Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report

DJ Basin, Marcellus Are the Stars of Noble’s Five-Year Plan

Noble Energy’s U.S. onshore activities are in the “early days of a tremendous story,” management said at the company’s analyst day Tuesday. That story is mainly being written in two books: the Denver-Julesburg (DJ) Basin and the Marcellus Shale, and they both look to be best sellers.

In a Wednesday note on the company, Wunderlich Securities analyst Irene Haas enthused that Noble is “one of the best exploration companies, hands down.” The company is the largest operator in the DJ Basin, which has garnered much enthusiasm from the industry of late as companies such as Anadarko Petroleum Corp., Encana Corp. and PDC Energy have found that there’s plenty of oil — 3.8 billion bbl or so — there, and it’s easier and cheaper to drill for than in the Bakken Shale, for instance.

Noble said capital spending next year will be about $4.8 billion, with about two-thirds ($3.2 billion) of that allocated to the U.S. onshore and the rest going to global deepwater activities. “We continue to accelerate development in the DJ Basin, which will receive the greatest portion of our capital program, as well as the drilling program in the wet gas area of the Marcellus Shale,” said CEO Charles D. Davidson, who outlined the company’s new five-year plan for analysts.

In the DJ Basin, horizontal drilling and infrastructure development are accelerating, laterals are getting longer and the company’s “integrated development plans” (IDP) are being rolled out to drive efficiencies and cost savings.

For instance, Noble anticipates drilling 11 million lateral feet in the DJ Basin during the period 2014-2018, which is an estimate 15% higher than what Noble projected a year ago. Management said it is focused on accelerating the company’s extended reach lateral (ERL) program.

Like soft drinks at a soda fountain, Noble’s laterals don’t come in “small” or “short,” but rather “normal,” which is around 4,000 feet. A “medium” lateral is about 7,000 feet, according to Noble, and “long” is 9,000 feet or more. As one would expect, as lengths increase, so do estimated ultimate recoveries (EUR) — substantially. A well with a normal lateral might have an EUR of 305,000 boe, but a long-lateral well can clock in with a 750,000 EUR, a nearly 146% improvement, Noble said.

IDPs in the DJ Basin are expected to enhance before-tax net present value by more than $1 billion per IDP, thanks to drilling and completion efficiencies, improved facility coordination and increased drilling of ERLs, the company said.

IDPs are being implemented in the company’s Wells Ranch and East Pony areas in the DJ Basin in northeastern Colorado, another five IDPs are planned for the basin. Next year about 320 operated horizontal wells are expected to be drilled, including more than 55 ERLs. Sales volumes are expected to be up 28% in the DJ Basin after adjusting for an acreage swap with Anadarko in October.

“We now have over 600,000 net acres in the basin, a majority of which is located in the rural areas of Weld County. Much of that is on large ranches; 87% of it is in the oil window, and roughly two-thirds of it is in areas where we are, today, planning these integrated development plans. And I’m actually confident that, that percentage will increase over time,” Gary W. Willingham, U.S. onshore senior vice president, said during an analyst day presentation.

“Looking at the map, you can clearly see how this contiguous position lends itself nicely to an integrated development concept in the drilling of even more extended reach lateral wells. Not a lot of companies have an acreage position of this magnitude, in an oil play with these strong economics that can be developed as efficiently as this one. And we truly believe that this play is competitive with anything else out there.”

In the DJ Basin, net risked resources have grown to 2.6 billion boe, a 24% increase in 2013 driven by continued strong well performance and increased well density, the company said. DJ Basin production is expected to grow at a five-year compound annual growth rate (CAGR) of 23%, versus the production CAGR of 18% for the same time period in the company’s 2012 analyst conference plan. Before-tax operating cash flow is anticipated to exceed capital during the 2014 to 2018 period by approximately $5 billion.

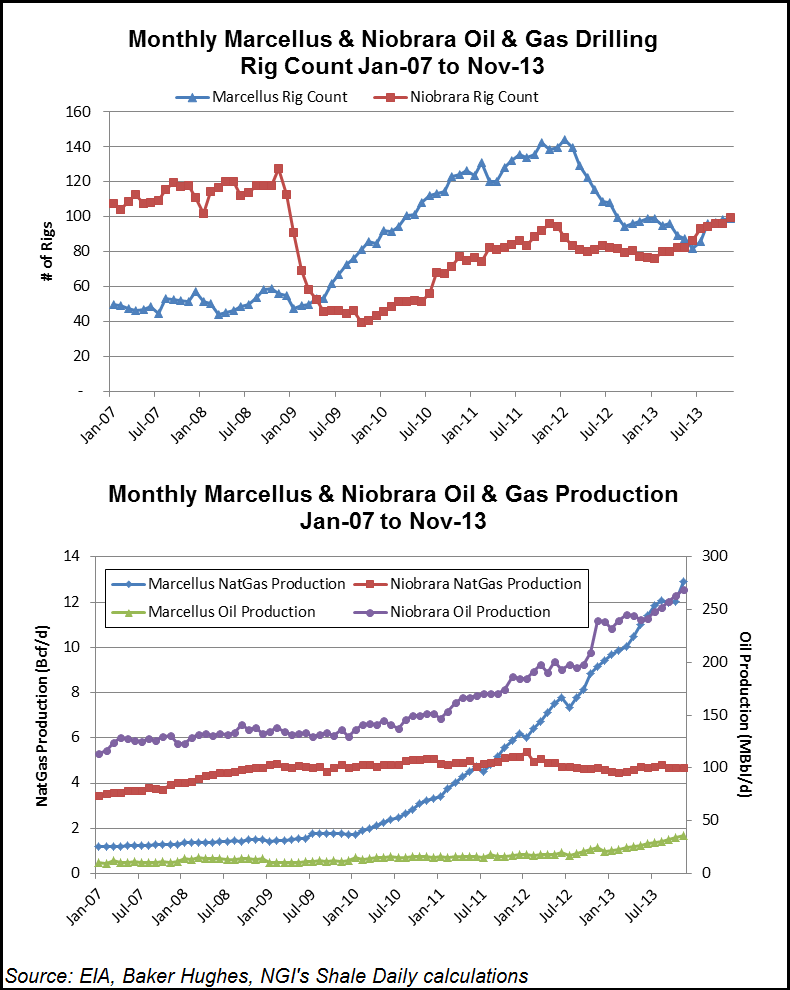

Meanwhile in the Marcellus Shale, Noble’s development continues to accelerate with about 170 joint venture wells, including nearly 100 operated horizontal wells with laterals exceeding 7,000 feet in the liquids-rich areas of the play.

Net risked Marcellus resources have increased 30% from the company’s last analyst conference to 13 Tcfe due to higher per-well EURs and increased lateral density, Noble said. Net production is expected to grow at a five-year CAGR of 46%, exceeding 1 Bcfe/d in 2018.

Noble plans to double its Marcellus rig count and develop up to two million lateral feet per year in the play by 2018. “The Marcellus assets are taking on a higher profile within [Noble’s] portfolio,” Haas wrote.

“Strong continued operational performance has further enhanced per-well valuation, resulting in a doubling of average rates of return and a net present value increase of between five and seven times,” the company said. “These substantial improvements are the result of a 15% increase in EURs, a 10% decrease in average drilling and completion costs, along with increased focus on drilling extended-reach laterals.”

Noble is employing its IDP approach in the Marcellus, as well. The first IDP is in the Majorsville wet-gas area in West Virginia and Pennsylvania, where the projected value of the IDP is an incremental $150 million net to Noble. In a research note Wednesday, Wells Fargo Securities analyst David Tameron wrote that the gradual implementation of IDPs, “…which is driving larger facility investments, likely portends future improvement in margins.”

Just as the company has done in the DJ Basin, Noble is drilling longer laterals in the Marcellus, Willingham told analysts. “Our acreage position, which is largely [held by production], allows us to drill more wells per pad and longer lateral wells than we would probably be able to if we were moving rigs around chasing acreage,” he said. “…[O]ur average lateral length has increased from 5,000 feet to 7,000 feet in just one year, which places us well ahead of the average of our local peers based on their public disclosures. And we will continue to extend laterally even further where possible.

“A 10,000-foot lateral well has more than triple the net present value of a 5,000-foot lateral with the development cost that’s about 30% less. Given the significant increase in value and capital efficiency, as well as the performance that we’ve seen from these wells, we’ll continue to push more and more of these and drilling them even longer. In fact, we recently brought on a pad where we have five laterals that are all greater than 10,000 feet.”

Overall in the company’s onshore operations, total net risked resources have grown to 5.5 billion boe. Production from the U.S. Onshore assets is anticipated to grow at a CAGR of 27% through 2018. Noble said company-wide production is projected to increase at an 18% CAGR over the next five years, resulting in company-wide production of 629,000 boe/d in 2018.

“After having already delivered double-digit growth over the past two years normalized for divestitures, we are now positioned to deliver another five years of growth at an annual compounded rate of 18%,” Davidson said. “The result in 2018 is projected production of well over 600,000 boe/d, more than triple what we averaged in 2011.

“Our multi-year growth continues to be extremely transparent, with over 95% of the 2018 volume coming from our existing proven and discovered unbooked resources, which combined now total 7.5 billion boe.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |