Infrastructure | NGI All News Access

NatGas Part of More Diverse West Power Supply

While the litany of coal-fired electric generation plant closings continues unabated, the West is increasingly using a diversity of sources for its power supplies with natural gas, hydroelectric and coal still the dominant sources, according to a report released Wednesday by the U.S. Energy Information Administration (EIA).

A combination of “aggressive” state renewable portfolio standards (RPS), federal tax credits, grants and other support has increased the use of non-hydro sources of power generation, the EIA said.

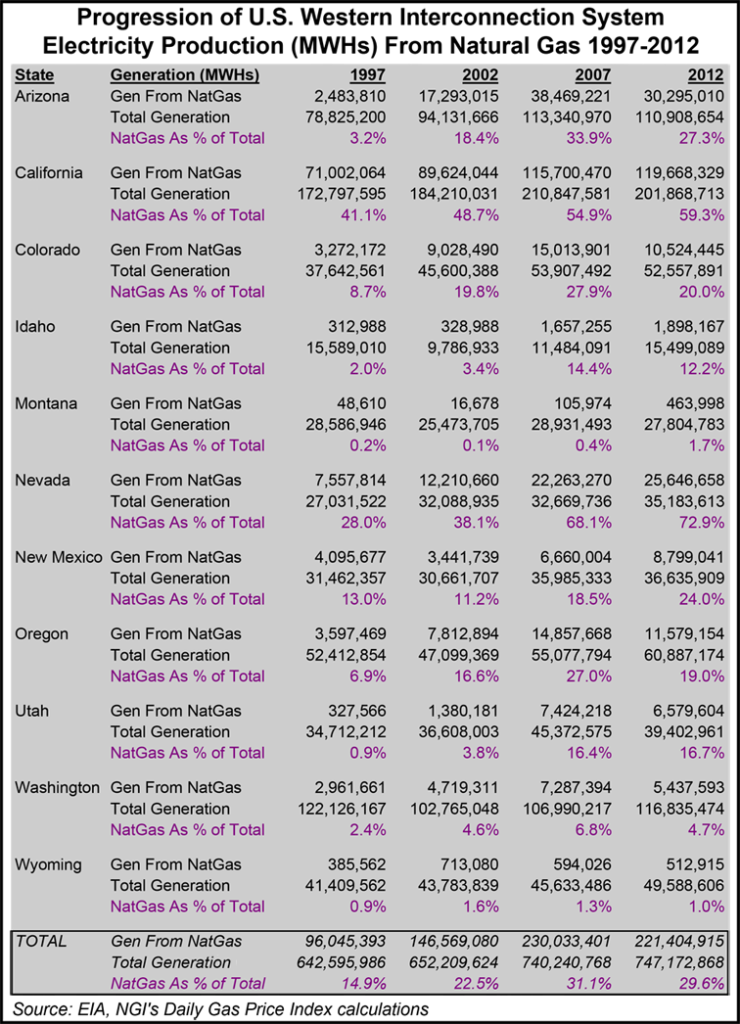

In 2012, natural gas was the fuel behind 221.4 million MWh of power in 11 western states — 29.6% of total electricity generation in those states — according to EIA data. That was down from 230.0 million MWh (31.1%) in 2007 but still more than double the 96.0 million MWh (14.9%) gas was responsible for in 1997.

Gas increased its share of total generation in all Western Interconnection System states between 1997 and 2012, with some of the most significant growth coming in Arizona (30.3 million MWh in 2012, up from 2.5 million MWh in 1997), California (119.7 million MWh, up from 71.0 million MWh) and Nevada (25.6 million MWh, up from 7.6 million MWh).

Some industry experts believe the western United States is on the brink of an upsurge in natural gas demand, based largely on the needs of the region’s power generators and resulting in a need for a new wave of infrastructure being built from the Rockies westward (see Daily GPI, Oct. 11).

The Sierra Club, which runs a “Beyond Coal” campaign championing more renewables and conservation, maintains that nationally increased wind, solar and other renewables are filling the gap created by the retirement of 158 coal-fired plants representing a little more than 65,000 MW of capacity.

In the 11 western continental states, California represents about 40% of the overall power demand, and that state influences the regional generation source mix by its policy decisions related to a 33% RPS by 2020 and various climate change initiatives, the EIA pointed out.

“The West region consists of the entire Western Interconnection [grid], where resources are generally shared and power flows are often directed toward California, which imports about 25% of its electricity needs,” the EIA said. “It is common for electric utilities in California to own shares of, or entire plants (or enter long-term power purchase agreements) that operate outside of the state.”

In addition to declines in coal-fired generation, nuclear is less of a factor in the West, given the closing of the 2,200 MW San Onofre Nuclear Generating Station (SONGS) (see Daily GPI, Aug. 9).

“Several new [mostly gas-fired] generators brought online before the summer of 2013 helped the system deal with the loss of SONGS, which was crucially located in a load pocket by providing voltage support and reactive power to the system,” Tyson Brown said in EIA’s latest report.

Separately, activists, such as the Sierra Club’s anti-coal campaign, are expecting another 365 coal-fired generation plant closures to occur in the years ahead, meaning another 278,000 MW of capacity will need to be replaced either by gas-fired generation, more renewables or greater efficiency gains in the nation’s energy use.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |