MGP had been in limbo since soon after receiving regulatory approval, which came as gas prices tumbled due to supply growth generated by shale production across the United States and Canada.

MGP output forecasts, while large at the time the project was first proposed, have come to look modest by standards of shale gas development. Initial arctic production and delivery capacity was forecast to be 1.2 Bcf/d, with potential to rise to 1.9 Bcf/d by eventually adding pipeline compressors and drilling further wells.

Shell put its share in MGP production assets up for sale about two years ago. The offer has attracted no takers.

The regulatory approval set a deadline of year-end 2015 for the MGP consortium both to make a decision on whether to proceed into construction and start the action. “Actual construction must begin by the end of 2015 for our approvals to remain valid,” said the ruling.

Along with construction preparations, discussions on fiscal terms with federal, Northwest Territories and aboriginal authorities remain suspended.

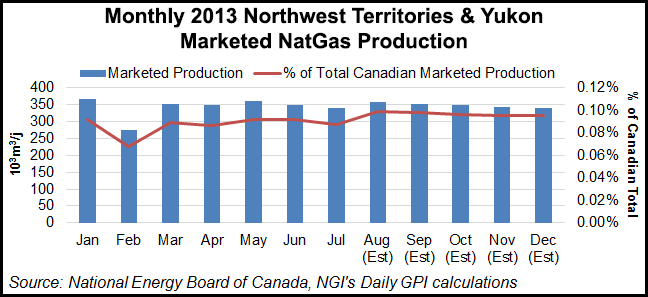

Northwest Territories and Yukon marketed natural gas production typically accounts for just 0.1% of total Canadian production.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |