Markets | NGI All News Access | NGI Data

East, Northeast Make Solid Gains As Cold Puts Bears In Hibernation

Physical natural gas for delivery Wednesday retreated around a dime on average with declines in the Midcontinent, Rockies and California more than offsetting gains at eastern points.

The gains at eastern points were spotty, with some locations adding anywhere from 20 cents to some more than $10. Four New England locations finished the day’s trading in excess of $20. Multi-dollar losses were noted in the Rockies and California as weather forecasts were expected to moderate.

At the close of futures trading, January had added 0.5 cent to $4.237 and February was up by 0.6 cent to $4.231. January crude oil rose $1.17 to $98.51/bbl.

Prices jumped at eastern points as forecasts called for temperatures to trend more than 20 degrees below normal. Forecaster Wunderground.com predicted that the high Tuesday in New York City of 32 would ease to 31 Wednesday before settling in at 26 Thursday, well below the seasonal norm of 45. Philadelphia’s forecast high of 35 Tuesday was anticipated to slide to 29 Wednesday before dropping to 24 Thursday. The normal mid-December high in Philadelphia is 45. Washington, DC’s Tuesday high of 33 was anticipated to rise to 34 Wednesday before plunging to 25 Thursday, more than 20 degrees below the normal high of 48.

Surging power prices in the Northeast provided a firm foundation for power generators seeking gas to supply power generation. IntercontinentalExchange reported that next-day peak power in western New York (New York ISO Zone A) rose $26.40 to $75.40/MWh and peak power delivered to eastern New York (Zone G) added $24.80 to $83.00/MWh. At the New England ISO’s Massachusetts Hub, peak power for Wednesday delivery surged $64.61 to $181.30/MWh.

Gas for Wednesday delivery at the Algonquin Citygates jumped $3.33 to $20.75, and gas into Iroquois Waddington added $11.05 to $17.78. Deliveries to Tennessee Zone 6 200 L added a hefty $4.85 to $21.13.

Farther south, gains were more muted. Gas on Transco Leidy added 35 cents to $3.63, and deliveries on Dominion rose 24 cents to $3.89. On Tetco M-3 gas for Wednesday came in at $5.49, up $1.06, and gas bound for New York City on Transco Zone 6 jumped $2.98 to $8.02.

Well freeze-offs continued to be a problem, and next-day gas into important market centers rose while prices at points in the Great Plains and Rockies eased. Genscape reported an ominous trend in lost production with production declines reaching 1.564 Bcf/d Sunday, 1.590 Bcf/d Monday, and a whopping 1.858 Bcf/d Tuesday.

Temperatures in the Plains were expected to reach normal by Thursday. Wunderground.com forecast that Denver’s high of 49 Tuesday was expected to ease to 39 Wednesday before jumping to 51 on Thursday. The normal high in Denver is 43. Kansas City’s Tuesday high of 37 was predicted to drop to 22 Wednesday before rising to 40 on Thursday. The normal high in Kansas City is 41. In Omaha the high on Tuesday reached 29 and was predicted to skid to 13 Wednesday before jumping to 35 Thursday, one degree below normal.

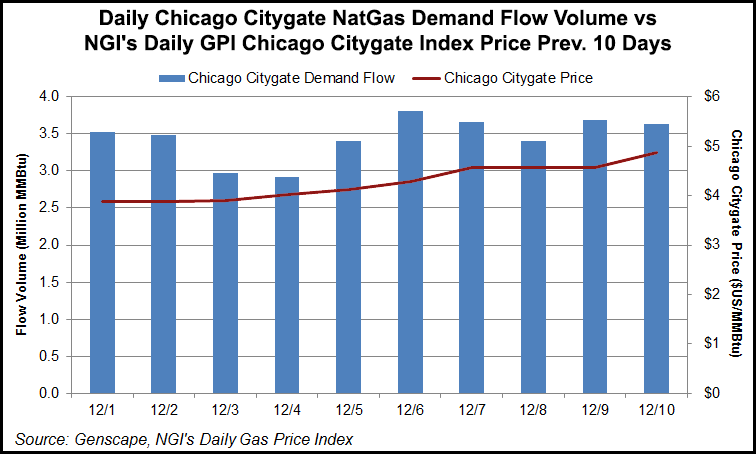

Wednesday gas into Alliance rose a dime to $4.90, and deliveries at the Chicago Citygates added 22 cents to $5.09. According to NGI’s Daily Gas Price Index, daily spot prices for gas delivery into Chicago have risen each trading day so far in December, and in the process, have moved from $3.88/MMbtu at the beginning of the month to $5.09 for gas flow on December 11.

Gas for next-day delivery into Northern Natural Ventura eased 45 cents to $5.12, and gas at Demarcation slid 41 cents to $5.10.

Gas at Rocky Mountain points fell hard from its Monday $6-plus perch. Gas on CIG was quoted at $4.82, down $2.00, and deliveries to the Cheyenne Hub skidded $1.82 to $4.84. On Northwest Pipeline south of Green River, gas came in at $4.52, down $1.22, and at Opal packages for Wednesday changed hands at $4.86, down $2.20.

Longer term, forecasters were caught off guard as temperatures in the Midwest dropped more than anticipated. “Temperatures plummeted [Tuesday] morning in the Chicago area, dropping O’Hare at least eight degrees colder than our forecast low from just yesterday (-2F so far),” said Matt Rogers, president of Commodity Weather Group, in the firm’s morning six- to 10-day forecast.

“High pressure and snow cover have an ability to surprise guidance to the significantly colder side, and that issue could continue to offer colder risks for the coming days in both the Midwest and newly-snowed East. Otherwise, the six-10 and 11-15 are not as cold as the one-five day, but still offer plenty of cold weather opportunities yet. The latest round of modeling still shows plenty of cold air in Canada, but some increase in warmer Southeast ridging in the 11-15 day could expand into the Mid-Atlantic and Northeast, too at times. Ridging in the east Pacific still acts as a ‘gatekeeper’ preventing a bigger Pacific warm flow and allowing cold air entry yet.”

Traders see the market as overextended. “This market continues to surge higher off of weather considerations where focus has shifted from the demand to the supply side,” said Jim Ritterbusch in closing comments to clients Monday. “Since we didn’t see anything within the weekly updates to the short-term temperature views as capable of forcing fresh highs, we are proceeding on the assumption that widespread well freeze-offs due to the adverse weather conditions drove much of today’s advance with power outages providing some offset.

“Although [Monday’s] advance carried further than we had anticipated, we have allowed for the fact that limited chart resistance develops until about the $4.30 level. Although we have shifted from a short-term bullish to a neutral stance since we are viewing current price levels as unsustainably high, we will nonetheless caution against attempts to pick a top to this strong rally of the past month.”

Demand may be stout in the “newly-snowed East,” but gas flows in California continued to set records. Genscape reported that California demand continues to reach new highs. “This week, daily average temperatures in Southern California reached just 50 degrees, 8 degrees below seasonal norms. This helped lift total California demand on Sunday to 11.7 Bcf/d, a single-day high. This December has featured seven days that now rank among the top 10 highest single-day demand levels in Genscape’s history set for California. Month-to-date demand [MTD] is now averaging 9.74 Bcf/d, nearly 2.7 Bcf/d greater than last December MTD, and 0.8 Bcf/d above the prior three-year MTD average.”

Tom Saal, vice president at INTL FC Stone in Miami, in his work with Market Profile is looking for the market to test Monday’s value area at $4.237 to $4.195. Saal also cites trend-day “space,” which can act as a pricing target at $4.013 to $4.044.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |