Infrastructure | NGI All News Access

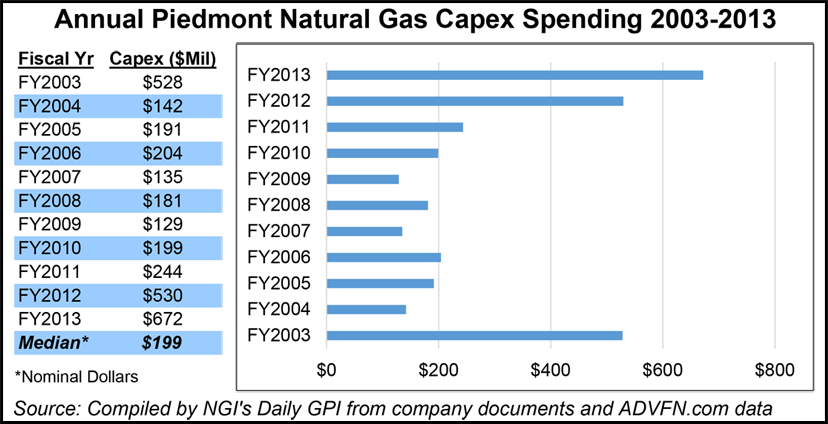

Record Capex Yielded Dividends, Customers to Piedmont in FY2013

Piedmont Natural Gas Co. Inc., wrapping up a year during which it spent a record amount on capital expenditures (capex) and added thousands of customers to its fold, reported net income of $134.4 million for fiscal 2013, which ended Oct. 31.

Net income for 2013 was 12.2% higher than fiscal 2012, when the Charlotte, NC-based company reported net income of $119.8 million. Piedmont said it earned $1.78/share at the end of 2013, compared to $1.66/share at the end of 2012, a 7.2% increase.

According to Piedmont CEO Thomas Skains, the company spent a record $672 million on capex in 2013 “in support of customer growth, power generation delivery projects, system integrity programs and joint venture [JV] opportunities.”

Piedmont’s Sutton Pipeline project, announced in 2010, was completed on May 31 (see Daily GPI, April 10, 2010). The project included construction of 120 miles of 20-inch diameter gas transmission pipeline, eight miles of 30-inch diameter transmission pipeline and approximately 25,000 hp of additional compression on Piedmont’s system.

The Sutton Pipeline, once estimated at $217 million, connects Progress Energy Carolinas’ new gas-fired power generation facility near Wilmington, NC, with Williams’ Transco pipeline in Iredell County, NC.

“In 2013, we also continued to improve our business processes, enhance our customer service, and implement sustainable business practices, all of which will serve us well in the years ahead,” Skains said. Piedmont added 14,274 customers in its three-state service area — North Carolina, South Carolina and Tennessee — during fiscal 2013.

Piedmont said system throughput totaled 387.8 million Dth, a 19.5% increase over the 324.3 million Dth sent through the system in 2012. The company attributed most of the increase to a 26% rise in volumes delivered for power generation, along with a 22% increase in volumes delivered to weather-sensitive residential, commercial and industrial customers.

According to Piedmont, utility margin increased $46 million from 2012 “primarily due to increased transportation services from new contracts for power generation customers, customer growth and higher volumes from residential, commercial and industrial customers due to colder weather.” The company added that operations and maintenance expenses increased $10.5 million from the previous year, “primarily due to higher costs incurred for contract labor related to process improvement and pipeline integrity programs, payroll, bad debt expense and regulatory amortizations, partially offset by a decrease in employee benefits costs.”

Piedmont said utility interest charges were $24.9 million in 2013, up 23.9% from $20.1 million in 2012. The increase in interest charges was due to increases in long-term debt, but those were partially offset by an increase in capitalized interest income and lower balances of short-term debt at lower interest rates.

The company will hold a conference call to discuss FY2013 at 10 a.m. EST on Friday (Jan. 3).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |