U.S. E&P Spending Seen Rising, Total Rig Count Falling in 2014

U.S. exploration and production (E&P) spending should increase 5-10% in 2014, but that won’t translate into gains for drilling rig activity, analysts with Raymond James & Associates Inc. have concluded.

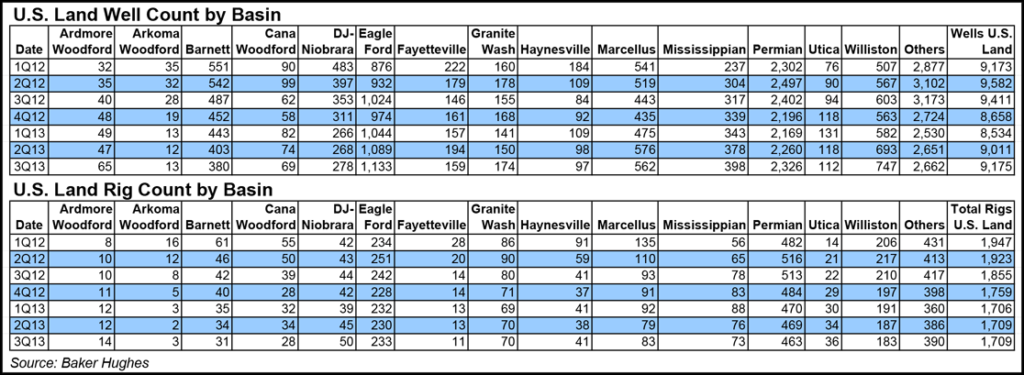

Well counts and footage drilled, however, will increase in the coming year, said analysts J. Marshall Adkins and Praveen Nara in the latest Energy Stat of the Week. This year the domestic well count is expected to decline by about 4% from 2012 to 46,400 wells.

“That well count underperformance should reverse in 2014 as we expect U.S. spending to be up more than 5% while the U.S. well count posts a modest year/year gain (up 0.6% to 46,650 wells in 2014) in the face of higher E&P cash flows. Additionally, as we increase the percentage of wells that are horizontal and the footage per well increases, we expect to see a decent uptick (5%) in footage drilled in 2014.”

Oilfield activity metrics aren’t black and white anymore, factors that Raymond James and others, including the Energy Information Administration, have expounded on over the past year. Three months ago the analyst offered a substitute for the rig count on gains in horizontal drilling and longer laterals (see Shale Daily, Sept. 25). Meanwhile, PacWest Consulting Partners said last month the domestic land market should complete a record number of hydraulic fracturing (fracking) stages in 2013 (see Shale Daily, Nov. 22).

“Clearly, times have changed and the oilfield activity metrics simply aren’t that black and white anymore,” wrote the Raymond James analysts. “We are now looking toward a slightly higher well count and higher footage drilled forecasts as the indications for higher 2014 overall service activity.”

Raymond James rig count forecast for 2014 calls for an average of 1,736, down 26 rigs from 2013 (minus 1.5%), but up 1.2% from its previous forecast of 1,717 on slightly stronger activity in 4Q2013.

The U.S. well count in 2014, meanwhile, looks to gain about 1%, while footage drilled should climb close to 5%.

The question remains as to where the rig count stacks up as a metric for the oilfield service industry. Raymond James analysts for nearly two years have been more bearish than consensus on the outlook for domestic drilling. The rig count long has been the barometer of activity in the oilfield service industry and historically, everything tracked with the number of active rigs.

The increase in drilling efficiencies and shift to horizontals “has left the rig count lacking as the only activity measurement metric,” said the analysts. “Today, the drilling rig companies will still be driven by active rigs but, the frack companies will be driven by frack stage counts, artificial lift by well count, and the directional drillers by footage drilled. In other words, look for increasing separation between performances of different oilfield service subsectors.”

Efficiency gains, and not only on the drilling side, have made the outlook for service providers more complicated, but as overall technologies begin to slow, the rig could should return as the “metric du jour,” said Adkins and Nara.

Based on the gains from shifting to horizontals from vertical drillers, the analysis found that in most established basins, each horizontal displaced five to 15 vertical rigs but still resulted in a net production increase.

“Now that the shift from vertical to horizontal has largely played out, we are not expecting the U.S. rig count to continue falling sharply in a $100 oil world. That said, the shift to pad drilling (and our expectations for lower oil prices) leads us to be modestly below consensus U.S. rig count expectations…Our expectation remains that drilling rigs are going to capture a smaller percentage of the overall E&P dollar spent as we drill more horizontal wells with longer laterals and more frack stages.”

Domestic gas-directed drilling overall should increase in 2014 on the backs of two shales: the Utica and Marcellus, where about 45 more rigs are expected to be raised. If the gas rig count overall does increase, it would be the first time since 2010, the analysts said.

A lot more capital expenditures (capex) is being poured into the red-hot Permian Basin, but that doesn’t mean a lot of new active rigs. It’s one of the only U.S. basins where the shift to horizontal from vertical drilling hasn’t played out fully.

The Permian, said the Raymond James analysts, now represents more than one-third (37%) of all vertical drilling rigs in the United States, and many larger operators are dropping the old rigs and advancing their horizontal attack, which requires better rigs, more time to drill and higher costs — three to four times more than vertical drilling.

“In some cases, one horizontal rig is actually displacing five or more vertical rigs,” said Adkins and Nara. “While we agree that the overall spending should increase substantially in the Permian, we expect the majority of this to flow through to the completions side of the well. We now expect the Permian vertical rig count to fall 55 rigs by year-end 2014 from its current level of 250 (or down over 20%).

“Offsetting that slightly, we think the Permian horizontal activity will continue to grow. The net effect is a gradual slowdown in overall rig count…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |